Travelers 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of $5.47 billion generated by our four ongoing property-liability under-

writing segments in 2002 grew 24% over comparable 2001 earned

premiums of $4.43 billion, whereas earned premiums produced by

the three runoff segments in 2002 declined 33% compared with 2001.

Net investment income declined 4% from 2001, primarily due to

reduced yields on new investments. Realized investment losses in

2002 were concentrated in our venture capital and equity portfolios

and included losses originating from sales of investments, as well as

impairment write-downs. The majority of our “Other” revenues con-

sisted of risk management consulting fees and claim servicing fees in

our insurance underwriting operations and foreign exchange gains

and losses.

In 2001, consolidated revenue growth was driven by price

increases, strong business retention rates and new business in sev-

eral segments that resulted in a 30% increase in earned premiums

over 2000. Realized investment gains in 2000 were unusually high

due to strong returns generated by our venture capital holdings.

SEPTEMBER 11, 2001 TERRORIST ATTACK

On September 11, 2001, terrorists hijacked four commercial pas-

senger jets in the United States. Two of the jets were flown into the

World Trade Center towers in New York, NY, causing their collapse.

The third jet was flown into the Pentagon building in Washington, DC,

causing severe damage, and the fourth jet crashed in rural

Pennsylvania. This terrorist attack caused significant loss of life and

property damage and resulted in unprecedented losses for the prop-

erty-liability insurance industry.

In 2001, we recorded estimated net pretax losses totaling

$941 million related to the terrorist attack, consisting of the following

components.

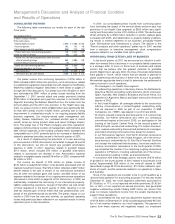

Year Ended

December 31

(In millions)

Gross pretax loss and loss adjustment expenses $2,299

Reinsurance recoverables (1,231)

Provision for uncollectible reinsurance 47

Additional and reinstatement premiums (83)

Reduction in reinsurance contingent commission expense (91)

Total estimated pretax operating loss $941

Our estimate of losses was based on a variety of actuarial tech-

niques, coverage interpretation and claims estimation methodologies,

and include an estimate of losses incurred but not reported, as well

as estimated costs related to the settlement of claims. Our estimate of

losses was originally based on our belief that property-liability insur-

ance losses from the terrorist attack will total between $30 billion and

$35 billion for the insurance industry. In 2002, our estimate of ultimate

losses was supplemented by our ongoing analysis of both paid and

reported claims related to the attack. Our estimate of losses remains

subject to significant uncertainties and may change over time as addi-

tional information becomes available.

We regularly evaluate the adequacy of our estimated net losses

related to the terrorist attack, weighing all factors that may impact the

total net losses we will ultimately incur. Based on the results of those

regular evaluations, we reallocated certain estimated losses among

our property-liability segments in 2002. In addition, during 2002, we

recorded an additional loss provision of $20 million and a $33 million

reduction in our estimated provision for uncollectible reinsurance

related to the attack.

We and other insurers have obtained a summary judgment ruling

that the World Trade Center property loss is a single occurrence.

Certain insureds have appealed that ruling, asking the court to deter-

mine that the property loss constituted two separate occurrences

rather than one. In addition, through separate litigation, the aviation

losses could be deemed four separate events rather than three, for

purposes of insurance and reinsurance coverage. Even if the courts

ultimately rule against us regarding the number of occurrences or

events, we believe the additional amount of estimated after-tax

losses, net of reinsurance, that we would record would not be mate-

rial to our results of operations.

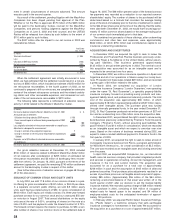

The (benefit) detriment on our business segments of the estimated

net pretax operating loss of $941 million recorded in 2001 and the

$13 million net reduction in and reallocation of losses among seg-

ments in 2002 are shown in the following table.

Years Ended December 31 2002 2001

(In millions)

Specialty Commercial $8 $52

Commercial Lines (30) 139

Surety & Construction —2

International & Lloyd’s (22) 95

Subtotal – ongoing segments (44) 288

Health Care —5

Reinsurance 24 556

Other 792

Subtotal – runoff segments 31 653

Total $(13) $941

Through December 31, 2002, we paid a total of $307 million in net

losses related to the terrorist attack since it occurred, including

$242 million during the year ended December 31, 2002.

TERRORISM RISK AND LEGISLATION

On November 26, 2002, President Bush signed into law the

Terrorism Risk Insurance Act of 2002, or TRIA. TRIA establishes a

temporary federal program which requires U.S. and other insurers to

offer coverage in their commercial property and casualty policies for

losses resulting from terrorists’ acts committed by foreign persons or

interests in the United States or with respect to specified U.S. air car-

riers, vessels or missions abroad.The coverage offered may not differ

materially from the terms, amounts and other coverage limitations

applicable to other policy coverages.

Under TRIA, the U.S. Secretary of the Treasury determines

whether an act is a covered terrorist act, and if it is covered, losses

resulting from that act ultimately are shared among insurers, the fed-

eral government and policyholders. Generally, insurers pay all losses

to policyholders, retaining a defined “deductible” and 10% of losses

above that deductible.The federal government will reimburse insurers

for 90% of losses above the deductible and, under certain circum-

stances, the federal government will require insurers to levy sur-

charges on policyholders to recoup for the federal government its

reimbursements paid. An insurer’s deductible in 2003 is 7% of the

insurer’s 2002 direct earned premiums, and rises to 10% of 2003

direct earned premiums in 2004 and, if the program continues in

2005, 15% of 2004 direct earned premiums in 2005. The program ter-

minates at the end of 2004 unless the Secretary of the Treasury

extends it to 2005. Federal reimbursement of the insurance industry

is limited to $100 billion in each of 2003, 2004 and 2005, and no

insurer that has met its deductible shall be liable for the payment of its

portion of the aggregate industry insured loss that exceeds $100 bil-

lion, thereby capping the insurance industry’s and each insurer’s ulti-

mate exposure to terrorist acts covered by TRIA.

TRIA voided terrorist exclusions in policies in-force on Novem-

ber 26, 2002 to the extent of the TRIA coverage required to be offered

and imposed requirements on insurers to offer the TRIA coverage to

policyholders at rates chosen by the insurers on policies in-force on

November 26, 2002 and all policies renewed or newly offered there-

after. Policyholders may accept or decline coverage at the offered rate

and, with respect to policies in-force on November 26, 2002, TRIA

coverage remains in effect until the policyholder fails to purchase the

coverage within a specified period following the insurer’s rate quota-

tion for the TRIA coverage. After November 26, we commenced a

process of offering and quoting TRIA coverage on over 5,000 policies

in-force on November 26, 2002 (approximately 40% in Specialty

Commercial’s excess and surplus lines business and 10% in the

Construction business center). As of February 28, 2003, only a small

number of insureds have responded to our quoted rates, with the sub-

stantial majority of insureds declining coverage or not yet responding

The St. Paul Companies 2002 Annual Report 25