Travelers 2002 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Because many of the coverages we offer involve claims that may

not ultimately be settled for many years after they are incurred, sub-

jective judgments as to our ultimate exposure to losses are an integral

and necessary component of our loss reserving process. We record

our reserves by considering a range of estimates bounded by a high

and low point. Within that range, we record management’s best esti-

mate.We continually review our reserves, using a variety of statistical

and actuarial techniques to analyze current claim costs, frequency

and severity data, and prevailing economic, social and legal factors.

We adjust reserves established in prior years as loss experience

develops and new information becomes available.Adjustments to pre-

viously estimated reserves are reflected in our financial results in the

periods in which the changes in estimate are made.

Reserves for environmental and asbestos exposures cannot be

estimated solely with the traditional loss reserving techniques

described above, which rely on historical accident year development

factors and take into consideration the previously mentioned vari-

ables. Environmental and asbestos reserves are more difficult to esti-

mate than our other loss reserves because of legal issues, societal

factors and difficulty in determining the parties who may ultimately be

held liable.Therefore, in addition to taking into consideration the tradi-

tional variables that are utilized to arrive at our other loss reserve

amounts, we also look at the length of time necessary to clean up pol-

luted sites, controversies surrounding the identity of the responsible

party, the degree of remediation deemed to be necessary, the esti-

mated time period for litigation expenses, judicial expansions of cov-

erage, medical complications arising with asbestos claimants’

advanced age, case law, and the history of prior claim development.

We also consider the impact of changes in the legal environment,

including our experience in the Western MacArthur matter, in estab-

lishing our reserves for other asbestos and environmental cases.

Generally, case reserves and loss adjustment expense reserves are

established where sufficient information has been obtained to indicate

coverage under a specific insurance policy. We also consider end of

period reserves in relation to paid losses in a period. Furthermore,

IBNR reserves are established to cover additional estimated expo-

sures on both known and unasserted claims.These reserves are con-

tinually reviewed and updated as additional information is acquired.

While our reported reserves make a reasonable provision for our

unpaid loss and LAE obligations, it should be noted that the process

of estimating required reserves, by its very nature, involves substan-

tial uncertainty. The level of uncertainty can be influenced by factors

such as the existence of coverage with long duration payment pat-

terns and changes in claim handling practices, as well as the factors

noted above. Ultimate actual payments for claims and LAE could turn

out to be significantly different from our estimates.

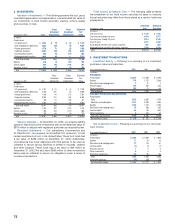

Our liabilities for unpaid losses and LAE related to tabular workers’

compensation and certain assumed reinsurance coverage are dis-

counted to the present value of estimated future payments. Prior to

discounting, these liabilities totaled $887 million and $948 million at

December 31, 2002 and 2001, respectively. The total discounted lia-

bility reflected on our balance sheet was $718 million and $768 mil-

lion at December 31, 2002 and 2001, respectively. The liability for

workers’ compensation was discounted using rates of up to 3.5%,

based on state-prescribed rates.The liability for certain assumed rein-

surance coverage was discounted using rates up to 7.5%, based on

our return on invested assets or, in many cases, on yields contractu-

ally guaranteed to us on funds held by the ceding company, as per-

mitted by the state of domicile.

Lloyd’s — We participate in Lloyd’s as an investor in underwriting

syndicates and as the owner of a managing agency. Using the periodic

method, which provides for current recognition of profits and losses,

we record our pro rata share of syndicate assets, liabilities, revenues

and expenses, after making adjustments to convert Lloyd’s accounting

to U.S. GAAP. The most significant U.S. GAAP adjustments relate to

income recognition. Lloyd’s syndicates determine underwriting results

by year of account at the end of three years.We record adjustments to

recognize underwriting results as incurred, including the expected ulti-

mate cost of losses incurred. These adjustments to losses are based

on actuarial analysis of syndicate accounts, including forecasts of

64

expected ultimate losses provided by the syndicates.The results of our

operations at Lloyd’s are recorded on a one-quarter lag due to time

constraints in obtaining and analyzing such results for inclusion in our

consolidated financial statements on a current basis. (Also see discus-

sion under “Premiums Earned” above.)

Policy Acquisition Expenses — The costs directly related to writing

an insurance policy are referred to as policy acquisition expenses and

consist of commissions, state premium taxes and other direct under-

writing expenses. Although these expenses are incurred when we

issue a policy, we defer and amortize them over the same period as

the corresponding premiums are recorded as revenues. On a regular

basis, we perform a recoverability analysis of the deferred policy

acquisition costs in relation to the expected recognition of revenues,

including anticipated investment income, and reflect adjustments, if

any, as period costs. Should the analysis indicate that the acquisition

costs are unrecoverable, further analyses are performed to determine

if a reserve is required to provide for losses, which may exceed the

related unearned premiums.

Allowance for Doubtful Accounts — Our allowance for doubtful

accounts for premiums and deductibles receivable is calculated by

applying an estimated bad debt percentage to an aging of receivables

segmented by business unit to determine general collectibility.

Specific collection issues are highlighted separately, and a compari-

son of prior year write-offs with year-to-date results is made to deter-

mine reasonableness. We also have an allowance for uncollectible

reinsurance recoverables that is calculated based on the outstanding

balances, taking into consideration the status of the reinsurer, the

nature of the balance and whether or not the amount is in dispute.The

establishment of our allowance for doubtful accounts involves judg-

ment and therefore creates a degree of uncertainty as to adequacy at

each reporting date.

Guarantee Fund and Other Insurance-Related Assessments —

We establish an accrual related to estimated future guarantee fund

payments and other insurance-related assessments, primarily second

injury funds. Guarantee fund payments are based on our historical

experience as well as for specific known events or insolvencies. Loss-

based second injury fund assessments are accrued based on our

total loss reserves for the relevant states and lines of business. As of

December 31, 2002 and 2001, we carried an accrual of $43 million

and $49 million, respectively, for these payments, which are expected

to be disbursed as assessed during a period of up to 30 years. We

also establish assets related to the recovery of these costs when

appropriate. As of December 31, 2002 and 2001, we carried assets of

$15 million and $9 million for premium tax offsets, respectively, and

$11 million and $2 million for policy surcharges, respectively. This

accrual is subject to change following revisions to assessments that

may be enacted by any of the states we write business in.

ACCOUNTING FOR OUR ASSET MANAGEMENT OPERATIONS

We hold a 79% interest in Nuveen Investments, Inc. (“Nuveen

Investments,” formerly The John Nuveen Company), which consti-

tutes our asset management segment. Nuveen Investments’ core

businesses are asset management and related research, as well as

the development, marketing and distribution of investment products

and services for the affluent, high-net-worth and institutional market

segments. Nuveen Investments distributes its investment products

and services, including individually managed accounts, closed-end

exchange-traded funds and mutual funds, to the affluent and high-net-

worth market segments through unaffiliated intermediary firms includ-

ing broker/dealers, commercial banks, affiliates of insurance

providers, financial planners, accountants, consultants and invest-

ment advisors. Nuveen Investments also provides managed account

services to several institutional market segments and channels.

In August 2002, Nuveen Investments purchased NWQ Investment

Management Company, Inc. (“NWQ”), an asset management firm

based in Los Angeles with approximately $6.9 billion of assets under

management in both retail and institutional managed accounts. NWQ

specializes in value-oriented equity investments with significant rela-

tionships among institutions and financial advisors serving high-

net-worth investors.