Travelers 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

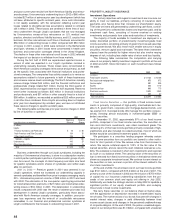

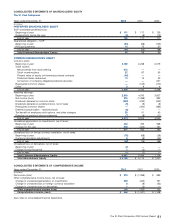

Because of the subjective nature of certain plan assumptions, the

following table presents, for the U.S. plan only, a sensitivity analysis to

hypothetical changes in the LTROR (in 50 basis point increments) and

the discount rate (in 25 basis point increments) on net income for the

year ended December 31, 2002. The results presented in the tables

assume that only the LTROR or discount rate assumption, as applica-

ble for each table, is changed and that all other assumptions remain

constant.

($ in millions) Base

LTROR 8.00% 8.50% 9.00% 9.50% 10.00% 10.50%

Incremental benefit (cost) $ (20) $ (15) $ (10) $ (5) $ — $ 5

Percent of 2002 net income 9% 7% 5% 2% —% 2%

($ in millions) Base

Discount Rate 6.50% 6.75% 7.00% 7.25% 7.50%

Incremental benefit (cost) $ (7) $ (3) $ — $ 3 $ 6

Percent of 2002 net income 3% 1% —% 1% 3%

It is estimated that the December 31, 2002 assumptions will result

in a 2003 pension cost of approximately $29 million for the U.S. plan

only. The impact of the changes in assumptions from December 31,

2001 will be somewhat offset by changes to the plan design effective

December 31, 2002.

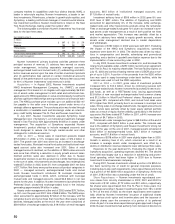

Postretirement Benefits Plan Assumptions

The following table presents our postretirement benefits plan

assumptions as of December 31.

2002 2001 2000

Discount rate 6.50% 7.00% 7.25%

Expected long-term rate of return 6.00% 7.00% 7.00%

Expected rate of compensation increase 4.00% 4.00% 4.00%

Our expected long-term rate of return for our postretirement ben-

efits plan differs from that used for our pension plan due to differences

in the funded assets (fixed maturity investments in our postretirement

benefits plan compared with various investment classes in our pen-

sion plan) used to fund certain of the related obligations.

The following table presents the impact of postretirement expense

(income) on our results of operations (before and after the impact of

curtailment gains resulting from plan design changes in 2002 and

2001) for the years 2002, 2001, and 2000, respectively.

Years Ended December 31 2002 2001 2000

(In millions)

Net periodic benefit cost (income) $24 $17 $18

Curtailment gain (9) (17) —

Net impact after curtailment $15 $— $18

THE ST. PAUL COMPANIES

EXPOSURES TO MARKET RISK

Market risk can be described as the risk of change in fair value of

a financial instrument due to changes in interest rates, equity prices,

creditworthiness, foreign exchange rates or other factors. We seek to

mitigate that risk by a number of actions, as described below.Our poli-

cies to address these risks were unchanged from the previous year.

The only significant changes to our market risk from 2001 were a

reduced allocation of assets to our equity investment portfolio, and a

reduction in the estimated duration of our fixed income investment

portfolio, which includes our consolidated holdings of fixed income

securities, securities on loan and short-term investments.We reduced

our equity holdings from $1.4 billion as of December 31, 2001 to

$394 million as of December 31, 2002.

As discussed in more detail in the Critical Accounting Policies sec-

tion on pages 30 through 32 of this discussion, there are risks and

uncertainties related to our assessment of “other than temporary”

impairments in our investment portfolio.

Interest Rate Risk — Our exposure to market risk for changes in

interest rates is concentrated in our investment portfolio, and to a

54

lesser extent, our debt obligations. However, changes in investment

values attributable to interest rate changes are mitigated by corre-

sponding and partially offsetting changes in the economic value of our

insurance reserves and debt obligations. We monitor this exposure

through periodic reviews of our asset and liability positions. Our esti-

mates of cash flows, as well as the impact of interest rate fluctuations

relating to our investment portfolio and insurance reserves, are mod-

eled and reviewed quarterly. At December 31, 2002, the estimated

duration of our fixed income investment portfolio (as defined above)

was 3.3, compared with 4.0 at December 31, 2001.

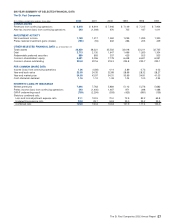

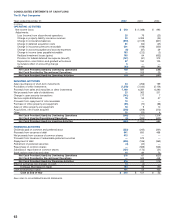

The following table provides principal cash flow estimates by year

for our December 31, 2002 and 2001 holdings of interest-sensitive

investment assets considered to be other than trading. Those hold-

ings consist of our consolidated fixed income securities, securities on

loan, short-term investments, mortgage loans and certain securities

issued as part of a series of insurance transactions.Also provided are

the weighted-average interest rates associated with each year’s cash

flows. Principal cash flow projections for collateralized mortgage obli-

gations were prepared using third-party prepayment models and esti-

mates. Cash flow estimates for mortgage passthroughs were

prepared using consensus prepayment forecasts obtainable from a

third-party provider. Principal cash flow estimates for callable bonds

are either to maturity or to the next call date depending on whether

the call was projected to be “in-the-money” assuming no change in

interest rates. No projection of the impact of reinvesting the estimated

cash flows is included in the table, regardless of whether the cash flow

source is a short-term or long-term fixed maturity security. Our fixed

income investments are primarily held to pay liabilities inherent in our

insurance reserves. We match these expected liability payments with

our fixed income cash flows.

Interest-sensitive

Investment Assets December 31, 2002 December 31, 2001

Weighted Weighted

Period from balance Principal Cash Average Interest Principal Cash Average Interest

sheet date: Flows Rate Flows Rate

($ in millions)

One year $5,988 3.3% $4,416 4.4%

Two years 2,348 6.7% 2,017 6.6%

Three years 2,070 5.9% 1,616 7.5%

Four years 1,950 6.0% 1,454 6.5%

Five years 1,668 5.1% 1,562 6.4%

Thereafter 6,638 5.8% 7,547 6.2%

Total $20,662 $18,612

Fair value $20,614 $18,198

The following table provides principal runoff estimates by year for

our December 31, 2002 and 2001 inventories of interest-sensitive

debt obligations and related weighted average interest rates by stated

maturity dates.

Medium-term Notes,

Zero Coupon Notes

and Senior Notes December 31, 2002 December 31, 2001

Weighted Weighted

Period from balance Principal Cash Average Interest Principal Cash Average Interest

sheet date: Flows Rate Flows Rate

($ in millions)

One year $67 6.5% $49 7.5%

Two years 55 7.1% 67 6.5%

Three years 429 7.5% 54 7.1%

Four years 59 7.0% 429 7.5%

Five years 1,015 5.6% 59 7.0%

Thereafter 562 6.7% 635 6.8%

Total $2,187 $1,293

Fair value $2,293 $1,330

To mitigate a portion of the interest rate risk related to $730 million

notional amount of certain of our fixed rate medium-term and senior

notes, we have entered into a number of pay-floating, receive-fixed

interest rate swap agreements. Of the total notional amount of the

swaps, $330 million mature in 2005, $150 million mature in 2008 and