Travelers 2002 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

income in future periods as the invested assets related to these

reserves decline.

TRANSFER OF ONGOING REINSURANCE OPERATIONS TO

PLATINUM UNDERWRITERS HOLDINGS, LTD.

On November 1, 2002, we completed the transfer of our continu-

ing reinsurance business (previously operating under the name

“St. Paul Re”) and certain related assets, including renewal rights, to

Platinum Underwriters Holdings, Ltd. (“Platinum”), a newly formed

Bermuda company that underwrites property and casualty reinsur-

ance on a worldwide basis. The following description of the transac-

tion is qualified in its entirety by the terms of the Formation and

Separation Agreement between us and Platinum dated as of

October 28, 2002 and filed as an exhibit to Platinum’s Registration

Statement No. 333-86906 on Form S-1.

As part of this transaction, we contributed $122 million of cash to

Platinum and transferred $349 million in assets relating to the insur-

ance reserves that we also transferred. In exchange, we acquired six

million common shares, representing a 14% equity ownership interest

in Platinum, and a ten-year option to buy up to six million additional

common shares at an exercise price of $27 per share, which repre-

sents 120% of the initial public offering price of Platinum’s shares.

In conjunction with the transfer of our continuing reinsurance busi-

ness to Platinum, we entered into various agreements with Platinum

and its subsidiaries, including quota share reinsurance agreements by

which Platinum reinsured substantially all of the reinsurance contracts

entered into by St. Paul Re on or after January 1, 2002. This transfer

(based on September 30, 2002 balances) included $125 million of

unearned premium reserves (net of ceding commissions), $200 million

of existing loss and loss adjustment expense reserves and $24 million

of other reinsurance-related liabilities. The transfer of unearned pre-

mium reserves to Platinum was accounted for as prospective reinsur-

ance, while the transfer of existing loss and loss adjustment expense

reserves was accounted for as retroactive reinsurance.

As noted above, the transfer of reserves to Platinum at the incep-

tion of the quota share reinsurance agreements was based on the

September 30, 2002 balances. We intend to transfer additional insur-

ance reserves to Platinum to reflect business activity between

September 30, 2002 and the November 2, 2002 inception date of the

quota share reinsurance agreements. Our insurance reserves at

December 31, 2002 included our estimate of additional amounts due

to Platinum for this activity, which totaled $54 million. We expect that

this amount, which is subject to adjustment under the provisions of

the reinsurance agreements, will be agreed to and settled upon in the

first half of 2003. This adjustment, if any, is not expected to be mate-

rial to our results of operations.

For business underwritten in the United States and the United

Kingdom, until October 31, 2003, Platinum has the right to underwrite

specified reinsurance business on our behalf in cases where Platinum

is unable to underwrite that business because it has yet to obtain nec-

essary regulatory licenses or approval to do so, or Platinum has not

yet been approved as a reinsurer by the ceding company. We entered

into this agreement solely as a means to accommodate Platinum

through a transition period. Any business written by Platinum on our

policy forms during this transition period is being fully ceded to

Platinum under the quota share reinsurance agreements.

The transaction resulted in a pretax gain of $29 million and an

after-tax loss of $54 million.The after-tax loss was driven by the write-

off of approximately $73 million in deferred tax assets associated with

previously incurred losses related to St. Paul Re’s United Kingdom-

based operations, as well as approximately $10 million in taxes asso-

ciated with the pretax gain.

Our investment in Platinum is included in “Other investments.” The

income from our 14% proportionate equity ownership in Platinum is

included in our statement of operations as a component of “Net invest-

ment income” from the date of closing. Our warrants to purchase addi-

tional Platinum shares are carried at their market value ($61 million at

December 31, 2002), with changes in their fair value recorded as other

realized gains or losses in our statement of operations.

24

REVISIONS TO BUSINESS SEGMENT REPORTING STRUCTURE

In the fourth quarter of 2002, we revised our property-liability busi-

ness segment reporting structure to reflect the manner in which those

businesses are currently managed, particularly in recognition of cer-

tain operations being separately managed as runoff operations. As of

December 31, 2002, our property-liability underwriting operations

consist of four segments constituting our ongoing operations, and

three segments comprising our runoff operations. The composition of

those respective segments is described in greater detail in the analy-

sis of their results on pages 35 through 44 of this discussion. We

retained the concept of a “specialty commercial” business center,

which is an operation possessing dedicated underwriting, claims and

risk control services requiring specialized expertise and focusing

exclusively on the customers it serves. Eleven of those business cen-

ters comprise our Specialty Commercial reportable segment. None of

those business centers alone met the quantitative threshold to qualify

as a separate reportable segment; therefore they were combined

based on the applicable aggregation criteria. All data for 2001 and

2000 included in this report were restated to be consistent with the

new reporting structure in 2002. The following is a summary of

changes made to our segments at the end of 2002.

• In our Specialty Commercial segment, all international specialty

business that had either been included in respective business

centers, or had been included in the separate International

Specialty business center, was reclassified to the newly formed

International & Lloyd’s segment (for ongoing operations) or our

Other segment (for international operations considered to be in

runoff).

• All international Health Care business, previously included in the

Health Care segment, was reclassified to the newly formed Other

segment.

• The International & Lloyd’s segment was formed, comprised of

our ongoing operations at Lloyd’s, ongoing specialty commercial

business underwritten outside the United States (currently con-

sisting of operations in the United Kingdom, Canada and the

Republic of Ireland), and Global Accounts. All operations in this

segment are under common management.

• The new runoff segment Other was formed, comprised of the

results of all of our international and Lloyd’s business considered

to be in runoff (including our involvement in insuring the Lloyd’s

Central Fund), as well as those of Unionamerica, the U.K.-based

underwriting entity acquired in the MMI transaction.

• Our Catastrophe Risk business center, previously included in the

Specialty Commercial segment in its entirety, was split into two,

with Personal Catastrophe Risk remaining in the Specialty

Commercial segment and Commercial Catastrophe Risk moving

to the Commercial Lines segment as part of the Property

Solutions business center.

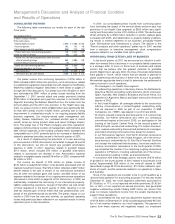

CONSOLIDATED REVENUES

The following table summarizes the sources of our consolidated

revenues from continuing operations for the last three years.

Years Ended December 31 2002 2001 2000

(In millions)

Revenues:

Property-liability insurance premiums earned $7,390 $7,296 $ 5,592

Net investment income 1,169 1,217 1,262

Realized investment gains (losses) (165) (94) 632

Asset management 397 374 370

Other 127 126 90

Total revenues $8,918 $8,919 $ 7,946

Change from prior year 0% 12%

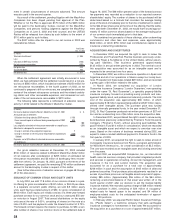

Earned premiums in 2002 were $94 million higher than in 2001, as

the positive impacts of significant price increases in 2001 and 2002

and new business in many of our ongoing operations were largely off-

set by our withdrawal from several lines of business and the transfer

of our ongoing reinsurance operations to Platinum. Earned premiums