Travelers 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

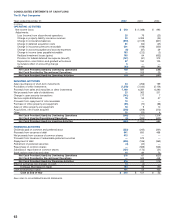

8. INVESTMENTS

Valuation of Investments — The following presents the cost, gross

unrealized appreciation and depreciation, and estimated fair value of

our investments in fixed income securities, equities, venture capital

and securities on loan.

Gross Gross Estimated

Unrealized Unrealized Fair

December 31, 2002 Cost Appreciation Depreciation Value

(In millions)

Fixed income:

U.S. government $1,054 $ 73 $ (2) $ 1,125

State and political subdivisions 4,263 350 (4) 4,609

Foreign governments 1,779 71 (2) 1,848

Corporate securities 6,482 433 (22) 6,893

Asset-backed securities 660 40 (17) 683

Mortgage-backed securities 1,940 90 — 2,030

Total fixed income 16,178 1,057 (47) 17,188

Equities 416 15 (37) 394

Venture capital 577 123 (119) 581

Securities on loan 764 47 (5) 806

Total $17,935 $ 1,242 $ (208) $ 18,969

Gross Gross Estimated

Unrealized Unrealized Fair

December 31, 2001 Cost Appreciation Depreciation Value

(In millions)

Fixed income:

U.S. government $ 1,197 $ 74 $ (1) $ 1,270

State and political subdivisions 4,720 231 (3) 4,948

Foreign governments 1,168 44 (11) 1,201

Corporate securities 5,324 212 (43) 5,493

Asset-backed securities 445 12 (10) 447

Mortgage-backed securities 2,493 65 (6) 2,552

Total fixed income 15,347 638 (74) 15,911

Equities 1,415 107 (112) 1,410

Venture capital 766 210 (117) 859

Securities on loan 739 40 (4) 775

Total $ 18,267 $ 995 $ (307) $ 18,955

Statutory Deposits — At December 31, 2002, our property-liability

operation had fixed income investments with an estimated fair value of

$973 million on deposit with regulatory authorities as required by law.

Restricted Investments — Our subsidiaries Unionamerica and

St. Paul Re-U.K., are required, as accredited U.S. reinsurers, to hold

certain investments in trust in the United States.These trust funds had

a fair value of $496 million at December 31, 2002. Additionally,

Unionamerica has funds deposited with third parties to be used as

collateral to secure various liabilities on behalf of insureds, cedants

and other creditors. These funds had a fair value of $44 million at

December 31, 2002. We also have $386 million of other investments

being used as collateral to secure our obligations under a series of

insurance transactions.

72

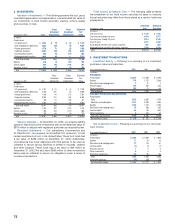

Fixed Income by Maturity Date — The following table presents

the breakdown of our fixed income securities by years to maturity.

Actual maturities may differ from those stated as a result of calls and

prepayments.

Amortized Estimated

December 31, 2002 Cost Fair Value

(In millions)

One year or less $1,130 $ 1,155

Over one year through five years 4,463 4,777

Over five years through 10 years 3,814 4,105

Over 10 years 4,171 4,438

Asset-backed securities with various maturities 660 683

Mortgage-backed securities with various maturities 1,940 2,030

Total $16,178 $ 17,188

9. INVESTMENT TRANSACTIONS

Investment Activity — Following is a summary of our investment

purchases, sales and maturities.

Years ended December 31 2002 2001 2000

(In millions)

PURCHASES

Fixed income $6,019 $4,959 $ 2,489

Equities 776 1,737 2,168

Real estate and mortgage loans 327 3

Venture capital 192 287 446

Other investments 588 23 48

Total purchases 7,578 7,033 5,154

PROCEEDS FROM SALES AND MATURITIES

Fixed income:

Sales 3,215 2,035 1,739

Maturities and redemptions 2,131 2,200 1,406

Equities 1,705 1,732 2,183

Real estate and mortgage loans 76 100 265

Venture capital 64 50 663

Other investments 8164 34

Total sales and maturities 7,199 6,281 6,290

Net purchases (sales) $379 $752 $ (1,136)

Net Investment Income – Following is a summary of our net invest-

ment income.

Years ended December 31 2002 2001 2000

(In millions)

Fixed income $1,068 $1,069 $ 1,090

Equities 11 16 16

Real estate and mortgage loans 77 115 91

Venture capital (2) (4) (1)

Securities on loan 122

Other investments 534

Short-term investments 33 55 83

Total 1,193 1,256 1,285

Investment expenses (24) (39) (23)

Net investment income $1,169 $1,217 $ 1,262