Travelers 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In July 2001, Nuveen Investments acquired Symphony Asset

Management, LLC (“Symphony”), an institutional investment man-

ager, with approximately $4 billion in assets under management. As a

result of the acquisition, Nuveen Investments’ product offerings were

expanded to include managed accounts and funds designed to

reduce risk through market-neutral and other strategies in several

equity and fixed-income asset classes for institutional investors.

Nuveen Investments has three principal sources of revenue: advi-

sory fees on assets under management, including separately man-

aged accounts, closed-end exchange-traded funds and mutual funds;

underwriting and distribution revenues earned upon the sale of cer-

tain investment products; and performance fees earned on certain

institutional accounts based on the performance of such accounts.

Advisory fees accounted for 90% of Nuveen Investments’ consoli-

dated revenues in 2002.Total advisory fee income earned during any

period is directly related to the market value of the assets managed.

Advisory fee income increases or decreases with a rise or fall, respec-

tively, in the level of assets under management. Investment advisory

fees are recognized as revenue in the statement of operations over

the period that assets are under management. With respect to funds,

Nuveen Investments receives fees based either on each fund’s aver-

age daily net assets or on a combination of the average daily net

assets and gross interest income.With respect to managed accounts,

Nuveen Investments generally earns fees, on a quarterly basis,

based on the value of the assets managed on a particular date, such

as the last calendar day of a quarter, or on the average asset value

for the period.

Nuveen Investments’ distribution revenues are earned as defined

portfolio and mutual fund products are sold to the public through

financial advisors. Distribution revenues will rise and fall commensu-

rate with the level of sales of these products. In March 2002, Nuveen

Investments ceased offering defined portfolio products. Underwriting

fees are earned on the initial public offering of Nuveen Investments’

exchange-traded funds.

Through its subsidiary, Symphony, which manages equity and

fixed-income market-neutral accounts and funds for institutional

investors, Nuveen Investments earns performance fees for invest-

ment performance above specifically defined benchmarks.These fees

are recognized as revenue only at the performance measurement

date contained in the individual account management agreement.

Currently, approximately 80% of such measurement dates fall in the

second half of the calendar year.

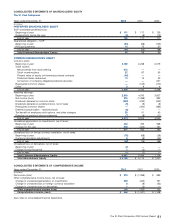

We consolidate 100% of Nuveen Investments’ assets, liabilities,

revenues and expenses, with reductions on the balance sheet and

statement of operations for the minority shareholders’ proportionate

interest in Nuveen Investments’ equity and earnings. Minority interest

of $80 million and $93 million was recorded in other liabilities at the

end of 2002 and 2001, respectively.

Nuveen Investments repurchased and retired 5.7 million and

8.2 million of its common shares from minority shareholders in 2002

and 2001, respectively, for a total cost of $151 million in 2002 and

$172 million in 2001. (The 2001 share repurchase total was adjusted

to reflect Nuveen Investments’ 2-for-1 stock split in 2002). No shares

were repurchased from The St. Paul in those years. Our percentage

ownership increased from 77% in 2001 to 79% in 2002 as the effect

of Nuveen Investments’ repurchases were partially offset by Nuveen

Investments’ issuance of additional shares under various stock option

and incentive plans and the issuance of common shares upon the

conversion of a portion of its preferred stock.

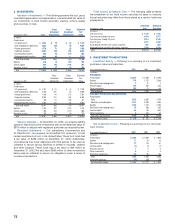

ACCOUNTING FOR OUR INVESTMENTS

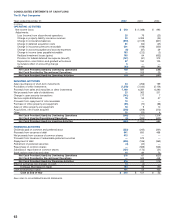

Fixed Income — Our fixed income portfolio is composed primarily

of high-quality, intermediate-term taxable U.S. government, corpo-

rate and mortgage-backed bonds, and tax-exempt U.S. municipal

bonds. Our entire fixed income investment portfolio is classified as

available-for-sale. Accordingly, we carry that portfolio on our balance

sheet at estimated fair value. Fair values are based on quoted mar-

ket prices, where available, from a third-party pricing service. If

quoted market prices are not available, fair values are estimated

using values obtained from independent pricing services or a cash

flow estimate is used.

Real Estate and Mortgage Loans — Our real estate investments

include warehouses and office buildings and other commercial land

and properties that we own directly or in which we have a partial inter-

est through joint ventures with other investors. Our mortgage loan

investments consist of fixed-rate loans collateralized by apartment,

warehouse and office properties.

For direct real estate investments, we carry land at cost and build-

ings at cost less accumulated depreciation and valuation adjust-

ments. We depreciate real estate assets on a straight-line basis over

40 years. Tenant improvements are amortized over the term of the

corresponding lease.The accumulated depreciation of our real estate

investments was $169 million and $153 million at December 31, 2002

and 2001, respectively.

We use the equity method of accounting for our real estate joint

ventures, which means we carry these investments at cost, adjusted

for our share of undistributed earnings or losses, and reduced by cash

distributions from the joint ventures and valuation adjustments.Due to

time constraints in obtaining financial results, the results of these joint

venture operations are recorded on a one-month lag. If events occur

during the lag period that are significant to our consolidated results,

the impact is included in the current period results.

We carry our mortgage loans at the unpaid principal balances less

any valuation adjustments, which approximates fair value. Valuation

allowances are recognized for loans with deterioration in collateral

performance that is deemed other than temporary. The estimated fair

value of mortgage loans was $82 million and $134 million at

December 31, 2002 and 2001, respectively.

Venture Capital — Our venture capital investments represent own-

ership interests in small- to medium-sized companies. These invest-

ments are made through limited partnerships or direct ownership.The

limited partnerships are carried at our equity in the estimated market

value of the investments held by these limited partnerships. The

investments we own directly are carried at estimated fair value. Fair

values are based on quoted market prices obtained from third-party

pricing services for publicly traded stock, or an estimate of value as

determined by an internal valuation committee for privately-held secu-

rities. Certain publicly traded securities may be carried at a discount

of 10-35% of the quoted market price, due to the impact of various

restrictions that limit our ability to sell the stock. Due to time con-

straints in obtaining financial results, the operations of the limited part-

nerships are recorded on a one-quarter lag. If security-specific events

occur during the lag-period that are significant to our consolidated

results, the impact is included in the current period results.

Equities — Our equity securities are also classified as available-

for-sale and carried at estimated fair value, which is based on quoted

market prices obtained from a third-party pricing service.

Securities on Loan — We participate in a securities lending pro-

gram whereby certain securities from our fixed income portfolio are

loaned to other institutions. Our policy is to require collateral equal to

102 percent of the fair value of the loaned securities. We maintain full

ownership rights to the securities loaned, and continue to earn interest

on them. In addition, we have the ability to sell the securities while they

are on loan. We have an indemnification agreement with the lending

agents in the event a borrower becomes insolvent or fails to return

securities. We record securities lending collateral as a liability and pay

the borrower an agreed upon interest rate.The proceeds from the col-

lateral are invested in short-term investments and are reported on the

balance sheet. We share a portion of the interest earned on these

short-term investments with the lending agent. The fair value of the

securities on loan is removed from fixed income securities on the bal-

ance sheet and shown as a separate investment asset.

Realized Investment Gains and Losses — We record the cost of

each individual investment so that when we sell an investment, we are

able to identify and record that transaction’s gain or loss on our state-

ment of operations.

The size of our investment portfolio allows our portfolio managers

a degree of flexibility in determining which individual investments

The St. Paul Companies 2002 Annual Report 65