Travelers 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

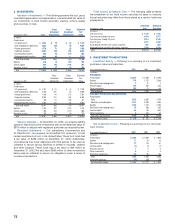

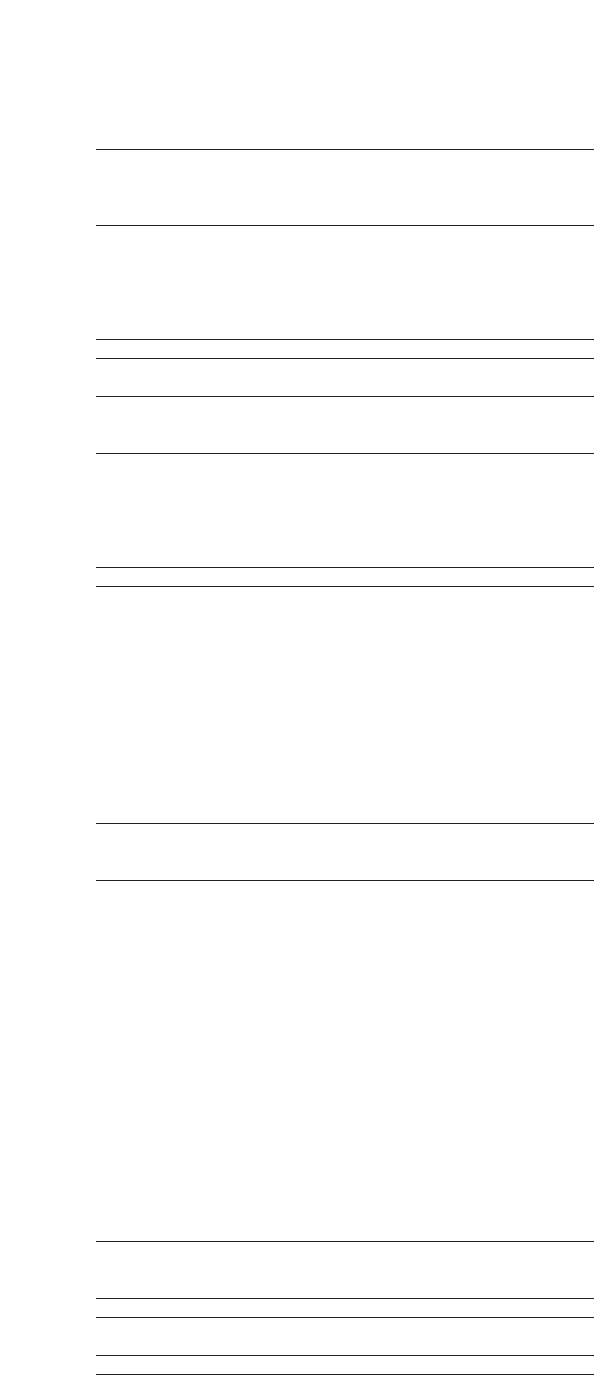

The following tables summarize the status of fixed stock options

outstanding and exercisable at December 31, 2002.

Options Outstanding

Weighted

Average Weighted

Range of Number of Remaining Average

Exercise Prices Options Contractual Life Exercise Price

$18.43 – 29.63 3,007,674 4.5 $ 27.31

30.19 – 35.00 1,969,279 6.1 31.47

35.25 – 42.94 3,677,825 7.0 35.99

43.13 – 44.21 3,797,379 8.3 44.07

44.35 – 48.04 3,229,673 8.4 45.81

48.39 – 50.44 3,339,173 7.8 48.47

$18.43 – 50.44 19,021,003 7.2 $ 39.62

Options Exercisable

Weighted

Range of Number of Average

Exercise Prices Options Exercise Price

$18.43 – 29.63 2,474,414 $ 26.85

30.19 – 35.00 1,471,887 31.56

35.25 – 42.94 1,269,119 36.93

43.13 – 44.21 780,360 43.57

44.35 – 48.04 779,503 45.48

48.39 – 50.44 1,114,077 48.49

$18.43 – 50.44 7,889,360 $ 35.90

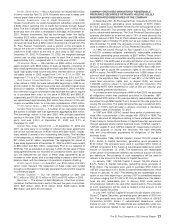

The following table summarizes the options exercisable at the end

of the last three years and the weighted average fair value of options

granted during those years. The fair value of options is estimated on

the date of grant using the Black-Scholes option-pricing model, with

the following weighted-average assumptions used for grants in 2002,

2001 and 2000, respectively: dividend yield of 2.9%, 3.0% and 3.0%;

expected volatility of 34.2%, 33.8% and 30.0%; risk-free interest rates

of 4.9%, 5.0% and 6.5%; and an expected life of 6.9 years, 6.8 years

and 6.5 years.

2002 2001 2000

Options exercisable at year-end 7,889,360 5,982,799 5,751,780

Weighted average fair value of options

granted during the year $14.02 $14.94 $ 10.58

VARIABLE STOCK OPTION GRANT

Prior to 2000, we made variable option grants of 2,341,800 shares

from our 1994 stock incentive plan to certain of our key executives.

The exercise price of each option was equal to the market price of our

stock on the grant date. One-half of the options vested when the mar-

ket price of our stock reached a 20-consecutive-trading-day average

of $50 per share, which occurred in November 2000. The remaining

options were to vest when our stock price reached a 20-consecutive-

trading-day average of $55 per share, which did not occur. Any of

these options not exercised prior to December 1, 2001 expired on that

date.

The following table summarizes the activity for our variable option

grants for the last three years.

Weighted

Option Average

Shares Exercise Price

Outstanding Jan. 1, 2000 1,720,800 $ 30.20

Exercised (290,975) 30.41

Canceled (437,850) 29.59

Outstanding Dec. 31, 2000 991,975 30.15

Exercised (290,500) 29.74

Canceled (701,475) 30.32

Outstanding Dec. 31, 2001 — $ —

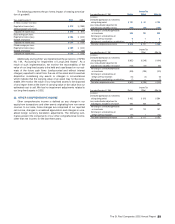

RESTRICTED STOCK AND DEFERRED STOCK AWARDS

Up to 20% of the 33.4 million shares authorized under our 1994

stock incentive plan may be granted as restricted stock awards. The

stock for this type of award is restricted because recipients receive the

stock only upon completing a specified objective or period of employ-

ment, generally one to five years. The shares are considered issued

when awarded, but the recipient does not own and cannot sell the

shares during the restriction period. During the restriction period, the

recipient receives compensation in an amount equivalent to the divi-

dends paid on such shares. Up to 5,500,000 shares were available for

restricted stock awards at December 31, 2002.

In 2002 we implemented the Capital Accumulation Plan. Under

this plan eligible employees may receive up to 25% of their annual

bonus in the form of restricted stock of the company. The company

provides a matching contribution of restricted stock at a 10 percent

discount from the market price on the date of grant. The restricted

stock is generally subject to a two-year vesting period. Participation in

this program is voluntary unless an employee’s annualized base pay

is greater than $100,000, is not retirement-eligible and will not

become retirement-eligible within two years of the date the bonus was

paid. Although the “performance year” to be measured is the current

year, $8.5 million of expense will be recognized over the two-year

vesting period, beginning in 2003.

We also have a Deferred Stock Award Plan for stock awards to

non-U.S. employees. Deferred stock awards are the same as

restricted stock awards, except that shares granted under the

deferred plan are not issued until the vesting conditions specified in

the award are fulfilled. Up to 3,000 shares were available for deferred

stock awards at December 31, 2002.

Please refer to Note 1 for the Pro Forma information on stock

option grants based on the “fair value” method as described in SFAS

No. 123.

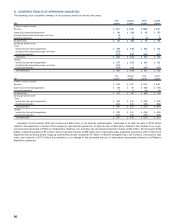

16. DISCONTINUED OPERATIONS

Life Insurance — On September 28, 2001, we completed the sale

of our life insurance company, Fidelity and Guaranty Life Insurance

Company, and its subsidiary, Thomas Jefferson Life, (together, “F&G

Life”) to Old Mutual plc (“Old Mutual”) for $335 million in cash and

$300 million in Old Mutual shares. In accordance with the sale agree-

ment, the sales proceeds were reduced by $11.7 million, on a pretax

basis, related to a decrease in market value of certain securities

within F&G Life’s investment portfolio between March 31, 2001 and

the closing date.

When the sale was announced in April 2001, we expected to real-

ize a modest gain on the sale of F&G Life, when proceeds were com-

bined with F&G Life’s operating results through the disposal date.

However, a decline in the market value of certain of F&G Life’s invest-

ments subsequent to April, coupled with a change in the anticipated

tax treatment of the sale, resulted in an after-tax loss of $74 million on

the sale proceeds. That loss was combined with F&G Life’s results of

operations for a year-to-date after-tax loss of $55 million and was

included in the reported loss from discontinued operations for the year

ended December 31, 2001.

Pursuant to the sale agreement, we were originally required to

hold the 190.4 million Old Mutual shares we received for one year

after the closing of the transaction, and the proceeds from the sale of

F&G Life were subject to possible adjustment based on the move-

ment of the market price of Old Mutual’s shares at the end of the one-

year period.The amount of possible adjustment was to be determined

by a derivative “collar” agreement included in the sale agreement. In

May 2002, Old Mutual granted us a release from the one-year hold-

ing requirement in order to facilitate our sale of those shares in a

placement made outside the United States, together with a concur-

rent sale of shares by Old Mutual by means of an overallotment

option, which was exercised by the underwriters.We sold all of the Old

Mutual shares we were holding on June 6, 2002 for a total net consid-

eration of $287 million, resulting in a pretax realized loss of $13 mil-

lion that was recorded as a component of discontinued operations on

The St. Paul Companies 2002 Annual Report 81