Travelers 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IMPAIRMENTS OF LONG-LIVED ASSETS

We monitor the recoverability of the value of our long-lived assets

to be held and used based on our estimate of the future cash flows

(undiscounted and without interest charges) expected to result from

the use of the asset and its eventual disposition considering any

events or changes in circumstances which indicate that the carrying

value of an asset may not be recoverable.We monitor the value of our

long-lived assets to be disposed of and report them at the lower of

carrying value or fair value less our estimated cost to sell.

OFFICE PROPERTIES AND EQUIPMENT

We carry office properties and equipment at depreciated cost. We

depreciate these assets on a straight-line basis over the estimated

useful lives of the assets. The accumulated depreciation for office

properties and equipment was $504 million and $483 million at the

end of 2002 and 2001, respectively.

INTERNALLY DEVELOPED SOFTWARE COSTS

We capitalize certain internally developed software costs incurred

during the application development stage of a project. These costs

include external direct costs associated with the project and payroll

and related costs for employees who devote time to the project. We

begin to amortize costs once the software is ready for its intended

use, and amortize them over the software’s expected useful life,

generally five years.

At December 31, 2002 and 2001, respectively, we had $54 million

and $50 million of unamortized internally developed computer soft-

ware costs and recorded $12 million and $7 million of amortization

expense during 2002 and 2001, respectively.

TAXES

We account for income taxes under the asset and liability method.

Deferred income tax assets and liabilities are recognized for the dif-

ferences between the financial and income tax reporting bases of

assets and liabilities based on enacted tax rates and laws. The

deferred income tax provision or benefit generally reflects the net

change in deferred income tax assets and liabilities during the year.

The current income tax provision generally reflects the tax conse-

quences of revenues and expenses currently taxable or deductible on

income tax returns.

FOREIGN CURRENCY TRANSLATION

We assign functional currencies to our foreign operations, which

are generally the currencies of the local operating environment.

Foreign currency amounts are remeasured to the functional currency,

and the resulting foreign exchange gains or losses are reflected in the

statement of operations. Functional currency amounts are then trans-

lated into U.S. dollars. The unrealized gain or loss from this transla-

tion, net of tax, is recorded as a part of common shareholders’ equity.

The change in unrealized foreign currency translation gain or loss dur-

ing the year, net of tax, is a component of comprehensive income.

Both the remeasurement and translation are calculated using current

exchange rates for the balance sheets and average exchange rates

for the statements of operations.

STOCK OPTION ACCOUNTING

We follow the provisions of Accounting Principles Board Opinion

No. 25, “Accounting for Stock Issued to Employees” (“APB 25”), FASB

Interpretation 44, “Accounting for Certain Transactions involving Stock

Compensation (an interpretation of APB Opinion No. 25),” and other

related interpretations in accounting for our stock option plans utiliz-

ing the “intrinsic value method” described in that literature.We also fol-

low the disclosure provisions of SFAS No. 123, “Accounting for

Stock-Based Compensation” for our option plans, as amended by

SFAS No. 148, “Accounting for Stock-Based Compensation —

Transition and Disclosure; an amendment of FASB Statement

No. 123”. These require pro forma net income and earnings per share

information, which is calculated assuming we had accounted for

our stock option plans under the “fair value method” described in

those Statements.

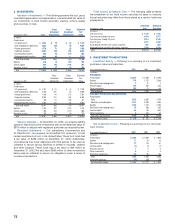

Had we calculated compensation expense on a combined basis

for our stock option grants based on the “fair value method” described

in SFAS No. 123, our net income and earnings per share would have

been reduced to the pro forma amounts as indicated.

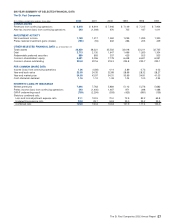

Years ended December 31 2002 2001 2000

($ in millions, except per share data)

Net income (loss)

As reported * $218 $(1,088) $ 993

Less: Total stock-based employee compensation

expense determined under fair value based

method for all awards, net of related tax effects (37) (25) (4)

Pro forma $181 $(1,113) $ 989

Basic earnings (loss) per share

As reported $0.94 $(5.22) $ 4.50

Pro forma $0.77 $(5.33) $ 4.48

Diluted earnings (loss) per share

As reported $0.92 $(5.22) $ 4.24

Pro forma $0.77 $(5.33) $ 4.24

*As reported net income or loss included $8 million, $5 million, and $18 million for 2002, 2001 and 2000,

respectively, in stock-based compensation expenses, net of related tax benefits.

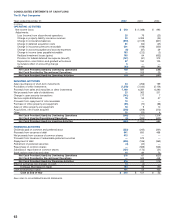

SUPPLEMENTAL CASH FLOW INFORMATION

Interest and Income Taxes Paid — We paid interest on debt and dis-

tributions on redeemable preferred securities of trusts of $167 million in

2002, $133 million in 2001 and $134 million in 2000. We received net

federal income tax refunds of $100 million in 2002 and $54 million in

2001, and paid federal income taxes of $161 million in 2000.

Non-cash Investing and Financing Activities — In July 2002, con-

current with the common stock issuance described in Note 13, we

issued 8.9 million equity units, each having a stated amount of $50.

Each equity unit included a forward purchase contract on our common

stock. Related to these contracts, we established a $46 million liabil-

ity, with a corresponding reduction to shareholders’ equity.

In November 2002, concurrent with the transfer of our continuing

reinsurance operations as described in Note 2, we received warrants

to purchase up to six million additional common shares of Platinum

Underwriters Holdings, Ltd. as partial consideration for the transferred

business. We carry the warrants as an asset on our balance sheet at

their market value, which was $61 million at December 31, 2002.

In September 2001, related to the sale of our life insurance

subsidiary to Old Mutual plc, we received approximately 190 million

Old Mutual ordinary shares as partial consideration.The shares were

valued at $300 million at the time of closing. In August 2000, we

issued 7,006,954 common shares in connection with the conversion

of over 99% of the $207 million of 6% Convertible Monthly Income

Preferred Securities issued by St. Paul Capital LLC (our wholly-

owned subsidiary).

2. TRANSFER OF ONGOING REINSURANCE OPERATIONS TO

PLATINUM UNDERWRITERS HOLDINGS, LTD.

On November 1, 2002, we completed the transfer of our continu-

ing reinsurance business (previously operating under the name

“St. Paul Re”) and certain related assets, including renewal rights, to

Platinum Underwriters Holdings, Ltd. (“Platinum”), a newly formed

Bermuda company that underwrites property and casualty reinsur-

ance on a worldwide basis. Further description of the transaction is

available in the Formation and Separation Agreement between us and

Platinum dated as of October 28, 2002 and filed as an exhibit to

Platinum’s Registration Statement No. 333-86906 on Form S-1.

As part of this transaction, we contributed $122 million of cash to

Platinum and transferred $349 million in assets relating to the insur-

ance reserves that we also transferred. In exchange, we acquired six

million common shares, representing a 14% equity ownership interest

in Platinum and a ten-year option to buy up to six million additional

common shares at an exercise price of $27 per share, which repre-

sents 120% of the initial public offering price of Platinum’s shares.

In conjunction with the transfer of our continuing reinsurance busi-

ness to Platinum, we entered into various agreements with Platinum

and its subsidiaries, including quota share reinsurance agreements by

The St. Paul Companies 2002 Annual Report 67