Travelers 2002 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

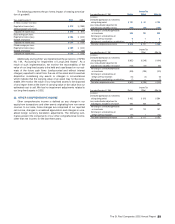

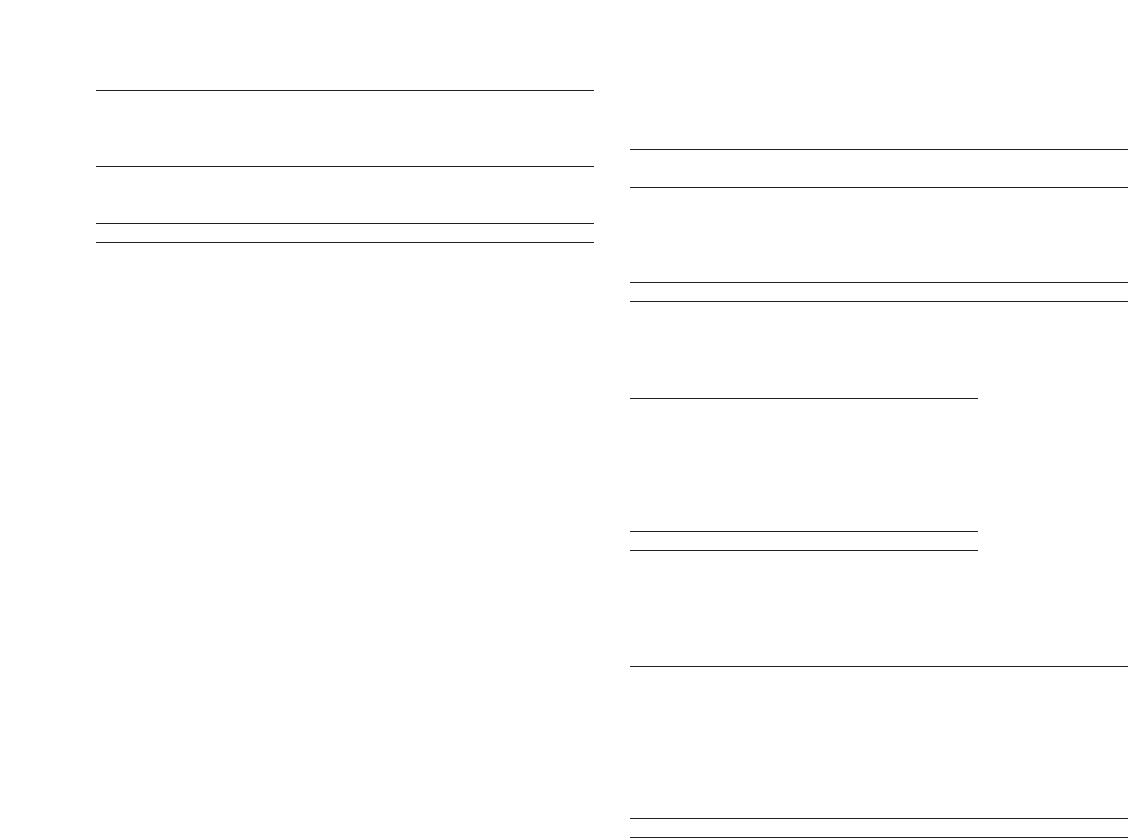

December 31 2002 2001

(In millions)

IDENTIFIABLE ASSETS

Property-liability insurance $38,333 $36,490

Asset management 1,081 855

Total reportable segments 39,414 37,345

Parent company, other operations,

consolidating eliminations and discontinued operations 506 976

Total assets $39,920 $38,321

Note 16, “Restructuring and Other Charges,” describes charges

we recorded during 2001 and 2000 and where they are included in

the foregoing tables.

22. ADOPTION OF ACCOUNTING POLICIES

In the first quarter of 2002, we began implementing the provisions

of SFAS No. 141, “Business Combinations” and SFAS No. 142,

“Goodwill and Other Intangible Assets,” which establish financial

accounting and reporting for acquired goodwill and other intangible

assets. The statement changes prior accounting practice in the way

intangible assets with indefinite useful lives, including goodwill, are

tested for impairment on an annual basis. Generally, it also requires

that those assets meeting the criteria for classification as intangible

assets with estimable useful lives be amortized to expense over those

lives, while intangible assets with indefinite useful lives and goodwill

are not to be amortized. As a result of implementing the provisions of

this statement, we did not record any goodwill amortization expense

in 2002. For the year of 2001, goodwill amortization expense totaled

$114 million. Amortization expense associated with intangible assets

totaled $18 million for 2002, compared with $2 million in the same

2001 period.

During the second quarter of 2002, we completed the evaluation

of our recorded goodwill for impairment in accordance with provisions

of SFAS No. 142, which required a two-step approach for determining

impairment of goodwill. The first step was to test for potential impair-

ment by comparing the fair value of our respective reporting units to

the carrying value of each unit. The second step would have meas-

ured the impairment loss by using the unit’s implied fair value as com-

pared to its carrying amount. As no impairment was indicated in the

first step, the second step was not necessary. This evaluation con-

cluded that none of our goodwill was impaired. In connection with our

reclassification of certain assets previously accounted for as goodwill

to other intangible assets in 2002, we established a deferred tax lia-

bility of $6 million in the second quarter of 2002. That provision was

classified as a cumulative effect of accounting change effective as of

January 1, 2002.

Related to our adoption of SFAS Nos. 141 and 142, we also

reviewed the amortization method and useful lives of existing intangi-

ble assets, and adjusted as appropriate. Generally, amortization was

accelerated and useful lives shortened.

88

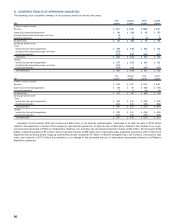

The following presents a summary of our acquired intangible

assets.

December 31, 2002

Gross Carrying Accumulated Net

AMORTIZABLE INTANGIBLE ASSETS Amount Amortization Amount

(In millions)

Customer relationships $67 $4 $63

Present value of future profits 69 16 53

Renewal rights 27 5 22

Internal use software 211

Total $165 $ 26 $ 139

At December 31, 2002, our estimated intangible asset amortiza-

tion expense for the next five years was as follows.

December 31, 2002

(In millions)

2003 $20

2004 17

2005 15

2006 13

2007 11

Thereafter 63

Total $139

The changes in the carrying value of goodwill from December 31,

2001 to December 31, 2002 sheet were as follows.

Balance at Goodwill Impairment Balance at

Goodwill by Segment Dec. 31, 2001 acquired losses Dec. 31, 2002

(In millions)

Specialty Commercial $ 36 $— $— $36

Commercial Lines 33 —— 33

Surety & Construction 14 12 — 26

International & Lloyd’s 7 11 — 18

Asset Management 519 233 — 752

Property-Liability

Investment Operations — 9— 9

Total $ 609 $265 $ — $ 874

The increase in goodwill in our Asset Management segment

resulted from Nuveen Investments’ purchase of shares from minority

shareholders, its acquisition of NWQ Investment Management, and

from final valuation of previously acquired goodwill. See Note 6 for a

discussion of the increase to the Specialty Commercial and Surety &

Construction segments. The increase in goodwill in our International

& Lloyd’s segment related to an increase in syndicate capacity at

Lloyd’s. The $9 million of goodwill acquired in Property Liability

Investment Operations was a result of the Platinum transaction, and

represents the excess value of the shares received over our share of

Platinum’s equity. See Note 2 for further discussion regarding the

Platinum transaction.