Travelers 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

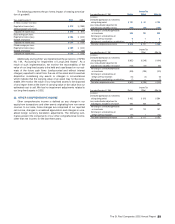

of additional capital to a new venture capital fund or agree to contribute

an additional $150 million (not reflected in the table above) to Fund VI.

Letters of Credit — In the normal course of business, we enter into

letters of credit as collateral, as required in certain of our operations.

As of December 31, 2002, we had entered into letters of credit with

an aggregate amount of $1.08 billion.

Lease Commitments — A portion of our business activities is con-

ducted in rented premises. We also enter into leases for equipment,

such as office machines and computers. Our total rental expense was

$86 million in 2002, $83 million in 2001 and $83 million in 2000.

Certain leases are noncancelable, and we would remain responsible

for payment even if we stopped using the space or equipment. On

December 31, 2002, the minimum rents for which we would be liable

under these types of leases are as follows: $122 million in 2003,

$100 million in 2004, $76 million in 2005, $66 million in 2006, $58 mil-

lion in 2007 and $140 million thereafter. We are also the lessor under

various subleases on our office facilities. The minimum rentals to be

received under noncancelable subleases are as follows: $22 million in

2003, $17 million in 2004, $16 million in 2005, $15 million in 2006,

$12 million in 2007 and $25 million thereafter.

Sale of Minet — In May 1997, we completed the sale of our insur-

ance brokerage operation, Minet, to Aon Corporation. We agreed to

indemnify Aon against any future claims for professional liability and

other specified events that occurred or existed prior to the sale. We

monitor our exposure under these claims on a regular basis. We

believe reserves for reported claims are adequate, but we do not have

information on unreported claims to estimate a range of additional lia-

bility. We purchased insurance to cover a portion of our exposure to

such claims.

Under the sale agreement, we also committed to pay Aon commis-

sions representing a minimum level of annual reinsurance brokerage

business through 2012. We also have commitments under lease

agreements through 2015 for vacated space (included in our lease

commitment totals above), as well as a commitment to make pay-

ments to a former Minet executive.

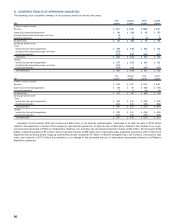

Acquisitions — Our asset management subsidiary, Nuveen

Investments, Inc., may be required to make additional payments of up

to $180 million related to their acquisition of Symphony, based on

Symphony reaching specified performance and growth targets.

Joint Ventures — Our subsidiary, Fire and Marine, is a party to five

separate joint ventures, in each of which Fire and Marine is a 50%

owner of various real estate holdings and does not exercise control over

the joint ventures, financed by non-recourse mortgage notes. Because

we own only 50% of the holdings, we do not consolidate these entities

and the joint venture debt does not appear on our balance sheet. Our

maximum exposure under each of these joint ventures, in the event of

foreclosure of a property, is limited to our carrying value in the joint ven-

ture, ranging individually from $8 million to $29 million, and cumulatively

totaling $62 million at December 31, 2002.

Legal Matters — In the ordinary course of conducting business,

we (and certain of our subsidiaries) have been named as defendants

in various lawsuits. Some of these lawsuits attempt to establish liabil-

ity under insurance contracts issued by our underwriting operations,

including liability under environmental protection laws and for injury

caused by exposure to asbestos products. Plaintiffs in these lawsuits

are seeking money damages that in some cases are substantial or

extra contractual in nature or are seeking to have the court direct the

activities of our operations in certain ways.

Although the ultimate outcome of these matters is not presently

determinable, it is possible that the resolution of one or more matters

may be material to our results of operations; however, we do not

believe that the total amounts that we and our subsidiaries will ulti-

mately have to pay in all of these lawsuits will have a material effect

on our liquidity or overall financial position.

The following is a summary of certain litigation matters with

contingencies:

• Asbestos Settlement Agreement — On June 3, 2002, we

announced that we and certain of our subsidiaries had entered

into an agreement settling all existing and future claims arising

from any insuring relationship of United States Fidelity and

Guaranty Company, St. Paul Fire and Marine Insurance

Company and their affiliates and subsidiaries, including us, with

any of MacArthur Company, Western MacArthur Company, and

Western Asbestos Company. There can be no assurance that

this agreement will receive bankruptcy court approval. See dis-

cussion in Note 3.

• Petrobras Oil Rig Construction — In September 2002, the United

States District Court for the Southern District of New York

entered a judgment in the amount of approximately $370 million

to Petrobras, an energy company that is majority-owned by the

government of Brazil, in a claim related to the construction of two

oil rigs. One of our subsidiaries provided a portion of the surety

coverage for that construction. As a result, we recorded a pretax

loss of $34 million ($22 million after-tax) in 2002 in our Surety &

Construction business segment. The loss recorded was net of

reinsurance and previously established case reserves for this

exposure, and prior to any possible recoveries related to indem-

nity. We are actively pursuing an appeal of this judgment.

• Purported Class Action Shareholder Lawsuits — In the fourth

quarter of 2002, several purported class action lawsuits were

filed against our chief executive officer, our chief financial officer

and us.The lawsuits make various allegations relating to the ade-

quacy of our previous public disclosures and reserves relating to

the Western MacArthur asbestos litigation, and seek unspecified

damages and other relief. We view these lawsuits as without

merit and intend to contest them vigorously.

• Boson v. Union Carbide Corp., et al. — Lawsuits have been filed

in Texas against one of our subsidiaries, USF&G, and other

insurers and non-insurer corporate defendants asserting liability

for failing to warn of the dangers of asbestos. It is difficult to pre-

dict the outcome or financial exposure represented by this type

of litigation in light of the broad nature of the relief requested and

the novel theories asserted. We believe, however, that the cases

are without merit and we intend to contest them vigorously.

Agency Loans — We have provided guarantees for certain agency

loans in order to enhance the business operations and opportunities

of several of the insurance agencies with which we do business. As of

December 31, 2002, these loans had an aggregate outstanding bal-

ance of approximately $9 million. We have guaranteed the lending

institutions that we will pay up to the entire principal amount outstand-

ing in case of any agency defaults, plus any reasonable costs associ-

ated with the default. There are varying terms on the loans, and the

guarantees are in place until the loans are paid in full.

Corporate Securities — Through the issuance of our debt securi-

ties, we have guaranteed to indemnify the financial institutions against

any loss, liability, claim, damage, or expense, including taxes that may

arise out of the administration of the debt arrangement. There are no

contractual monetary limits placed on these guarantees, and they sur-

vive until the applicable statutes of limitation expire.

Venture Capital — Our subsidiary, St. Paul Venture Capital VI, LLC

has guaranteed third party loans in the aggregate amount of approx-

imately $4 million. In the event that the borrower would default,

St. Paul Venture Capital has guaranteed payment up to the aforemen-

tioned limits, plus any costs, fees, and expenses that the lending insti-

tution might incur in the administration of the default on the loans.

These guarantees are in place until the loans are paid in full.

Swap Agreements — We are party to a number of interest rate

swaps. Each party to a standard swap agreement agrees to indemnify

the other for tax liabilities that may arise out of the swap transactions.

We have no way to value the potential liability or asset that may arise

due to these tax issues, and there are no contractual monetary limits

placed on these indemnifications.

Platinum Transaction — In connection with the Platinum transac-

tion, we entered into a series of servicing agreements with Platinum

relating to the transfer of our 2002 reinsurance business. Such agree-

ments provide general indemnification obligations on each of the par-

ties with respect to representations, warranties and covenants made

under the terms of each of the agreements. Generally, the indemnifi-

cation obligations of each party are capped at the aggregate of all

The St. Paul Companies 2002 Annual Report 83