Travelers 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

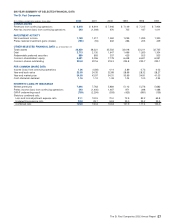

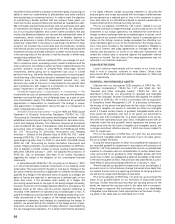

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

The St. Paul Companies

Years ended December 31 2002 2001 2000

(In millions)

PREFERRED SHAREHOLDERS’ EQUITY

SOP convertible preferred stock:

Beginning of year $111 $117 $ 129

Redemptions during the year (6) (6) (12)

End of year 105 111 117

Guaranteed obligation – SOP:

Beginning of year (53) (68) (105)

Principal payments 13 15 37

End of year (40) (53) (68)

Total Preferred Shareholders’ Equity 65 58 49

COMMON SHAREHOLDERS’ EQUITY

Common stock

Beginning of year 2,192 2,238 2,079

Stock issued:

Net proceeds from stock offering 413 ——

Stock incentive plans 32 67 95

Present value of equity unit forward purchase contracts (46) ——

Preferred shares redeemed 13 13 23

Conversion of company-obligated preferred securities ——207

Reacquired common shares —(135) (170)

Other 294

End of year 2,606 2,192 2,238

Retained earnings:

Beginning of year 2,500 4,243 3,827

Net income (loss) 218 (1,088) 993

Dividends declared on common stock (252) (235) (232)

Dividends declared on preferred stock, net of taxes (9) (9) (8)

Reacquired common shares —(454) (366)

Deferred compensation - restricted stock (5) ——

Tax benefit on employee stock options, and other changes 28 51 40

Premium on preferred shares redeemed (7) (8) (11)

End of year 2,473 2,500 4,243

Unrealized appreciation on investments, net of taxes:

Beginning of year 442 765 568

Change for the year 229 (323) 197

End of year 671 442 765

Unrealized loss on foreign currency translation, net of taxes:

Beginning of year (76) (68) (26)

Currency translation adjustments 8(8) (42)

End of year (68) (76) (68)

Unrealized loss on derivatives, net of taxes:

Beginning of year (2) ——

Change during the period 1(2) —

End of year (1) (2) —

Total Common Shareholders’ Equity 5,681 5,056 7,178

Total Shareholders’ Equity $5,746 $5,114 $ 7,227

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

Years ended December 31 2002 2001 2000

(In millions)

Net income (loss) $218 $(1,088) $ 993

Other comprehensive income (loss), net of taxes:

Change in unrealized appreciation on investments 229 (323) 197

Change in unrealized loss on foreign currency translation 8(8) (42)

Change in unrealized loss on derivatives 1(2) —

Other comprehensive income (loss) 238 (333) 155

Comprehensive income (loss) $456 $(1,421) $ 1,148

See notes to consolidated financial statements.

The St. Paul Companies 2002 Annual Report 61