Travelers 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

incurred losses; and the remainder of (37)% to incurred losses in 1997

and prior years. Of the Medical Malpractice reserve adjustments

recorded in 2001, approximately 29% related to 2000 incurred losses;

approximately 30% to 1999 incurred losses; approximately 15% to

1998 incurred losses; approximately 10% to 1997 incurred losses; and

the remaining 16% to incurred losses in 1996 and prior years.

In general, the reserve increases discussed below have primarily

resulted from claim payments being greater than anticipated due to the

recent escalation of large jury awards, which included substantially

higher than expected pain and suffering awards.This affected our view

of not only those cases going to trial, but also our view of all cases

where settlements are negotiated and the threat of a large jury verdict

aids the plaintiff bar in the negotiation process. The recent escalation

in claim costs in the periods noted below that resulted from these

developments was significantly higher than originally projected trends

(which had not forecasted the change in the judicial environment), and

has now been considered in our actuarial analysis and the projection

of ultimate loss costs. In addition, a portion of the reserve increase in

the fourth quarter of 2001 resulted from information obtained from the

work of a Health Care Claims Task Force, created during the first half

of 2001, which focused resolution efforts on our largest claims with the

intent of lowering our ultimate loss costs.

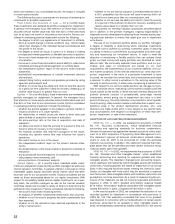

The following table summarizes, for each quarter of 2002, 2001

and 2000, our ending net reserves for losses and allocated loss

adjustment expenses for our Health Care segment, any prior-period

reserve strengthening recorded in the quarter (all related to the

Medical Malpractice portion of the segment), and the percentage

such reserve strengthening represented in relation to beginning of

period total loss liability.

Percent of Prior

Reserve Quarter

Ending Reserves Adjustment* Reserves

($ in millions)

2000:

1st quarter $ 1,724 $ — —%

2nd quarter $ 2,263 $ — —%

3rd quarter $ 2,258 $ 65 3%

4th quarter $ 2,204 $ 75 3%

2001:

1st quarter $ 2,195 $ 90 4%

2nd quarter $ 2,195 $ 105 5%

3rd quarter $ 2,226 $ — —%

4th quarter $ 2,577 $ 540 24%

2002:

1st quarter $ 2,439 $ — —%

2nd quarter $ 2,377 $ 97 4%

3rd quarter $ 2,291 $ — —%

4th quarter $ 2,076 $ — —%

*The insurance loss reserving process involves judgment by actuaries and management, including evaluation

not only of underlying data, but also of changes in legal, economic and societal factors that are generally not

quantifiable.Such application of judgment includes an analysis of trends that develop over time and which make

it difficult to directly correlate specific data points (as discussed previously) with a specific reserving decision.

2000 In the first quarter, our observations were within expected

ranges and no adjustments were made to these reserves. In the sec-

ond quarter, we closed on our acquisition of MMI Companies, Inc.

(“MMI”), including the medical malpractice business of their domestic

insurance subsidiary, American Continental Insurance Company

(“ACIC”). We concluded that ACIC’s loss reserves were appropriately

stated at the date of acquisition, as well as at the close of the second

quarter. However, we noted the possibility of a continuing adverse

trend with respect to average payments and case reserve levels which

we decided to continue to monitor for possible revised indications. In

the third quarter, both average payments and average case reserves

increased significantly for the ACIC business. Reserve additions of

$65 million were made based upon our analysis.Our observations with

respect to the St. Paul Fire and Marine Insurance Company (“F&M”),

our primary U.S. insurance underwriting subsidiary, health care busi-

ness were within expected ranges and no adjustments were made to

these reserves. In the fourth quarter, average ACIC loss payments

were again significantly above past experience. Even though average

case reserves had decreased from the prior quarter, they were higher

than historic observations. Reserve additions of $75 million for ACIC

were made based upon this analysis. F&M observations were slightly

above its historic averages, but were considered to be one-quarter

anomalies and did not cause us to believe there was a need to record

additional reserves.

2001 In the first quarter, we determined that trends that had begun

to appear in the third and fourth quarters of 2000 with respect to the

book of business of ACIC were outside of expected trends, resulting in

increases to our expected average case reserve outstanding and aver-

age paid claims. Within the F&M book of business, we also observed

a continuation of the increase in the average outstanding case reserve

levels and in the average paid claims. We believe the principal cause

of these increases was the judicial trend noted above. We revised our

estimate of ultimate losses and made a reserve addition of $90 million.

In the second quarter, we determined that the sharp increases in aver-

age paid claims and outstanding case reserve levels during the prior

quarters and the second quarter of 2001 indicated a need to increase

our actuarial estimate of required reserves (without changing our pro-

jected trends) in light of the adverse judicial awards noted above, and

we made a reserve addition of $105 million. In the third quarter, while

case reserve levels increased, the average paid claims were within an

expected level. Certain of our models indicated a need for increased

reserves, while other methods, including the results of stress testing

the underlying assumptions (primarily the level of case reserves and

paid activity), indicated that reserves were appropriate in total for our

Health Care segment. Management considered all available informa-

tion and determined that reserves were appropriate as of Septem-

ber 30, 2001.

In the fourth quarter of 2001, we revised certain actuarial assump-

tions based on the adverse trends observed in the prior three quarters.

Average case reserve levels increased significantly due to our efforts

to identify cases that could be expected to have a significant impact

and manage them to closure more actively. Based on the evolving

trends we had observed emerging in prior quarters, as well as escalat-

ing claim payments observed in the fourth quarter of 2001, we con-

cluded that average payments were not only at a new sustained and

higher level, but that they could also increase beyond those average

payments, and/or at a rate faster than inflation. We thus concluded it

was appropriate at that time to change the actuarial assumptions we

had been using in our development pattern to consider higher loss

severities and a faster rate of growth for losses. Specifically, during the

fourth quarter of 2001, we adjusted our assumptions with respect to

the expected ultimate incurred and paid losses at each 12-month

period from the reported loss date. These assumptions increased the

expected ultimate incurred loss from a 2% increase over our estimated

incurred at 108 months following the reported date, to a 24% increase

over estimated incurred at 12 months following the reported date.

Similarly, we increased our expected ultimate paid loss assumption

from a 3% increase over our paid losses at 108 months following the

reported date to a 46% increase over our assumption of the paid

losses at 12 months following the reported date. After careful analysis

and determination of development patterns and the resulting revision

of our actuarial assumptions described above, a charge to reserves of

$540 million was determined to be necessary and was recorded dur-

ing the fourth quarter of 2001.

2002 Following the cumulative prior-year reserve charges of

$735 million in 2001, activity in the first quarter of 2002 developed

according to projections. Average paid claims for the full year of 2001

for medical malpractice lines had been $117,000, including a fourth

quarter average of $124,000. The phrase “average paid claims” as

used herein excludes claims which were settled or closed for which no

loss or loss expense was paid. In the first quarter of 2002, the average

paid loss was down to $111,000.We interpreted this as a positive sign

that prior year reserve charges up to this point had been adequate.The

average outstanding case reserve increased slightly from $141,000 in

the fourth quarter of 2001 to $144,000 in the first quarter of 2002, but

this was interpreted as a relatively benign change, given inflation and

The St. Paul Companies 2002 Annual Report 41