Travelers 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ment in certain circumstances of amounts advanced. That amount

was also paid in the second quarter.

As a result of the settlement, pending litigation with the MacArthur

Companies has been stayed pending final approval of the Plan.

Whether or not the Plan is approved, $175 million of the $235 million

will be paid to the bankruptcy trustee, counsel for the MacArthur

Companies, and persons holding judgments against the MacArthur

Companies as of June 3, 2002 and their counsel, and the USF&G

Parties will be released from claims by such holders to the extent of

$110 million paid to such holders.

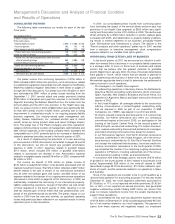

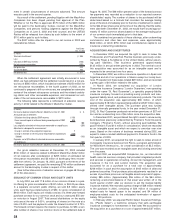

The $307 million after-tax impact to our net income in 2002 was

calculated as follows.

Year Ended

Dec. 31, 2002

(In millions)

Total cost of settlement $995

Less:

Utilization of IBNR loss reserves (153)

Net reinsurance recoverables (370)

Net pretax loss 472

Tax benefit @35% 165

Net after-tax loss $307

When the settlement agreement was initially announced in June

2002, we had estimated that the settlement would result in a net pre-

tax loss of $585 million, which included an estimate of $250 million for

net reinsurance recoverables. In the fourth quarter of 2002, as we

continued to prepare to bill our reinsurers, we completed an extensive

review of the relevant reinsurance contracts and the related underly-

ing claims and other recoverable expenses, and increased our esti-

mate of the net reinsurance recoverable to $370 million.

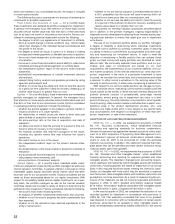

The following table represents a rollforward of asbestos reserve

activity in 2002 related to the Western MacArthur matter.

(In millions)

Net reserve balance related to Western MacArthur at Dec. 31, 2001 $6

Announced cost of settlement:

Utilization of existing asbestos IBNR reserves $153

Gross incurred impact of settlement during second quarter of 2002 835

Subtotal 988

Less: originally estimated net reinsurance recoverable on unpaid losses (250)

Adjustments subsequent to announcement:

Change in estimate of loss adjustment expenses 7

Change in estimate of net reinsurance recoverable on unpaid losses (120)

Subtotal (113)

Payments, net of $75 million of estimated reinsurance recoverables

on paid losses (189)

Net reserve balance related to Western MacArthur at Dec. 31, 2002 $442

Our gross asbestos reserves at December 31, 2002 included

$740 million of reserves related to Western MacArthur ($442 million

of net reserves after consideration of $295 million of estimated net

reinsurance recoverables and $3 million of bankruptcy fees recover-

able from others). On January 16, 2003, pursuant to the terms of the

settlement agreement, we paid the remaining $740 million settlement

amount to the bankruptcy trustee in respect of this matter.

(See further discussion of asbestos reserves on pages 48 through

49 of this discussion).

ISSUANCE OF COMMON STOCK AND EQUITY UNITS

In July 2002, we sold 17.8 million of our common shares in a pub-

lic offering for gross consideration of $431 million, or $24.20 per share.

In a separate concurrent public offering, we sold 8.9 million equity

units, each having a stated amount of $50, for gross consideration of

$443 million. Each equity unit initially consists of a three-year forward

purchase contract for our common stock and our unsecured $50 sen-

ior note due in August 2007. Total annual distributions on the equity

units are at the rate of 9.00%, consisting of interest on the note at a

rate of 5.25% and fee payments under the forward contract of 3.75%.

The forward contract requires the investor to purchase, for $50, a vari-

able number of shares of our common stock on the settlement date of

28

August 16, 2005.The $46 million present value of the forward contract

fee payments was recorded as a reduction to our reported common

shareholders’ equity. The number of shares to be purchased will be

determined based on a formula that considers the average trading

price of the stock immediately prior to the time of settlement in relation

to the $24.20 per share price at the time of the offering. Had the settle-

ment date been December 31, 2002, we would have issued approxi-

mately 15 million common shares based on the average trading price

of our common stock immediately prior to that date.

The combined net proceeds of these offerings, after underwriting

commissions and other fees and expenses, were approximately

$842 million, of which $750 million was contributed as capital to our

insurance underwriting subsidiaries.

ACQUISITIONS AND DIVESTITURES

In December 2002, we acquired the right to seek to renew the

Professional and Financial Risk Practice business previously under-

written by Royal & SunAlliance in the United States, without assum-

ing past liabilities. That business generated approximately

$125 million in annual written premiums in 2002. The nominal cost of

this acquisition was accounted for as an intangible asset and is

expected to be amortized over four years.

In December 2002, we sold our insurance operations in Spain and

Argentina and all of our operations in Mexico except our surety busi-

ness. Proceeds from these sales totaled $29 million, and we recorded

a pretax gain of $4 million related to the sales.

In March 2002, we completed our acquisition of London

Guarantee Insurance Company (“London Guarantee,” now operating

under the name “St. Paul Guarantee”), a specialty property-liability

insurance company focused on providing surety products and man-

agement liability, bond, and professional indemnity products.The total

cost of the acquisition was approximately $80 million, of which

approximately $18 million represented goodwill and $37 million repre-

sented other intangible assets. The purchase price was funded

through internally generated funds. In the year ended December 31,

2002, St. Paul Guarantee produced net written premiums of $57 mil-

lion and an underwriting loss of $6 million since the acquisition date.

In December 2001, we purchased the right to seek to renew surety

bond business previously underwritten by Fireman’s Fund Insurance

Company (“Fireman’s Fund”), without assuming past liabilities. We

paid Fireman’s Fund $10 million in consideration, which we recorded

as an intangible asset and which we expect to amortize over nine

years. Based on the volume of business renewed during 2002, we

expect to make a modest additional payment to Fireman’s Fund in the

first quarter of 2003.

In January 2001, we acquired the right to seek to renew a book of

municipality insurance business from Penco, a program administrator

for Willis North America Inc., for a total consideration of $3.5 million.

The cost was recorded as an intangible asset and is being amortized

over five years.

In April 2000, we acquired MMI Companies, Inc., an international

health care risk services company that provided integrated products

and services in operational consulting, clinical risk management, and

insurance in the U.S. and London markets. The acquisition was

accounted for as a purchase for a total cost of approximately

$206 million in cash and the assumption of $165 million of debt and

preferred securities. Final purchase price adjustments resulted in an

excess of purchase price over net tangible assets acquired of approx-

imately $85 million. (Approximately $56 million of the $64 million

remaining unamortized balance of that asset was written off in the

fourth quarter of 2001 after our decision to exit the medical liability

insurance market).We recorded a pretax charge of $28 million related

to the purchase in 2000, consisting of $24 million of occupancy-

related costs for leased space to be vacated, and $4 million of

employee-related costs for the anticipated termination of approxi-

mately 130 positions.

In February 2000, we acquired Pacific Select Insurance Holdings,

Inc. (“Pacific Select”), a California company that sells earthquake

insurance coverages to homeowners in that state. We accounted for

the acquisition as a purchase at a cost of approximately $37 million,