Travelers 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of which $11 million was goodwill (reclassified to other intangible

assets as of January 1, 2002) that we are amortizing over 20 years.

Pacific Select’s results of operations from the date of acquisition are

included in the catastrophe risk results included in our Commercial

Lines segment (commercial coverages) and in our Specialty

Commercial segment (personal coverages).

In addition, Nuveen Investments made strategic acquisitions in

both 2002 and 2001, which are discussed in greater detail on pages

49 and 50 of this discussion.

DISCONTINUED OPERATIONS

Life Insurance — In September 2001, we completed the sale of

our life insurance company, Fidelity and Guaranty Life Insurance

Company and its subsidiary, Thomas Jefferson Life (together, “F&G

Life”) to Old Mutual plc (“Old Mutual”), for $335 million in cash and

$300 million in ordinary shares of Old Mutual. Pursuant to the sale

agreement, we were originally required to hold the 190,356,631 Old

Mutual shares we received for one year after the closing of the trans-

action, and the proceeds from the sale of F&G Life were subject to

possible adjustment based on the movement of the market price of

Old Mutual’s shares at the end of the one-year period.The amount of

possible adjustment was to be determined by a derivative “collar”

agreement included in the sale agreement.

In May 2002, Old Mutual granted us a release from the one-year

holding requirement in order to facilitate our sale of those shares in a

placement made outside the United States, together with a concur-

rent sale of shares by Old Mutual by means of granting an overallot-

ment option, which was exercised by the underwriters. We sold all of

the Old Mutual shares we were holding on June 6, 2002 for a total net

consideration of $287 million, resulting in a pretax realized loss of

$13 million that was recorded as a component of discontinued opera-

tions on our statement of operations.The fair value of the collar agree-

ment had been recorded as an asset on our balance sheet and

adjusted quarterly. At the time of the sale of the Old Mutual shares,

the collar had a fair value of $12 million, which we agreed to terminate

at no value as part of the sale.The amount was also recorded as loss

included in discontinued operations on our statement of operations.

At the time of the sale of F&G Life in 2001, we recorded a net after-

tax loss of $74 million on the sale proceeds.When the sale agreement

with Old Mutual had been announced in April 2001, we expected to

realize a modest pretax gain on the sale of F&G Life, when proceeds

were combined with F&G Life’s operating results through the disposal

date. However, a decline in the market value of certain F&G Life’s

investments between the April announcement date and the

September closing date, coupled with an anticipated change in the

tax treatment of the sale, resulted in the net after-tax loss on the sale

proceeds.That loss is combined with F&G Life’s results of operations

prior to sale for an after-tax loss of $55 million and is included in the

reported loss from discontinued operations for the year ended

December 31, 2001.

Standard Personal Insurance — In 1999, we sold our standard

personal insurance operations to Metropolitan Property and Casualty

Insurance Company (“Metropolitan”). Metropolitan purchased

Economy Fire & Casualty Company and subsidiaries (“Economy”),

and the rights and interests in those non-Economy policies constitut-

ing the remainder of our standard personal insurance operations.

Those rights and interests were transferred to Metropolitan by way of

a reinsurance and facility agreement.We guaranteed the adequacy of

Economy’s loss and loss expense reserves, and we remain liable for

claims on non-Economy policies that result from losses occurring

prior to the September 30, 1999 closing date. Metropolitian adjusted

those claims and shares in redundancies in related reserves that

developed. Under the reserve guarantee, we agreed to pay for any

deficiencies in those reserves and would share in any redundancies

that developed by September 30, 2002. Any losses incurred by us

under these agreements were reflected in discontinued operations in

the period during which they were incurred. At December 31, 2002,

our analysis indicated that we owed Metropolitan approximately

$13 million related to the agreements. Subsequent to year-end 2002,

we have had additional settlement discussions with Metropolitan

regarding final disposition of the agreements, and have tentatively

agreed to an amount that is within established reserves.We anticipate

making that payment to Metropolitan in the first quarter of 2003. We

have no other contingent liabilities related to this sale.

Nonstandard Auto Insurance — Prudential purchased our non-

standard auto insurance business marketed under the Victoria

Financial and Titan Auto brands for $175 million in cash (net of a

$25 million dividend paid by these operations to our property-liability

insurance operations prior to closing). We recorded an estimated

after-tax loss of $83 million on the sale in 1999, representing the esti-

mated excess of carrying value of these entities at closing date over

proceeds to be received from the sale, plus estimated income through

the disposal date. This excess primarily consisted of goodwill. We

recorded an after-tax loss on disposal of $9 million in 2000, primarily

representing additional losses incurred through the disposal date in

May, and an additional after-tax loss on disposal of $5 million in 2001,

primarily representing tax adjustments made to the sale transaction.

Minet — In 1997, we sold our insurance brokerage operation,

Minet Holdings plc (“Minet”) to Aon Corporation. The results of the

operations sold are reflected as discontinued operations for all peri-

ods presented in this report.We recorded a $9 million pretax expense

in discontinued operations in 2001 related to the Minet sale, repre-

senting additional funds due Aon pursuant to provisions of the 1997

sale agreement.

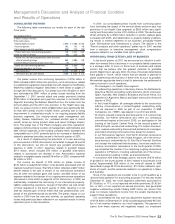

The following table presents the components of discontinued oper-

ations reported in our consolidated statement of operations for each

of the last three years.

Years Ended December 31 2002 2001 2000

(In millions)

F&G Life:

Operating income, net of taxes $— $19 $ 43

Loss on disposal, net of taxes (12) (74) —

Total F&G Life (12) (55) 43

Standard Personal Insurance:

Operating income, net of taxes ———

Loss on disposal, net of taxes (7) (13) (11)

Total Standard Personal Insurance (7) (13) (11)

Nonstandard Auto Insurance:

Operating income, net of taxes ———

Loss on disposal, net of taxes (3) (5) (9)

Total Nonstandard Auto Insurance (3) (5) (9)

Minet Holdings plc:

Operating income, net of taxes ———

Loss on disposal, net of taxes (3) (6) —

Total Minet Holdings plc (3) (6) —

Total discontinued operations $(25) $(79) $ 23

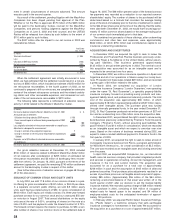

2001 RESTRUCTURING CHARGE

In the fourth quarter of 2001, in connection with our withdrawal

from the lines of business described above, and as part of our overall

plan to reduce company-wide expenses, we recorded a pretax

restructuring charge of $62 million. The charge was recorded in our

2001 results as follows: $42 million in property-liability insurance oper-

ations, and $20 million in “Parent company and other operations.”The

majority of the charge — $46 million — pertained to employee-related

costs associated with our plan to eliminate an estimated total of

800 positions by the end of 2002. As of December 31, 2002, we had

terminated 713 employees and made payments of $33 million related

to that charge. The remainder of the $62 million charge consisted of

legal, equipment and occupancy-related costs, for which approxi-

mately $2 million had been paid as of December 31, 2002.

In 2002, we recorded an additional pretax restructuring charge of

$3 million, related to additional employee-related expenses that did

not meet the criteria for accrual at December 31, 2001. This charge

was partially offset by a $4 million reduction in occupancy-related

restructuring charges recorded in prior years.

The St. Paul Companies 2002 Annual Report 29