Travelers 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our statement of operations. The fair value of the collar agreement

was recorded as an asset on our balance sheet and adjusted quar-

terly. At the time of the sale of the Old Mutual shares, the collar had a

fair value of $12 million, which we agreed to terminate at no value in

connection with the sale. The amount was recorded as a component

of discontinued operations on our statement of operations.

In September 2001, we sold American Continental Life Insurance

Company, a small life insurance company we had acquired as part of

our MMI purchase, to CNA Financial Corporation. We received cash

proceeds of $21 million, and recorded a net after-tax loss on the sale

of $1 million.

Standard Personal Insurance Business — In June 1999, we made

a decision to sell our standard personal insurance business and, on

July 12, 1999, reached an agreement to sell this business to

Metropolitan Property and Casualty Insurance Company

(“Metropolitan”). On September 30, 1999, we completed the sale of

this business to Metropolitan.As a result, the standard personal insur-

ance operations through June 1999 have been accounted for as dis-

continued operations for all periods presented herein, and the results

of operations subsequent to that period have been included in the

gain on sale of discontinued operations.

Metropolitan purchased Economy Fire & Casualty Company and

its subsidiaries (“Economy”), as well as the rights and interests in

those non-Economy policies constituting our remaining standard per-

sonal insurance operations. Those rights and interests were trans-

ferred to Metropolitan by way of a reinsurance and facility agreement

(“Reinsurance Agreement”).

The Reinsurance Agreement relates solely to the non-Economy

standard personal insurance policies, and was entered into solely as

a means of accommodating Metropolitan through a transition period.

The Reinsurance Agreement allows Metropolitan to write non-

Economy business on our policy forms while Metropolitan obtains the

regulatory license, form and rate approvals necessary to write non-

Economy business through their own insurance subsidiaries. Any

business written on our policy forms during this transition period is

then fully ceded to Metropolitan under the Reinsurance Agreement.

We recognized no gain or loss on the inception of the Reinsurance

Agreement and will not incur any net revenues or expenses related to

the Reinsurance Agreement. All economic risk of post-sale activities

related to the Reinsurance Agreement has been transferred to

Metropolitan. We anticipate that Metropolitan will pay all claims

incurred related to this Reinsurance Agreement. In the event that

Metropolitan is unable to honor their obligations to us, we will pay

these amounts.

As part of the sale to Metropolitan, we guaranteed the adequacy

of Economy’s loss and loss expense reserves. Under that guarantee,

we agreed to pay for any deficiencies in those reserves and to share

in any redundancies that developed by September 30, 2002. We

remain liable for claims on non-Economy policies that result from

losses occurring prior to closing. By agreement, Metropolitan adjusted

those claims and shared in redundancies in related reserves that

developed. Any losses incurred by us under these agreements were

reflected in discontinued operations in the period during which they

were incurred. At December 31, 2002, our analysis indicated that we

owed Metropolitan approximately $13 million related to these agree-

ments. Subsequent to year-end 2002, we have had additional settle-

ment discussions with Metropolitan regarding final disposition of the

agreements, and have tentatively agreed to an amount that is within

established reserves. We anticipate making that payment to

Metropolitan in the first quarter of 2003. We have no other contingent

liabilities related to this sale.

Nonstandard Auto Business — In December 1999, we decided to

sell our nonstandard auto business marketed under the Victoria

Financial and Titan Auto brands. On January 4, 2000, we announced

an agreement to sell this business to The Prudential Insurance

Company of America (“Prudential”) for $200 million in cash, subject to

certain adjustments based on the balance sheet as of the closing

date. As a result, the nonstandard auto business results of operations

were accounted for as discontinued operations for the year ended

December 31, 1999. Included in “Discontinued operations — gain

82

(loss) on disposal, net of tax” in our 1999 statement of operations was

an estimated loss on the sale of approximately $83 million, which

included the estimated results of operations through the disposal

date. All prior period results of nonstandard auto have been reclassi-

fied to discontinued operations.

On May 1, 2000, we closed on the sale of our nonstandard auto

business to Prudential, receiving total cash consideration of approxi-

mately $175 million (net of a $25 million dividend paid to our property-

liability operations prior to closing).

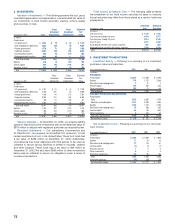

The following table summarizes our discontinued operations,

including our life insurance business, our standard personal insurance

business, our nonstandard auto business and our insurance broker-

age business, Minet (sold in 1997), for the three-year period ended

December 31, 2002.

Years ended December 31 2002 2001 2000

(In millions)

Operating income, before income taxes $— $19 $53

Income tax benefit ——(10)

Operating income, net of taxes —19 43

Gain (loss) on disposal, before income taxes (42) (61) (25)

Income tax expense (benefit) (17) 37 (5)

Gain (loss) on disposal, net of taxes (25) (98) (20)

Gain (loss) from discontinued operations $(25) $(79) $ 23

The following table summarizes our total gain (loss) from discon-

tinued operations, for each operation sold, for the three-year period

ended December 31, 2002.

Years ended December 31 2002 2001 2000

(In millions)

Life insurance $(12) $(55) $ 43

Standard personal insurance (7) (13) (11)

Nonstandard auto insurance (3) (5) (9)

Insurance brokerage (3) (6) —

Gain (loss) from discontinued operations $(25) $(79) $ 23

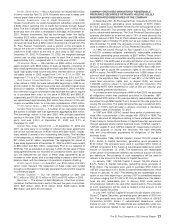

17. COMMITMENTS, CONTINGENCIES AND GUARANTEES

Investment Commitments — We have long-term commitments to

fund venture capital investments totaling $920 million as of

December 31, 2002. Of that amount, approximately $620 million of

commitments are to fund investments in St. Paul Venture Capital VI,

LLC (“Fund VI”), one of our venture capital investment subsidiaries.

Additional amounts have been committed to fund new and existing

investments in partnerships and certain other venture capital

entities. Our future obligations as of December 31, 2002 are esti-

mated as follows.

New Existing

Year Fund VI Partnerships Partnerships Total

2003 $ 170 $ 20 $ 25 $ 215

2004 180 60 23 263

2005 180 50 17 247

2006 50 50 10 110

Thereafter 40 40 5 85

Total $ 620 $ 220 $ 80 $ 920

Generally, we expect that our obligations to make the capital contri-

butions listed in the table above will be largely funded by distributions

we receive from our venture capital investments. The maximum

amount of new capital we are obligated to contribute to satisfy those

obligations to Fund VI in any calendar year without receiving any off-

setting distributions from our venture capital operation is $250 million

and, on a cumulative basis over the life of Fund VI, no more than

$325 million. In addition, we can elect to discontinue funding Fund VI

at any time. If we do so, we must contribute $250 million (not reflected

in the table above) to a termination fund and pay certain termination

and management fees. Alternatively, once 70% of the Fund VI capital

has been committed, we must elect either to commit a material amount