Travelers 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company markets its capabilities under four distinct brands: NWQ, a

leader in value-style equities; Nuveen Investments, a leader in tax-

free investments; Rittenhouse, a leader in growth-style equities; and

Symphony, a leading institutional manager of market-neutral alterna-

tive investment portfolios. Nuveen Investments is listed on the New

York Stock Exchange, trading under the symbol “JNC.”

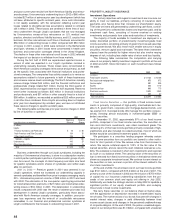

The following table summarizes Nuveen Investments’ key financial

data for the last three years.

Years Ended December 31 2002 2001 2000

(In millions)

Revenues $397 $378 $ 376

Expenses 190 190 201

Pretax income 207 188 175

Minority interest (45) (46) (40)

The St. Paul’s share of pretax income $162 $142 $ 135

Assets under management $79,719 $68,485 $ 62,011

Nuveen Investments’ primary business activities generate three

principal sources of revenue: (1) advisory fees earned on assets

under management, including separately managed accounts,

exchange-traded funds and mutual funds; (2) underwriting and distri-

bution revenues earned upon the sale of certain investment products

and (3) performance fees earned on certain institutional accounts

based on the performance of such accounts.Advisory fees accounted

for 90% of Nuveen Investments’ total revenues in 2002.

Acquisitions — In August 2002, Nuveen Investments acquired

NWQ Investment Management Company, Inc. (“NWQ”), an asset

management firm based in Los Angeles with approximately $6.9 bil-

lion of assets under management in both retail and institutional man-

aged accounts.NWQ specializes in value-oriented equity investments

and has significant relationships among institutions and financial advi-

sors. The NWQ purchase price includes up to an additional $20 mil-

lion payable to the seller over a five-year period under terms of a

strategic alliance agreement.The purchase price was funded through

a combination of available cash and borrowings under an intercom-

pany credit facility between The St. Paul and Nuveen Investments.

In July 2001, Nuveen Investments acquired Symphony Asset

Management LLC (“Symphony”), an institutional investment manager

based in San Francisco with approximately $4 billion in assets under

management. The acquisition of Symphony expanded Nuveen

Investment’s product offerings to include managed accounts and

funds designed to reduce risk through market-neutral and other

strategies for institutional investors.

2002 vs. 2001 — Gross sales of investment products totaled

$15.6 billion in 2002, a 10% increase over sales of $14.2 billion in

2001. The growth over 2001 was driven by an increase in exchange-

traded fund sales. Municipal mutual fund sales and institutional man-

aged account sales also increased over 2001. Sales of retail

managed accounts declined, as the addition of NWQ value accounts

was more than offset by a reduction in equity growth account sales.

Defined portfolio sales also declined in 2002, due to Nuveen

Investments’ decision to exit this product line in 2002.Net flows (equal

to the sum of sales, reinvestments and exchanges, less redemptions)

totaled $7.3 billion in 2002, down 5% from comparable 2001 net flows

of $7.7 billion. Net flows were positive across all product categories in

2002 — managed accounts, exchange-traded funds and mutual

funds. Nuveen Investments introduced 18 municipal closed-end

exchange-traded funds in 2002, which, combined with municipal

mutual funds and managed accounts, raised $4.8 billion in net new

assets for the year. In addition, Nuveen Investments launched the first

Preferred Stock closed-end exchange-traded fund in the industry,

generating approximately $4 billion in sales.

Assets under management at the end of 2002 totaled $79.7 billion,

up 16% over the year-end 2001 total of $68.5 billion.The NWQ acqui-

sition accounted for approximately $7 billion of the increase, with the

remainder due to strong net flows that more than offset equity market

declines. Managed assets at the end of the year were comprised of

$39.9 billion of exchange-traded funds, $19.4 billion of retail managed

50

accounts, $8.5 billion of institutional managed accounts, and

$11.9 billion of mutual funds.

Investment advisory fees of $356 million in 2002 grew 8% over

2001 fees of $331 million. The addition of Symphony and NWQ

accounted for approximately 6% of the increase, while exchange-

traded funds and other fixed-income products drove the remainder.

Fees on exchange-traded funds grew 10% due to an increase in aver-

age assets under management as a result of both positive net flows

and market appreciation. This increase was partially offset by a

decline in advisory fees related to equity growth accounts, where

assets under management declined due to market depreciation

and withdrawals.

Expenses of $190 million in 2002 were level with 2001. Excluding

the impact of the NWQ and Symphony acquisitions, operating

expenses were down 9% in 2002. The decline was driven by reduc-

tions in compensation and benefits, advertising and promotional

spending, and a decline in goodwill amortization expense due to the

implementation of new accounting rules in 2002.

In July 2002, Nuveen Investments entered into, and borrowed the

total amount available under, a $250 million revolving loan agreement

with The St. Paul, its majority shareholder.The loan facility expires on

July 15, 2003 and carries a floating interest rate of LIBOR plus a mar-

gin of up to 0.25%. A portion of the proceeds from the $250 million

loan was used to repay borrowings under bank facilities, while the

remainder was used to fund the NWQ acquisition.

2001 vs. 2000 — In 2001, gross sales of investment products

increased 32% to $14.2 billion, driven by continuing success with

exchange-traded funds.Nuveen Investments launched 20 new munic-

ipal funds, as well as a REIT-based fund, issuing approximately

$2.8 billion of new municipal exchange-traded fund common shares

and $1.2 billion in Muni/Fund Preferred‘ shares. Managed account

sales grew 39% compared with 2000, and mutual fund sales were

22% higher than 2000, primarily due to an increase in municipal fund

sales.Strong sales in exchange-traded funds, managed accounts and

mutual funds were partially offset by lower equity defined portfolio

sales as a result of equity market volatility, particularly in the technol-

ogy sector. Net flows totaled $7.7 billion in 2001, a 64% increase over

net flows of $4.7 billion in 2000.

Total assets under management grew to $68.5 billion at the end of

2001, compared with $62.0 billion a year earlier. The increase was

due to the addition of Symphony and Nuveen Investments’ strong net

flows for the year. At the end of 2001, managed assets consisted of

$32.0 billion of exchange-traded funds, $24.7 billion of managed

accounts, and $11.8 billion of mutual funds.

Revenue of $378 million in 2001 were slightly higher than in 2000.

Growth in advisory fees of 6%, which occurred as a result of an

increase in average assets under management, was offset by a

decline in distribution revenue related to lower defined portfolio sales.

Expenses for the year declined 5%. Excluding the impact of the

Symphony acquisition, operating expenses declined 9%. The decline

from 2000 was largely due to a reduction in advertising and promo-

tional spending, which had been higher in 2000 due to Nuveen

Investments’ brand awareness campaign.

During 2001, Nuveen Investments utilized a portion of its $250 mil-

lion bank revolving line of credit for general corporate purposes,

including day-to-day cash requirements, share repurchases and fund-

ing a portion of the $208 million acquisition of Symphony. At the end

of 2001, $183 million was outstanding under the line of credit.

Share Repurchases — Nuveen Investments repurchased com-

mon shares from minority shareholders in 2002, 2001 and 2000 for

total costs of $151 million, $172 million and $51 million, respectively.

No shares were repurchased from The St. Paul in those years. Our

percentage ownership in Nuveen Investments grew from 78% in 2000

to 79% at the end of 2002, as the share repurchases were substan-

tially offset by Nuveen Investments’ issuance of additional shares

under various stock option and incentive plans and the issuance of

common shares upon the conversion of a portion of its preferred

stock.As part of a new share repurchase program approved in August

2002, Nuveen Investments had authority from its board of directors to