Travelers 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

quarter of 2002. That provision was classified as a cumulative effect

of accounting change effective as of January 1, 2002. In accordance

with SFAS No. 142, we restated our results for the first quarter of

2002, reducing net income for that period from the reported $139 mil-

lion, or $0.63 per common share (diluted) to $133 million, or $0.60 per

common share (diluted).

At December 31, 2002, our goodwill and intangible assets totaled

$1.01 billion, compared with $690 million at December 31, 2001. Our

asset management subsidiary, Nuveen Investments, Inc., accounted

for the majority of the $321 million increase, primarily resulting from

its acquisition of NWQ Investment Management Company, Inc. in

2002, additional intangible assets recorded related to its 2001 acqui-

sition of Symphony Asset Management LLC and additional goodwill

recorded at The St. Paul parent company resulting from Nuveen

Investments’ repurchase of common shares from its minority share-

holders. Our acquisition of St. Paul Guarantee in 2002 also con-

tributed to the increase in goodwill and intangible assets over 2001.

See Note 22 to the consolidated financial statements for a schedule

of goodwill and acquired intangible assets.

SFAS No. 144 — During 2002, we also implemented the provi-

sions of SFAS No. 144, “Accounting for Impairment of Long-Lived

Assets”. As a result of implementation, we monitor the recoverability

of the value of our long-lived assets to be held and used based on our

estimate of the future cash flows (undiscounted and without interest

charges) expected to result from the use of each asset and its even-

tual disposition considering any events or changes in circumstances

which indicate that the carrying value of an asset may not be recov-

erable. We monitor the value of our long-lived assets to be disposed

of and report them at the lower of carrying value or fair value less our

estimated cost to sell. We had no impairment adjustments related to

our long-lived assets in 2002.

SFAS No. 133 — On January 1, 2001, we adopted the provisions

of Statement of Financial Accounting Standards (SFAS) No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” as

amended by SFAS Nos. 137 and 138. Provisions of SFAS No. 133

require the recognition of derivatives as either assets or liabilities on

the balance sheet and the measurement of those instruments at fair

value.We have limited involvement with derivative instruments, prima-

rily for purposes of hedging against fluctuations in market indices, for-

eign currency exchange rates and interest rates. We also have

entered into a variety of other financial instruments considered to be

derivatives, but which are not designated as hedges, that we utilize to

minimize the potential impact of market movements in certain invest-

ment portfolios. Our adoption of SFAS No. 133, as amended, did not

have a material impact on our financial position or results of continu-

ing operations.

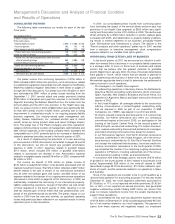

ELIMINATION OF ONE-QUARTER REPORTING LAG

In 2001, we eliminated the one-quarter reporting lag for our pri-

mary underwriting operations in foreign countries (not including our

operations at Lloyd’s), and now we report the results of those opera-

tions on a current basis. As a result, our consolidated results for 2001

include their results for the fourth quarter of 2000 and all quarters of

2001. The incremental impact on our property-liability operations for

the year ended December 31, 2001 of eliminating the reporting lag,

which consists of the results of these operations for the three months

ended December 31, 2001, was as follows.

Year Ended

Dec. 31, 2001

(In millions)

Net written premiums $ 71

Net earned premiums $ 86

GAAP underwriting loss $ (45)

Net investment income $ 14

Total pretax loss $ (31)

PROPERTY-LIABILITY INSURANCE OVERVIEW

Note: In the property-liability underwriting analyses and segment

discussions that follow, we sometimes use the term “prior-year loss

development,” which refers to the calendar year income statement

impact of changes in the provision for losses and LAE for claims

incurred in prior accident years. Similarly, we sometimes refer to “cur-

rent-year loss development” or “current accident year loss activity,”

which refers to the calendar year income statement impact of record-

ing the provision for losses and LAE for losses incurred in the current

accident year.

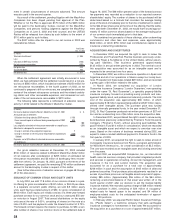

WRITTEN PREMIUMS

As described on page 24 of this discussion, in the fourth quarter

of 2002, we revised our segment reporting structure. Our ongoing

operations are reported in four segments — Specialty Commercial,

Commercial Lines, Surety & Construction, and International & Lloyd’s.

Those operations we consider to be in runoff are reported in three

segments — Health Care, Reinsurance and Other.The following

table presents a reconciliation of our ongoing and runoff segments’

net written premiums to our reported net written premiums for the last

three years.

Years Ended December 31 2002 2001 2000

($ in millions)

Ongoing segments:

Net written premiums $5,887 $4,836 $ 3,861

Percentage increase over prior year 22% 25%

Runoff segments:

Net written premiums 1,159 2,927 2,023

Percentage change from prior year (60)% 45%

Consolidated total $7,046 $7,763 $ 5,884

Percentage change from prior year (9)% 32%

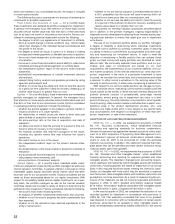

Our consolidated net written premiums in 2001 and 2000 included

reductions of $128 million and $474 million, respectively, for premi-

ums ceded under specific reinsurance treaties described in more

detail below. The 2001 total also included $71 million of incremental

premiums from the elimination of the one-quarter reporting lag for cer-

tain of our international operations. Excluding these factors for all

years, our 2002 premium volume of $7.05 billion was 10% lower than

the 2001 adjusted total of $7.82 billion, and that adjusted 2001 total

was 23% higher than the adjusted 2000 total of $6.36 billion. The

decline in 2002 primarily reflected our decision to exit certain lines of

business as described on pages 23 and 24 of this discussion, which

more than offset the impact of strong growth in our ongoing business

segments. In 2001, the increase in premium volume over 2000 was

driven by significant price increases, strong business retention rates

and new business throughout all of our segments.

In our ongoing segments, 2002 premium volume of $5.89 billion

was 21% higher than the 2001 total of $4.87 billion (as adjusted to

eliminate the impact of the reinsurance treaties and reporting lag

adjustment). All four segments recorded strong premium increases,

with the most notable growth occurring in our Surety & Construction

segment (primarily due to strong price increases in Construction, as

well as acquisition-related premium growth in Surety) and in the

Specialty Commercial segment (due to significant price increases and

new business volume in the majority of business centers comprising

the segment). The 2001 total premium volume was 18% higher than

the 2000 total of $4.14 billion (as adjusted to eliminate the impact of

the reinsurance treaties and reporting lag adjustment).

In our runoff segments, 2002 premiums of $1.16 billion were 60%

below the 2001 total of $2.95 billion (as adjusted to eliminate the

impact of the reinsurance treaties and reporting lag adjustment), and

that 2001 total was 33% higher than 2000 premiums of $2.22 billion

(as adjusted to eliminate the impact of the reinsurance treaties). The

substantial decline in 2002 reflected our decision at the end of 2001

to exit those lines of business. The increase in 2001 over 2000 was

centered in our Reinsurance segment, driven by price increases and

The St. Paul Companies 2002 Annual Report 33