Travelers 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

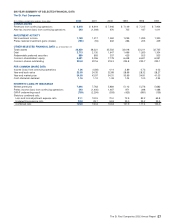

Number of Claims / Supplements(1)

Paid Losses

Dismissed Losses on Paid on

Pending as of Settled, or Settled Costs to Pools and

Line of Business: Dec. 31 Reported Resolved Claims Administer Related

($ in millions)

General Liability – Non E & A

2002 38,217 68,807 70,802 $ 643 $ 263 N/A

2001 40,212 70,540 68,384 $ 526 $ 234 N/A

2000 38,056 70,280 67,098 $ 521 $ 250 N/A

Workers’ Compensation

2002 35,731 51,604 54,300 $ 381 $ 57 N/A

2001 38,427 56,084 55,368 $ 374 $ 57 N/A

2000 37,711 55,081 58,768 $ 304 $ 55 N/A

Medical Malpractice

2002 12,862 8,271 10,635 $ 831 $ 190 N/A

2001 15,226 18,706 18,897 $ 834 $ 206 N/A

2000 15,417 9,337 10,952 $ 671 $ 194 N/A

Environmental(2)

2002 1,275 449 633 $ 34 $ 15 $ 9

2001 1,459 390 1,317 $ 34 $ 11 $ 14

2000 2,386 405 1,662 $ 15 $ 12 $ 11

Asbestos(2)

2002 3,923 1,757 1,093 $ 187 $ 31 $ 14

2001 3,259 1,096 929 $ 13 $ 22 $ 10

2000 3,092 1,226 1,277 $ 9 $ 12 $ 10

Assumed Reinsurance(3)

2002 N/A N/A N/A $ 1,150 $ 44 N/A

2001 N/A N/A N/A $ 825 $ 29 N/A

2000 N/A N/A N/A $ 736 $ 18 N/A

(1) The claim counts included in this table represent counts of “supplements,” which are extracted from our actuarial databases. A claim supplement is the finest level of detail recorded in our statistical systems. For example, two

claimants for a single general liability bodily injury occurrence would be counted as two separate supplements. Our claim department manages claims on a policyholder basis, while the data in this table is presented on a claim

count basis. For environmental and asbestos claims, a claim supplement count does not reflect the number of claimants involved on the account. For asbestos claims, supplements are generally created based on the number

of policy years potentially implicated on the account. For environmental claims, supplements are generally created to track the number of sites involved on the account.

(2) The environmental and asbestos claim count information includes only losses on direct written business whereas the paid loss data on assumed business, presented separately, includes loss and defense and cost containment

expenses. Claim count data is not shown on losses assumed from other companies and/or insurance pools because we are often either covering a very small portion of any one claim, or a number of claims which are com-

piled together as one for reporting purposes and, therefore, such statistics would not be meaningful. Also, the costs to administer these claims do not include adjusting and other related payments.

(3) Includes property and casualty loss experience since casualty only is not available. Also, claim counts are not available on assumed reinsurance. Loss settlement amounts include defense and cost containment expenses

whereas costs to administer include only adjusting and other related payments.

The St. Paul Companies 2002 Annual Report 47

General Liability (Non-E&A) — Includes insurance coverage pro-

tecting the insured against legal liability resulting from negligence,

carelessness, or failure to act causing property damage or personal

injury to others. Claims on these coverages are usually paid to third

party claimants. While we offer coverage that may result in low-fre-

quency, high-severity claims (i.e. excess umbrella, large accounts),

the majority of the non-E&A general liability business is generally sta-

ble and predictable due to the volume of business written. Although

the cost of administering these claims comprises a large portion of the

overall claim cost, the actual average loss payment per claim is gen-

erally low. The most significant risk for this line is unexpected

increases in inflation, either economic or social. The number of newly

reported claims dropped in 2002 driven by an underlying decrease in

our exposure to loss. Premiums have increased in the last several

years due to pricing, but the actual number of exposures insured has

dropped. The increase in paid dollars in 2002 was the result of clos-

ing more claims in 2002 than we did in 2001. Average paid severity

trends remain within industry norms.

Workers’ Compensation — Includes insurance which covers an

employers’ liability for injuries, disability or death to persons in their

employment, without regard to fault. The coverage provided under the

workers’ compensation policies is based on state-specific schedules

for wage replacement and medical payments for injured workers.While

the largest portion of the workers insured under our policies generate

a very low severity body of claims, a portion of our premium volume is

generated in our Construction business center, where there is an

increased possibility of permanent and total disability requiring lifetime

payments. Although each state government can make changes in cov-

erage, the changes happen after considerable public deliberation and

very seldom will impact policies that have been sold in the past. The

number of newly reported claims dropped in 2002 driven by an under-

lying decrease in our exposure to loss. Premiums have increased in

the last several years due to pricing, but the actual number of expo-

sures insured has dropped.We closed roughly as many claims in 2002

as in 2001, driving the number of pending claims down.

Medical Malpractice — Includes insurance protecting a licensed

health care provider or health care facility against legal liability result-

ing from death or injury of any person due to the insured’s miscon-

duct, negligence, or incompetence in rendering professional services.

Medical malpractice claims are volatile in nature. While a large num-

ber are closed without a loss payment, those with payments may be

very large depending on the circumstances and judicial climate.

Significant cost is expended in the settlement of these claims, often

with favorable outcomes. Since this book of business is in runoff, the

pending inventory is decreasing and will begin to distort some of the

statistics. As the runoff matures, there will be fewer small claims and

fewer meritless claims that can be quickly dismissed. The single

largest risk in this line of business is associated with social trends in

jury verdicts which is described in further detail in our Health Care

segment discussion on pages 40 through 43 of this discussion. As

reported in the Health Care discussion referenced above, newly

reported claim counts are dropping quickly as we exit this business

segment. As we execute our runoff strategy, we will continue to see a

drop in the inventory of pending claims.The unusually high number of

claims “reported” and “dismissed, settled or resolved” in 2001 in the

foregoing table was due to the impact of the MMI integration.

Environmental — This exposure relates to general liability coverage

on policies which may be interpreted to cover environmental-related

exposures. The information presented above represents business

reported as “Not underwritten” Environmental losses as described on

pages 48 and 49 of this discussion.Payment totals for these coverages

are driven by a few very large claims, accompanied by a large number

of very small claims.While the number of new reported claims appears

to increase, they are primarily matters for which there is no expectation