Travelers 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

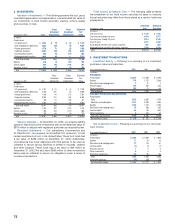

The following table summarizes the environmental and asbestos

reserves reflected in our consolidated balance sheet at December 31,

2002 and 2001. Amounts in the “net” column represent gross amounts

reduced by consolidated reinsurance recoverables. See Note 3 for a

discussion of a significant asbestos litigation settlement agreement.

December 31 2002 2001

(In millions) Gross Net Gross Net

Environmental $370 $ 298 $604 $ 519

Asbestos 1,245 778 577 387

Total environmental and asbestos reserves $1,615 $ 1,076 $1,181 $ 906

Late in 2001, we hired a new Executive Vice President of Claims,

with extensive experience with environmental and asbestos claims

handling and environmental and asbestos reserves, who conducted a

summary level review of our environmental and asbestos reserves.As

a result of observations made in this review, we undertook more

detailed actuarial and claims analyses of environmental reserves. No

adjustment to reserves was made in the fourth quarter of 2001, since

management did not have a sufficient basis for making an adjustment

until such supplemental analyses were completed, and we believed

our environmental and asbestos reserves were adequate as of

December 31, 2001.

Our historical methodology (through first quarter 2002) for review-

ing the adequacy of environmental and asbestos reserves utilized a

survival ratio method, which considers ending reserves in relation to

calendar year paid losses. When the environmental reserve analyses

were completed in the second quarter of 2002, we supplemented our

survival ratio analysis with the detailed additional analyses referred to

above, and concluded that our environmental reserves were redun-

dant by approximately $150 million. Based on our additional analyses,

we released approximately $150 million of environmental reserves in

the second quarter of 2002. Had we continued to rely solely on our

survival ratio analysis, we would have recorded no adjustment to our

environmental reserves through the six months ended June 30, 2002.

In the second quarter of 2002, we also supplemented our survival

ratio analysis of asbestos reserves with a detailed claims analysis.We

determined that, excluding the impact of the Western MacArthur set-

tlement, our asbestos reserves were adequate; however, including

that impact, we determined that our asbestos reserves were inade-

quate. As a result, gross and net asbestos reserves were increased

$150 million.

12. INCOME TAXES

Income Tax Expense (Benefit) — Income tax expenses or benefits

are recorded in various places in our consolidated financial state-

ments. A summary of the amounts and places follows.

Years ended December 31 2002 2001 2000

(In millions)

STATEMENTS OF OPERATIONS

Expense (benefit) on continuing operations $(73) $(422) $ 431

Expense on cumulative effect of accounting change 6——

Expense on operating loss of discontinued operations ——10

Expense (benefit) on gain or loss on disposal

of discontinued operations (17) 37 (6)

Total income tax expense (benefit) included

in consolidated statements of operations (84) (385) 435

COMMON SHAREHOLDERS’ EQUITY

Expense (benefit) relating to stock-based compensation

and the change in unrealized appreciation on

investments and unrealized foreign exchange 117 (218) 86

Total income tax expense (benefit) included

in consolidated financial statements $33 $(603) $ 521

Components of Income Tax Expense (Benefit) — The components

of income tax expense (benefit) on continuing operations are

as follows.

Years ended December 31 2002 2001 2000

(In millions)

Federal current tax expense (benefit) $7 $(303) $ 19

Federal deferred tax expense (benefit) (141) (81) 372

Total federal income tax expense (benefit) (134) (384) 391

Foreign income tax expense (benefit) 55 (48) 26

State income tax expense 610 14

Total income tax expense (benefit) on

continuing operations $(73) $(422) $ 431

Our Tax Rate is Different from the Statutory Rate — Our total

income tax expense (benefit) on income (loss) from continuing oper-

ations differs from the statutory rate of 35% of income from continu-

ing operations before income taxes as shown in the following table.

Years ended December 31 2002 2001 2000

($ in millions)

Federal income tax expense (benefit) at statutory rate $62 $(501) $ 490

Increase (decrease) attributable to:

Nontaxable investment income (76) (85) (95)

Valuation allowance 27 74 —

Foreign operations (89) 44 18

Goodwill —30 4

Employee stock ownership plan (4) (4) (4)

State income taxes, net of federal benefit 479

Other 313 9

Total income tax expense (benefit) on

continuing operations $(73) $(422) $ 431

Effective tax rate on continuing operations N.M.* 29.5% 30.8%

* Not meaningful.

Major Components of Deferred Income Taxes on Our Balance

Sheet — Differences between the tax basis of assets and liabilities

and their reported amounts in the consolidated financial statements

that will result in taxable or deductible amounts in future years are

called temporary differences.The tax effects of temporary differences

that give rise to the deferred tax assets and deferred tax liabilities are

presented in the following table.

December 31 2002 2001

(In millions)

DEFERRED TAX ASSETS

Loss reserves $715 $792

Unearned premium reserves 182 193

Alternative minimum tax credit carryforwards 79 124

Net operating loss carryforwards 909 496

Deferred compensation 114 113

Other 514 612

Total gross deferred tax assets 2,513 2,330

Less valuation allowance (133) (106)

Net deferred tax assets 2,380 2,224

DEFERRED TAX LIABILITIES

Unrealized appreciation of investments 326 218

Deferred acquisition costs 178 218

Real estate 102 132

Prepaid compensation 141 92

Other 366 316

Total gross deferred tax liabilities 1,113 976

Total deferred income taxes $1,267 $1,248

The St. Paul Companies 2002 Annual Report 75