Travelers 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

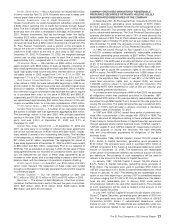

The effect of assumed and ceded reinsurance on premiums

written, premiums earned and insurance losses and loss adjustment

expenses is as follows (including the impact of the reinsurance

treaties).

Years ended December 31 2002 2001 2000

(In millions)

PREMIUMS WRITTEN

Direct $7,585 $7,135 $ 6,219

Assumed 1,973 2,700 2,064

Ceded (2,512) (2,072) (2,399)

Net premiums written $7,046 $7,763 $ 5,884

PREMIUMS EARNED

Direct $7,569 $6,656 $ 5,819

Assumed 2,163 2,685 2,019

Ceded (2,342) (2,045) (2,246)

Net premiums earned $7,390 $7,296 $ 5,592

INSURANCE LOSSES AND

LOSS ADJUSTMENT EXPENSES

Direct $6,955 $6,876 $ 4,068

Assumed 1,354 3,952 1,798

Ceded (2,314) (3,349) (1,953)

Net insurance losses and loss adjustment expenses $5,995 $7,479 $ 3,913

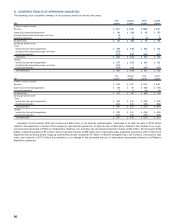

20. STATUTORY ACCOUNTING PRACTICES

Our underwriting operations are required to file consolidated finan-

cial statements with state and foreign regulatory authorities. The

accounting principles used to prepare these statutory financial state-

ments follow prescribed or permitted accounting principles, which dif-

fer from GAAP. Prescribed statutory accounting practices include

state laws, regulations and general administrative rules issued by the

state of domicile as well as a variety of publications and manuals of

the National Association of Insurance Commissioners (“NAIC”).

Permitted statutory accounting practices encompass all accounting

practices not so prescribed, but allowed by the state of domicile.

Beginning in 2001, Fire and Marine was granted a permitted practice

regarding the valuation of certain investments in affiliated limited lia-

bility companies, allowing it to value these investments at their audited

GAAP equity. Since these investments were not required to be valued

on a statutory basis, Fire and Marine is not able to determine the

impact on statutory surplus.

On a statutory accounting basis, as filed in our regulatory Annual

Statements, our property-liability underwriting operations reported net

income of $240 million in 2002, a net loss of $547 million in 2001 and

net income of $1.2 billion in 2000. Statutory surplus (shareholders’

equity) of our property-liability underwriting operations was $5.5 bil-

lion and $4.8 billion as of December 31, 2002 and 2001, respectively.

The NAIC published revised statutory accounting practices in con-

nection with its codification project, which became effective January 1,

2001. The cumulative effect to our property-liability insurance

operations of the adoption of these practices was to increase statu-

tory surplus by $126 million, primarily related to the treatment of

deferred taxes.

21. SEGMENT INFORMATION

In the fourth quarter of 2002, we revised our property-liability busi-

ness segment reporting structure to reflect the manner in which those

businesses are currently managed, particularly in recognition of cer-

tain operations being separately managed as runoff operations. As of

December 31, 2002, our property-liability underwriting operations

consist of four segments constituting our ongoing operations, and

three segments comprising our runoff operations. We retained the

concept of a “specialty commercial”business center, which is an oper-

ation possessing dedicated underwriting, claims and risk control serv-

ices requiring specialized expertise and focusing exclusively on the

customers it serves. Eleven of those business centers comprise our

Specialty Commercial reportable segment. None of those business

centers alone met the quantitative threshold to qualify as a separate

reportable segment; therefore they were combined based on the

applicable aggregation criteria. All data for 2001 and 2000 included in

86

this report were restated to be consistent with the new reporting struc-

ture in 2002.The following is a summary of changes made to our seg-

ments at the end of 2002.

• In our Specialty Commercial segment, all international specialty

business that had either been included in respective business

centers, or had been included in the separate International

Specialty business center, was reclassified to the newly formed

International & Lloyd’s segment (for ongoing operations) or our

Other segment (for international operations considered to be in

runoff).

• All international Health Care business, previously included in the

Health Care segment, was reclassified to the newly formed Other

segment.

• The International & Lloyd’s segment was formed, comprised of

our ongoing operations at Lloyd’s, ongoing specialty commercial

business underwritten outside the United States (currently con-

sisting of operations in the United Kingdom, Canada and the

Republic of Ireland), and Global Accounts. All operations in this

segment are under common management.

• The new runoff segment Other was formed, comprised of the

results of all of our international and Lloyd’s business considered

to be in runoff (including our involvement in insuring the Lloyd’s

Central Fund), as well as those of Unionamerica, the U.K.-based

underwriting entity acquired in the MMI transaction.

• Our Catastrophe Risk business center, previously included in the

Specialty Commercial segment in its entirety, was split into two,

with Personal Catastrophe Risk remaining in the Specialty

Commercial segment and Commercial Catastrophe Risk moving

to the Commercial Lines segment as part of the Property

Solutions business center.

In addition to our property-liability business segment, we also have

a property-liability investment operation segment, as well as an asset

management segment, consisting of our majority ownership in

Nuveen Investments.

The accounting policies of the segments are the same as those

described in the summary of significant accounting policies.We evalu-

ate performance based on underwriting results for our property-liabil-

ity insurance segments, investment income and realized gains for our

investment operations, and on pretax operating results for the asset

management segment. Property-liability underwriting assets are

reviewed in total by management for purposes of decision-making.We

do not allocate assets to these specific underwriting segments. Assets

are specifically identified for our asset management segment.

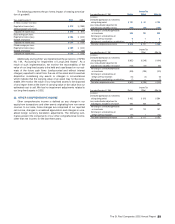

Geographic Areas — The following summary presents financial

data of our continuing operations based on their location.

Years ended December 31 2002 2001 2000

(In millions)

REVENUES

U.S. $7,163 $7,137 $ 6,766

Non-U.S. 1,755 1,782 1,180

Total revenues $8,918 $8,919 $ 7,946

Segment Information — After the revisions to our segment struc-

ture described above, our reportable segments in our property-liabil-

ity operations consisted of the following:

The Specialty Commercial segment includes business centers

that possess dedicated underwriting, claims and risk control services

that require specialized expertise and focus exclusively on the cus-

tomers served by those respective business centers. This segment

includes Financial & Professional Services, Technology, Public Sector

Services, Umbrella / Excess & Surplus Lines, Ocean Marine,

Discover Re, National Programs, Oil & Gas, Transportation, and

Personal Catastrophe Risk.

The Commercial Lines segment focuses on commercial clientele,

and although we target certain commercial customer groups and

industries, we do not have underwriting, claim or risk service person-

nel with specialized expertise dedicated exclusively to these groups or

industries. Accordingly, the business centers within Commercial Lines

are not considered “specialty” businesses. This reporting segment

includes Small Commercial, Middle Market Commercial and Property