Travelers 2002 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

In 2002, we substantially completed a successful, broad-based strategic repositioning of The St. Paul. We exited or

refocused underperforming businesses, took actions to significantly improve the performance and profitability of our

ongoing operations, and embarked on a number of new business strategies to enhance future growth.

That we accomplished so much in just a single year – having announced our new strategic plan at the end of 2001 –

is testimony to the commitment and drive of our people. Change is never easy, but our employees embraced the

company’s new focus and implemented these initiatives with a renewed sense of urgency.

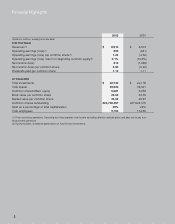

Despite our strategic successes in both our insurance and asset management segments, our consolidated financial per-

formance this past year was significantly hampered by the $307 million, or $1.35 per share, after-tax impact of the settle-

ment of the Western MacArthur asbestos litigation. Accordingly, in 2002 we reported net income of $218 million, or $0.92

per share, compared with a net loss of $1.1 billion, or $5.22 per share, in 2001. Operating earnings increased to $290 mil-

lion, or $1.24 per share, compared with an operating loss in 2001 of $941 million, or $4.52 per share. (Operating earnings

represent net income excluding after-tax realized gains and after-tax losses from discontinued operations.) Total capital at

the end of 2002 increased to $9.3 billion from $8.1 billion at the end of 2001.

Notwithstanding the cost of the Western MacArthur settlement, our results demonstrated dramatic improvement in

the execution within our insurance segments. We achieved strong price increases and made significant improvements

in our ongoing operations. Written premiums for these ongoing segments grew 22% to $5.9 billion in 2002. Adjusting

for the settlement of Western MacArthur, the 2002 combined ratio of these operations was 95.9, driven by disciplined

underwriting and a meaningful reduction in expenses. We also benefited from an

eighth consecutive year of record net earnings – $126 million in 2002 – from

Nuveen Investments, our asset management operation. Nuveen increased its

total assets under management by 16% to $80 billion in a very challenging

securities market.

Insurance Operations

In December 2001 we embarked on a three-part strategic plan in our insur-

ance operations designed to improve the company’s profitability and return

on capital, to generate more consistent and predictable earnings and to

broaden the company’s business profile to provide for future growth

opportunities. The plan included:

Exiting or Refocusing Underperforming Businesses The first

part of our plan was to exit or refocus businesses that could not

produce acceptable profitability or presented too much potential

volatility to our results. We:

•Discontinued our medical liability business. This business had

been unprofitable for some time, and we were unable to design a

strategy that was likely to succeed. As a result, we made the dif-

ficult decision to exit the business, issuing nonrenewal notices to

nearly all of our medical liability policyholders by year-end 2002.

The St. Paul Companies 2002 Annual Report 3

The Chairman’s Letter

Jay S. Fishman

Chairman and Chief Executive Officer