Travelers 2002 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

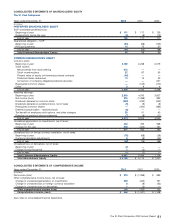

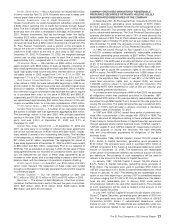

The original estimated losses in 2001 and the adjustments

recorded in 2002 impacted our statements of operations as follows.

The tax expense or benefit was calculated at the statutory rate of 35%.

Years Ended December 31 2002 2001

(In millions)

Premiums earned $— $83

Insurance losses and loss adjustment expenses 13 (1,115)

Operating and administrative expenses —91

Income (loss) from continuing operations, before income taxes 13 (941)

Income tax expense (benefit) 5(329)

Income (loss) from continuing operations $8 $(612)

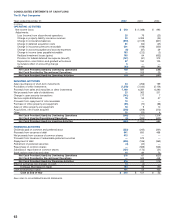

The estimated net pretax impacts of the original losses recorded

in 2001 and the adjustments recorded in 2002 were distributed

among our property-liability business segments as follows.

Net estimate

Original 2002 at Dec. 31,

2001 Losses Adjustments 2002

(In millions)

Specialty Commercial $ 52 $8 $60

Commercial Lines 139 (30) 109

Surety & Construction 2 —2

International & Lloyd’s 95 (22) 73

Health Care 5 —5

Reinsurance 556 24 580

Other 92 799

Total Property-Liability Insurance $ 941 $(13) $ 928

Through December 31, 2002, we paid a total of $307 million in net

losses related to the terrorist attack since it occurred, including

$242 million during the year ended December 31, 2002.

The Terrorism Risk Insurance Act of 2002 was signed into law in

November 2002. This temporary legislation remains in effect until

December 31, 2005, and requires insurers to offer coverage for cer-

tain types of terrorist acts in their commercial property and liability

insurance policies, and establishes a federal program to reimburse

insurers for a portion of losses so insured.

5. DECEMBER 2001 STRATEGIC REVIEW

In October 2001, we announced that we were undertaking a thor-

ough review of each of our business operations under the direction of

our new chief executive officer. On completion of that review in

December 2001, we announced a series of actions designed to

improve our profitability. The following summarizes the actions taken

in 2002 as a result of the strategic review.

• We exited, on a global basis, all business underwritten in our

Health Care segment through ceasing to write new business and

the non-renewal of business upon policy expiration, in accor-

dance with regulatory requirements. We offered reporting

endorsements to our insureds as or to the extent required.

• We substantially narrowed the product offerings and geographic

presence of our reinsurance operation, and in the fourth quarter

of 2002, we completed the transfer of our remaining ongoing

reinsurance operations, including substantially all of the reinsur-

ance business under contracts incepting during 2002, to

Platinum. See Note 2 for a discussion of that transaction.

• At Lloyd’s, we exited all of our casualty insurance and reinsur-

ance business, in addition to U.S. surplus lines and certain non-

marine reinsurance lines. We continue to underwrite aviation,

marine, property and personal insurance - including kidnap and

ransom, accident and health, creditor and other personal spe-

cialty products.

70

• We also exited those countries where we were not likely to

achieve competitive scale, and sold certain of these international

operations. We continue to underwrite business through our

offices in Canada, the United Kingdom and Ireland, and we con-

tinue to underwrite surety business in Mexico through our sub-

sidiary, Afianzadora Insurgentes.

• We reduced corporate overhead expenses, primarily through

staff reductions.

In connection with these actions in the fourth quarter of 2001, we

wrote off $73 million of goodwill related to businesses to be exited, of

which $56 million related to our Health Care segment and $10 million

related to our operations at Lloyd’s.The remaining goodwill written off

was related to our operations in Spain and Australia. In addition, in the

fourth quarter of 2001, we recorded $62 million pretax restructuring

charge related to the termination of employees and other costs to exit

these businesses. See Note 18 for a discussion of this charge.

None of the exited operations we consider to be in runoff qualify

as a “discontinued operation” for accounting purposes. For the year

ended December 2002, our runoff segments collectively accounted

for $1.16 billion or 17% of our reported net written premiums,

$1.92 billion, or 26% of our reported net earned premiums, and gen-

erated underwriting losses of $409 million (an amount that does not

include investment income from the assets maintained to support

these operations).

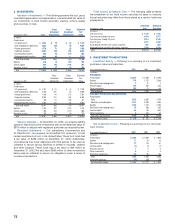

6. ACQUISITIONS & DIVESTITURES

ACQUISITIONS

Professional and Financial Risk Practice (“ProFin”) Business — In

December 2002, we purchased the right to seek renewal of the finan-

cial and professional services business previously underwritten by

Royal & SunAlliance (“RSA”), without assuming past liabilities. This

business represents approximately $125 million in expiring premium.

The nominal cost of the acquisition was recorded as an intangible

asset (characterized as renewal rights) and will be amortized on an

accelerated basis over four years.

London Guarantee — In late March 2002, we completed our

acquisition of London Guarantee Insurance Company (“London

Guarantee,” now operating under the name “St. Paul Guarantee”), a

Canadian specialty property-liability insurance company focused on

providing surety products and management liability, bond, and profes-

sional indemnity products. The total cost of the acquisition was

approximately $80 million.The preliminary allocation of this purchase

price resulted in $20 million of goodwill and $37 million of other intan-

gible assets. We recorded $13 million of the goodwill and $26 million

of the intangible assets (characterized as present value of future prof-

its) in our Surety & Construction segment, with the remaining $7 mil-

lion of goodwill and $11 million of the intangible assets in our

International and Lloyd’s segment.The intangible asset is being amor-

tized on an accelerated basis over eight years. The acquisition was

funded through internally generated funds.

St. Paul Guarantee’s assets and liabilities were included in our

consolidated balance sheet beginning June 30, 2002, and the results

of their operations since the acquisition date were included in our con-

solidated statements of operations for the twelve months ended

December 31, 2002. St. Paul Guarantee produced net written premi-

ums of $57 million and an underwriting loss of $6 million since the

acquisition date. In the fourth quarter we made a purchase account-

ing adjustment related to our deferred tax assumptions, which

decreased goodwill by $2 million.