Travelers 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

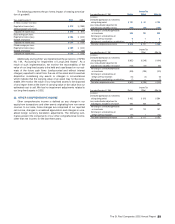

24. QUARTERLY RESULTS OF OPERATIONS (UNAUDITED)

The following is an unaudited summary of our quarterly results for the last two years.

First Second Third Fourth

2002 Quarter Quarter Quarter Quarter

(In millions, except per share data)

Revenues $2,311 $ 2,308 $ 2,288 $ 2,011

Income (loss) from continuing operations $148 $ (218) $ 69 $ 250

Cumulative effect of accounting change, net of taxes (6) — — —

Discontinued operations (9) (5) (5) (6)

Net income (loss) $133 $ (223) $ 64 $ 244

Earnings per common share:

Basic:

Income (loss) from continuing operations $0.69 $ (1.07) $ 0.29 $ 1.09

Cumulative effect of accounting change, net of taxes (0.03) — — —

Discontinued operations (0.04) (0.02) (0.02) (0.03)

Net income $0.62 $ (1.09) $ 0.27 $ 1.06

Diluted:

Income (loss) from continuing operations $0.67 $ (1.07) $ 0.29 $ 1.05

Cumulative effect of accounting change, net of taxes (0.03) — — —

Discontinued operations (0.04) (0.02) (0.02) (0.03)

Net income (loss) $0.60 $ (1.09) $ 0.27 $ 1.02

First Second Third Fourth

2001 Quarter Quarter Quarter Quarter

(In millions, except per share data)

Revenues $2,156 $ 2,157 $ 2,225 $ 2,381

Income (loss) from continuing operations $209 $ 96 $ (595) $ (719)

Discontinued operations (7) 8 (64) (16)

Net income (loss) $202 $ 104 $ (659) $ (735)

Earnings per common share:

Basic:

Income (loss) from continuing operations $0.95 $ 0.43 $ (2.86) $ (3.49)

Discontinued operations (0.04) 0.04 (0.30) (0.08)

Net income (loss) $0.91 $ 0.47 $ (3.16) $ (3.57)

Diluted:

Income (loss) from continuing operations $0.90 $ 0.41 $ (2.86) $ (3.49)

Discontinued operations (0.03) 0.04 (0.30) (0.08)

Net income (loss) $0.87 $ 0.45 $ (3.16) $ (3.57)

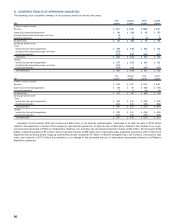

Included in fourth quarter 2002 net income were $56 million of net after-tax realized gains, comprised of an after-tax gain of $132 million

related to the divestiture of certain of the company’s international operations, an after-tax loss of $54 million related to the transfer of our ongo-

ing reinsurance business to Platinum Underwriters Holdings, Ltd., and after-tax net realized investment losses of $22 million.Fourth quarter 2002

pretax underwriting losses of $12 million were comprised of profits of $59 million from ongoing business segments and losses of $71 million from

segments that are being exited. Ongoing underwriting results included $175 million of reserve strengthening in the Surety & Construction seg-

ment, and a benefit of $115 million due primarily to our change in the estimated amount of reinsurance recoverable related to the Western

MacArthur settlement.

90