Travelers 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

should be sold to achieve our primary investment goals of assuring our

ability to meet our commitments to policyholders and other creditors

and maximizing our investment returns. In order to meet the objective

of maintaining a flexible portfolio that can achieve these goals, our

fixed income and equity portfolios are classified as “available-for-sale.”

We continually evaluate these portfolios, and our purchases and sales

of investments are based on our cash requirements, the characteris-

tics of our insurance liabilities, and current market conditions. We also

monitor the difference between our cost and the estimated fair value of

investments, which involves uncertainty as to whether declines in

value are temporary in nature. At the time we determine an “other than

temporary” impairment in the value of a particular investment to have

occurred, we consider the current facts and circumstances, including

the financial position and future prospects of the entity that issued the

investment security, and make a decision to either record a write-down

in the carrying value of the security or sell the security; in either case,

recognizing a realized loss.

With respect to our venture capital portfolio, we manage our port-

folio to maximize return, evaluating current market conditions and the

future outlook for the entities in which we have invested. Because this

portfolio primarily consists of privately-held, early-stage venture

investments, events giving rise to impairment can occur in a brief

period of time (e.g., the entity has been unsuccessful in securing addi-

tional financing, other investors decide to withdraw their support, com-

plications arise in the product development process, etc.), and

decisions are made at that point in time, based on the specific facts

and circumstances, with respect to a recognition of “other than tem-

porary” impairment, or sale of the investment.

Unrealized Appreciation or Depreciation on Investments — For

investments we carry at estimated fair value, we record the difference

between cost and fair value, net of deferred taxes, as a part of com-

mon shareholders’ equity. This difference is referred to as unrealized

appreciation or depreciation on investments. The change in unreal-

ized appreciation or depreciation during the year is a component of

other comprehensive income.

Derivative Financial Instruments — In June 1998, the FASB issued

Statement of Financial Accounting Standards ("SFAS") No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” which

establishes accounting and reporting standards for derivative instru-

ments and hedging activities. This statement required all derivatives

to be recorded at fair value on the balance sheet and established new

accounting rules for hedging. In June 1999, the FASB issued SFAS

No. 137, “Accounting for Derivative Instruments and Hedging

Activities — Deferral of the Effective Date of SFAS No. 133, " which

amended SFAS No. 133 to make it effective for all quarters of fiscal

years beginning after June 15, 2000. In June 2000, the FASB issued

SFAS No. 138, “Accounting for Certain Derivative Instruments and

Certain Hedging Activities,” as an additional amendment to SFAS No.

133, to address a limited number of issues causing implementation

difficulties. Effective January 1, 2001, we adopted the provisions of

SFAS No. 133, as amended. See Note 10 for further information

regarding the impact of the adoption on our consolidated financial

statements.

In accordance with SFAS No. 133, our policy as of January 1, 2001

is to record all derivative financial instruments on our balance sheet

at fair value.The accounting for the gain or loss due to changes in the

fair value of these instruments is dependent on whether the derivative

qualifies as a hedge. If the derivative does not qualify as a hedge, the

gains or losses are reported in earnings as a realized gain or loss

when they occur. If the derivative does qualify as a hedge, the

accounting varies based on the type of risk being hedged. Generally,

however, the portion of the hedge deemed effective is recorded on the

balance sheet at fair value, and the portion deemed ineffective is

recorded in the statement of operations as a realized gain or loss. To

qualify for hedge accounting treatment, the hedging relationship is for-

mally documented at the inception of the hedge detailing the risk

management objectives and strategy for undertaking the hedge. In

addition, we assess both at the inception of the hedge and on a quar-

terly basis, whether the derivative is highly effective in accomplishing

the risk management objectives. If it is determined that the derivative

66

is not highly effective, hedge accounting treatment is discontinued

and any gains and losses associated with the hedge’s ineffectiveness

are recognized as a realized gain or loss in the statement of opera-

tions. Fair value for our derivatives is based on quoted market rates or

models obtained from third party pricing services.

Prior to our adoption of SFAS No. 133 in 2001, related to our use

of forward contracts to hedge the foreign currency exposure to our net

investment in our foreign operations, we reflected the movements of

foreign currency exchange rates as unrealized gains or losses, net of

tax, as part of our common shareholders’ equity. If unrealized gains or

losses on the foreign currency hedge exceeded the offsetting cur-

rency translation gain or loss on the investments in the foreign opera-

tions, they were included in the statement of operations. Related to

our use of interest rate swap agreements to manage the effect of

interest rate fluctuations on some of our debt and investments, we

netted the interest paid or received against the applicable interest

expense or income. The fair value of the swap agreements was not

reflected in our financial statements.

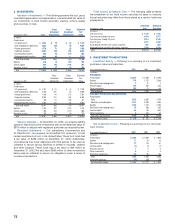

CASH RESTRICTIONS

Lloyd’s solvency requirements call for certain of our funds to be

held in trust in amounts sufficient to meet claims. These funds

amounted to $167 million and $76 million at December 31, 2002 and

2001, respectively.

GOODWILL AND INTANGIBLE ASSETS

Effective with our first-quarter 2002 adoption of SFAS No. 141,

“Business Combinations” (“SFAS No. 141”) and SFAS No. 142,

“Goodwill and Other Intangible Assets,” (“SFAS No. 142”) as

described in Note 22, our accounting for goodwill and intangible

assets has changed. (Nuveen Investments had applied the relevant

provisions of SFAS No. 141 in 2001 in connection with its acquisition

of Symphony Asset Management LLP). In a business combination,

the excess of the amount we paid over the fair value of the acquired

company’s tangible net assets is recorded as either an intangible

asset, if it meets certain criteria, or goodwill. Intangible assets with a

finite useful life (generally over four to 20 years) are amortized to

expense over their estimated life, on a basis expected to be consis-

tent with their estimated future cash flows. Intangible assets with an

indefinite useful life and goodwill, which represents the excess pur-

chase price over the fair value of tangible and intangible assets, are

no longer amortized, effective January 1, 2002, but remain subject to

tests for impairment.

Prior to the adoption of SFAS Nos. 141 and 142, we amortized

goodwill and intangible assets over periods of up to 40 years, gener-

ally on a straight-line basis.

During the second quarter of 2002, we completed the evaluation of

our recorded goodwill for impairment in accordance with provisions of

SFAS No. 142.That evaluation concluded that none of our goodwill was

impaired. In connection with our reclassification of certain assets previ-

ously accounted for as goodwill to other intangible assets with finite

useful lives in 2002, we established a deferred tax liability of $6 million

in the second quarter of 2002.That provision was classified as a cumu-

lative effect of accounting change effective as of January 1, 2002.

We will evaluate our goodwill for impairment on an annual basis. If

an event occurs or circumstances change that would more likely than

not reduce the fair value of a reporting unit below its carrying amount,

we will test for impairment between annual tests.

Prior to the adoption of SFAS Nos. 141 and 142, we monitored the

value of our goodwill based on our estimates of discounted future

earnings. If either estimate was less than the carrying amount of the

asset, we reduced the carrying value to fair value with a correspon-

ding charge to expense. We monitored the value of our identifiable

intangibles to be disposed of and reported them at the lower of carry-

ing value or fair value less our estimated cost to sell.