Travelers 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11. RESERVES FOR LOSSES AND LOSS

ADJUSTMENT EXPENSES

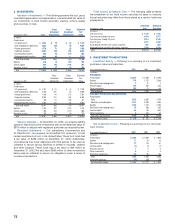

Reconciliation of Loss Reserves — The following table represents

a reconciliation of beginning and ending consolidated property-liabil-

ity insurance loss and loss adjustment expense (“LAE”) reserves for

each of the last three years.

Years ended December 31 2002 2001 2000

(In millions)

Loss and LAE reserves at beginning

of year, as reported $22,101 $18,196 $ 17,720

Less reinsurance recoverables on unpaid

losses at beginning of year (6,848) (4,651) (3,678)

Net loss and LAE reserves at beginning of year 15,253 13,545 14,042

Activity on reserves of discontinued operations:

Losses incurred 717 (4)

Losses paid (67) (131) (141)

Net activity (60) (114) (145)

Net reserves of acquired companies 57 —984

Provision for losses and LAE for claims

incurred on continuing operations:

Current year 4,996 6,902 4,178

Prior years 999 577 (265)

Total incurred 5,995 7,479 3,913

Losses and LAE payments for claims incurred

on continuing operations:

Current year (1,033) (1,125) (970)

Prior years (5,359) (4,443) (4,138)

Total paid (6,392) (5,568) (5,108)

Unrealized foreign exchange gain (4) (89) (141)

Net loss and LAE reserves at end of year 14,849 15,253 13,545

Plus reinsurance recoverables on unpaid

losses at end of year 7,777 6,848 4,651

Loss and LAE reserves at end of year, as reported $22,626 $22,101 $ 18,196

During 2002, we recorded a total of $1 billion in provisions for

losses and LAE for claims incurred in prior years, including $472 mil-

lion in our Commercial Lines segment related to the Western

MacArthur asbestos settlement agreement, $217 million in our Surety

& Construction segment, $168 million in our Other segment and

$97 million in our Health Care segment.

Health Care Exposures — During 2002, we concluded that the

impact of settling Health Care claims in a runoff environment was

causing abnormal effects on our average paid claims, average out-

standing claims, and the amount of average case reserves estab-

lished for new claims — all of which are traditional statistics used by

our actuaries to develop indicated ranges of expected loss.

Considering these changing statistics, we developed varying interpre-

tations of the underlying data, which added more uncertainty to our

evaluation of these reserves. It is our belief that this additional data,

when evaluated in light of the impact of our migration to a runoff envi-

ronment, supports our view that we will realize significant savings on

our ultimate Health Care claim costs.

During the fourth quarter of 2002, we established specific tools

and metrics to more explicitly monitor and validate our key assump-

tions supporting our Health Care reserve conclusions, to supplement

our traditional statistics and reserving methods. The tools developed

track the three primary metrics which are influencing our expecta-

tions, which are: a) newly reported claims, b) reserve development on

known claims, and c) the redundancy ratio comparing the cost of

resolving claims to the reserve established for individual claims.

While recent results of these indicators support our view that we

have recorded a reasonable provision for our Health Care reserves as

of December 31, 2002, there is a reasonable possibility that we may

incur additional adverse prior-year development if these indicators

significantly change from our current expectations, and could result in

additional loss provisions of up to $250 million.

During 2001, we recorded significant prior-year loss provisions for

our Health Care segment. In 2001, loss activity continued to increase

not only for the years 1995 through 1997, but also 1998, and early

activity on claims incurred in 1999 through 2001 indicated an increase

74

in severity for those years. Those developments led us to a much dif-

ferent view of loss development in this segment, which in turn caused

us to record provisions for prior year losses totaling $735 million in

2001. Excluding this specific increase, the change in the prior-year

loss provision was a reduction of $158 million. At the end of 2001, we

announced our intention to exit, on a global basis, all business under-

written in our Health Care segment through ceasing to write new busi-

ness and the non-renewal of business upon policy expiration, in

accordance with regulatory requirements. In 2000, loss trends in this

segment had indicated an increase in the severity of claims incurred

in the 1995 through 1997 accident years. Accordingly, we recorded a

$225 million provision for prior-year losses, $77 million of which was

recorded by MMI prior to our acquiring it in 2000.

Surety Exposures — Within our surety operations, we have expo-

sures related to a small number of accounts which are in various

stages of bankruptcy proceedings. In addition, certain other accounts

have experienced deterioration in creditworthiness since we issued

bonds to them. Given the current economic climate and its impact on

these companies, we may experience an increase in claims and, pos-

sibly, incur high severity losses. Such losses would be recognized in

the period in which the claims are filed and determined to be a valid

loss under the provisions of the surety bond issued.

With regard to commercial surety bonds issued on behalf of com-

panies operating in the energy trading sector (excluding Enron

Corporation), our aggregate pretax exposure net of facultative rein-

surance, is with six companies for a total of approximately $425 mil-

lion ($356 million of which is from gas supply bonds), an amount

which will decline over the contract periods. The largest individual

exposure approximates $192 million (pretax). These companies all

continue to perform their bonded obligations and, therefore, no claims

have been filed.

With regard to commercial surety bonds issued on behalf of com-

panies currently in bankruptcy, our largest individual exposure, pretax

and before estimated reinsurance recoveries, approximated $120 mil-

lion as of December 31, 2002. Although no claims have been filed for

this account, it is reasonably possible that a claim will be filed for up

to $40 million, the full amount of one bond related to this exposure.

Based on the availability of reinsurance and other factors, we do not

believe that such a claim would materially impact our after-tax results

of operations. Our remaining exposure to this account consists of

approximately $80 million in bonds securing certain workers’ compen-

sation obligations. To date, no claims have been asserted against

these workers’compensation bonds and we currently have insufficient

information to estimate the amount of any claims that might be

asserted in the future.To the extent that claims are made under these

workers’ compensation bonds, we believe that they would likely be

asserted for amounts lower than the face amounts, and settled on a

present value basis.

In addition to the exposures discussed above with respect to

energy trading companies and companies in bankruptcy, our com-

mercial surety business as of December 31, 2002 included eight

accounts with gross pretax bond exposures greater than $100 million

each, before reinsurance. The majority of these accounts have

investment grade ratings, and all accounts continue to perform their

bonded obligations.

Discontinued Operations — The “activity on reserves of discontin-

ued operations” represents certain activity related to the 1999 sale of

our standard personal insurance business. The reserve balances

associated with certain portions of the business sold are included in

our total reserves, but the related incurred losses are excluded from

continuing operations in our statements of operations for all periods

presented, and included in discontinued operations. See Note 15 for

a discussion of reserve guarantees we made related to this sale.

Environmental and Asbestos Reserves — Our underwriting opera-

tions continue to receive claims under policies written many years ago

alleging injury or damage from environmental pollution or seeking pay-

ment for the cost to clean up polluted sites. We have also received

asbestos injury claims tendered under general liability policies.