Travelers 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to our Report on Form 8-K dated July 23, 2002. That document

includes more detailed information about the settlement agreement.

Pursuant to the provisions of the settlement agreement, on

November 22, 2002, the MacArthur Companies filed voluntary peti-

tions under Chapter 11 of the Bankruptcy Code to permit the channel-

ing of all current and future asbestos-related claims solely to a trust to

be established pursuant to Section 524(g) of the Bankruptcy Code.

Consummation of most elements of the settlement agreement is con-

tingent upon bankruptcy court approval of the settlement agreement

as part of a broader plan for the reorganization of the MacArthur

Companies (the “Plan”). Approval of the Plan involves substantial

uncertainties that include the need to obtain agreement among exist-

ing asbestos plaintiffs, a person to be appointed to represent the inter-

ests of unknown, future asbestos plaintiffs, the MacArthur Companies

and the USF&G Parties as to the terms of such Plan. Accordingly,

there can be no assurance that bankruptcy court approval of the Plan

will be obtained.

Upon final approval of the Plan, and upon payment by the USF&G

Parties of the amounts described below, the MacArthur Companies

will release the USF&G Parties from any and all asbestos-related

claims for personal injury, and all other claims in excess of $1 million

in the aggregate, that may be asserted relating to or arising from

directly or indirectly, any alleged coverage provided by any of the

USF&G Parties to any of the MacArthur Companies, including any

claim for extra contractual relief.

The after-tax impact on our 2002 net income, net of expected rein-

surance recoveries and the re-evaluation and application of asbestos

and environmental reserves, was approximately $307 million. This

calculation, summarized in the table below, reflected payments of

$235 million during the second quarter of 2002, and $740 million on

January 16, 2003. The $740 million (plus interest) payment, together

with $60 million of the original $235 million, shall be returned to the

USF&G Parties if the Plan is not finally approved. The settlement

agreement also provides for the USF&G Parties to pay $13 million

and to advance certain fees and expenses incurred in connection with

the settlement, bankruptcy proceedings, finalization of the Plan and

efforts to achieve approval of the Plan, subject to a right of reimburse-

ment in certain circumstances of amounts advanced. That amount

was also paid in the second quarter.

As a result of the settlement, pending litigation with the MacArthur

Companies has been stayed pending final approval of the Plan.

Whether or not the Plan is approved, $175 million of the $235 million

will be paid to the bankruptcy trustee, counsel for the MacArthur

Companies, and persons holding judgments against the MacArthur

Companies as of June 3, 2002 and their counsel, and the USF&G

Parties will be released from claims by such holders to the extent of

$110 million paid to such holders.

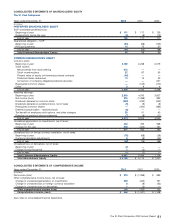

The $307 million after-tax impact to our net income in 2002 was

calculated as follows.

Year ended

December 31, 2002

(In millions)

Total cost of settlement $995

Less:

Utilization of existing IBNR loss reserves (153)

Net reinsurance recoverables (370)

Net pretax loss 472

Tax benefit @ 35% 165

Net after-tax loss $307

When the settlement agreement was initially announced in June

2002, we had estimated that the settlement would result in a net pre-

tax loss of $585 million, which included an estimate of $250 million of

reinsurance recoverables. In the fourth quarter of 2002, as we contin-

ued to prepare to bill our reinsurers, we completed an extensive

review of the relevant reinsurance contracts and the related underly-

ing claims and other recoverable expenses, and increased our esti-

mate of the net reinsurance recoverable to $370 million.

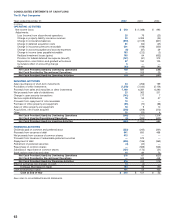

A rollforward of asbestos reserve activity related to Western

MacArthur is as follows.

(In millions)

Net reserve balance related to Western MacArthur at Dec. 31, 2001 $6

Announced cost of settlement:

Utilization of existing asbestos IBNR reserves $153

Gross incurred impact of settlement during second quarter of 2002 835

Subtotal 988

Less: originally estimated net reinsurance recoverable on unpaid losses (250)

Adjustments subsequent to announcement:

Change in estimate of loss adjustment expenses 7

Change in estimate of net reinsurance recoverable on unpaid losses (120)

Subtotal (113)

Payments, net of $75 million of estimated reinsurance

recoverables on paid losses (189)

Net reserve balance related to Western MacArthur at Dec. 31, 2002 $442

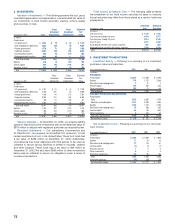

Our gross asbestos reserves at December 31, 2002 included

$740 million of reserves related to Western MacArthur ($442 million

of net reserves after consideration of $295 million of estimated net

reinsurance recoverables and $3 million of bankruptcy fees recover-

able from others). On January 16, 2003, pursuant to the terms of

the settlement agreement, we paid the remaining $740 million settle-

ment amount, plus interest, to the bankruptcy trustee in respect of

this matter.

4. SEPTEMBER 11, 2001 TERRORIST ATTACK

On September 11, 2001, terrorists hijacked four commercial pas-

senger jets in the United States. Two of the jets were flown into the

World Trade Center towers in New York, NY, causing their collapse.

The third jet was flown into the Pentagon building in Washington, DC,

causing severe damage, and the fourth jet crashed in rural

Pennsylvania. This terrorist attack caused significant loss of life and

property damage and resulted in unprecedented losses for the prop-

erty-liability insurance industry.

As of December 31, 2001, our estimated gross pretax losses and

loss adjustment expenses incurred as a result of the terrorist attack

totaled $2.3 billion, with an estimated net pretax operating loss of

$941 million.These estimated losses were based on a variety of actu-

arial techniques, coverage interpretation and claims estimation

methodologies, and included an estimate of losses incurred but not

reported, as well as estimated costs related to the settlement of

claims. Our estimate of losses was originally based on our belief that

property-liability insurance losses from the terrorist attack will total

between $30 billion and $35 billion for the insurance industry. In 2002,

our estimate of ultimate losses was supplemented by our ongoing

analysis of both paid and reported claims related to the attack. Our

estimate of losses remains subject to significant uncertainties and

may change over time as additional information becomes available.

We regularly evaluate the adequacy of our estimated net losses

related to the terrorist attack, weighing all factors that may impact the

total net losses we will ultimately incur. Based on the results of those

regular evaluations, we reallocated certain estimated losses among

our property-liability segments in 2002. In addition, during 2002, we

recorded both an additional loss provision of $20 million and a

$33 million reduction in our estimated provision for uncollectible rein-

surance related to the attack.

We and other insurers have obtained a summary judgement ruling

that the World Trade Center property loss is a single occurrence.

Certain insureds have appealed that ruling, asking the court to deter-

mine that the property loss constituted two separate occurrences

rather than one. In addition, through separate litigation, the aviation

losses could be deemed four separate events rather than three, for

purposes of insurance and reinsurance coverage. Even if the courts

ultimately rule against us regarding the number of occurrences or

events, we believe the additional amount of estimated after-tax

losses, net of reinsurance, that we would record would not be mate-

rial to our results of operations.

The St. Paul Companies 2002 Annual Report 69