Travelers 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

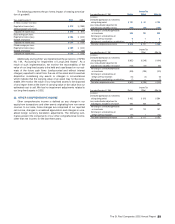

The following presents the pro forma impact of ceasing amortiza-

tion of goodwill.

Years ended December 31 2002 2001

(In millions, except per share data)

Reported net income (loss) $218 $(1,088)

Add back goodwill amortization —114

Adjusted net income (loss) $218 $(974)

Basic earnings per share:

Reported net income (loss) $0.94 $(5.22)

Goodwill amortization —0.54

Adjusted net income (loss) $0.94 $(4.68)

Diluted earnings per share:

Reported net income (loss) $0.92 $(5.22)

Goodwill amortization —0.54

Adjusted net income (loss) $0.92 $(4.68)

Additionally, during 2002, we implemented the provisions of SFAS

No. 144, “Accounting for Impairment of Long-Lived Assets”. As a

result of such implementation, we monitor the recoverability of the

value of our long-lived assets to be held and used based on our esti-

mate of the future cash flows (undiscounted and without interest

charges) expected to result from the use of the asset and its eventual

disposition considering any events or changes in circumstances

which indicate that the carrying value of an asset may not be recov-

erable. We monitor the value of our long-lived assets to be disposed

of and report them at the lower of carrying value or fair value less our

estimated cost to sell. We had no impairment adjustments related to

our long-lived assets in 2002.

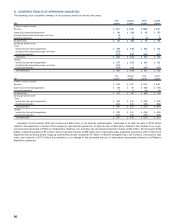

23. OTHER COMPREHENSIVE INCOME

Other comprehensive income is defined as any change in our

equity from transactions and other events originating from non-owner

sources. In our case, those changes are comprised of our reported

net income, changes in unrealized appreciation and changes in unre-

alized foreign currency translation adjustments. The following sum-

maries present the components of our other comprehensive income,

other than net income, for the last three years.

The St. Paul Companies 2002 Annual Report 89

Income Tax

Year ended December 31, 2002 Pretax Effect After-tax

(In millions)

Unrealized appreciation on investments

arising during period $181 $ 61 $ 120

Less: reclassification adjustment for

realized losses included in net loss (168) (59) (109)

Net change in unrealized appreciation

on investments 349 120 229

Net change in unrealized loss on

foreign currency translation 91 8

Net change in unrealized loss on derivatives 1— 1

Total other comprehensive income $359 $ 121 $ 238

Income Tax

Year ended December 31, 2001 Pretax Effect After-tax

(In millions)

Unrealized depreciation on investments

arising during period $ (652) $ (248) $ (404)

Less: reclassification adjustment for

realized losses included in net income (124) (43) (81)

Net change in unrealized depreciation

on investments (528) (205) (323)

Net change in unrealized loss on

foreign currency translation (12) (4) (8)

Net change in unrealized loss on derivatives (2) — (2)

Total other comprehensive loss $ (542) $ (209) $ (333)

Income Tax

Year ended December 31, 2000 Pretax Effect After-tax

(In millions)

Unrealized appreciation on investments

arising during period $ 902 $ 318 $ 584

Less: reclassification adjustment for

realized gains included in net income 595 208 387

Net change in unrealized appreciation

on investments 307 110 197

Net change in unrealized loss on

foreign currency translation (41) 1 (42)

Total other comprehensive income $ 266 $ 111 $ 155