Travelers 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fireman’s Fund Surety Business — In December 2001, we pur-

chased the right to seek to renew surety bond business previously

underwritten by Fireman’s Fund Insurance Company (“Fireman’s

Fund”), without assuming past liabilities. We paid Fireman’s Fund

$10 million in 2001 for this right, which we recorded as an intangible

asset and which we expect to amortize over nine years. Based on the

volume of business renewed during 2002, we expect to make a mod-

est additional payment to Fireman’s Fund in the first quarter of 2003.

This amount was also recorded as an intangible asset in 2002 and will

be amortized on an accelerated basis over the remaining life of the

intangible asset.

Penco — In January 2001, we acquired the right to seek to renew

a book of municipality insurance business from Penco, a program

administrator for Willis North America Inc., for total consideration of

$3.5 million, without assuming past liabilities. We recorded that

amount as an intangible asset and are amortizing it on an accelerated

basis over five years.

MMI — In April 2000, we closed on our acquisition of MMI

Companies, Inc. (“MMI”), a Deerfield, IL-based provider of medical

services-related insurance products and consulting services. The

transaction was accounted for as a purchase, with a total purchase

price of approximately $206 million, in addition to the assumption of

$165 million in preferred securities and debt.The final purchase price

adjustments resulted in an excess of purchase price over net tangible

assets acquired of approximately $85 million.

As part of the strategic review discussed in Note 5, we decided to

exit the Health Care business, including that obtained through the MMI

acquisition. Accordingly, in December 2001, we wrote off $56 million in

goodwill associated with the underwriting operations of MMI. The

remaining unamortized goodwill balance at December 31, 2001 of

$8 million, which relates to the consulting business obtained in the pur-

chase, was reclassified to an intangible asset effective January 1, 2002

in conjunction with the implementation of SFAS No. 141, “Business

Combinations” (“SFAS No. 141”) and SFAS No. 142, “Goodwill and

Other Intangible Assets” (“SFAS No. 142”), as described in Note 22.

The unamortized balance of this intangible asset at December 31,

2002 was $7 million, which is being amortized on an accelerated basis

over the remaining expected life of eighteen years.

Pacific Select — In February 2000, we closed on our acquisition of

Pacific Select Insurance Holdings, Inc. and its wholly-owned sub-

sidiary Pacific Select Property Insurance Co. (together, “Pacific

Select”), a California insurer that sells earthquake coverage to

California homeowners. The transaction was accounted for as a pur-

chase, at a cost of approximately $37 million, resulting in goodwill of

approximately $11 million.

The remaining unamortized goodwill balance at December 31,

2001 of $9 million was reclassified to an intangible asset effective

January 1, 2002 in conjunction with the implementation of SFAS Nos.

141 and 142, as described in Note 22. The unamortized balance of

this intangible asset at December 31, 2002 was $8 million, which is

being amortized on an accelerated basis over the remaining expected

life of eighteen years.

NWQ Investment Management Company, Inc. — In August 2002,

Nuveen Investments purchased NWQ Investment Management

Company, Inc. (“NWQ”), a Los Angeles-based equity management

firm, with approximately $6.9 billion in assets under management.The

cost of the acquisition consisted of $120 million paid at closing and up

to an additional $20 million payable over five years. As of

December 31, 2002, Nuveen Investments had $133 million recorded

for goodwill and $22 million for the intangible asset, net of accumu-

lated amortization, related to NWQ. The intangible asset relates to

customer relationships and is being amortized over nine years.

Symphony Asset Management — In July 2001, Nuveen

Investments purchased Symphony Asset Management, LLC

(“Symphony”), an institutional investment manager based in San

Francisco, with approximately $4 billion in assets under management.

The 2001 preliminary allocation of the $208 million purchase price

resulted in $151 million recorded as goodwill and $53 million recorded

as other intangible assets. In 2002, Nuveen Investments made a pur-

chase accounting adjustment due to a revision in the valuation of

Symphony, which resulted in a $9 million decrease in the intangible

recorded and a corresponding increase in the goodwill recorded. As

of December 31, 2002, Nuveen Investments had $160 million

recorded for goodwill and $41 million for net intangibles related to

Symphony. The majority of the intangible assets related to customer

relationships that are being amortized over approximately 20 years.

DIVESTITURES

In 2002, we sold our insurance operations in Spain, Argentina and,

in Mexico, all of our operations except our surety business. Proceeds

from these sales totaled $29 million and we recorded a pretax gain of

$4 million related to the sales.

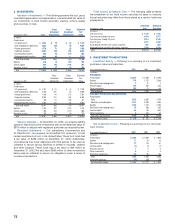

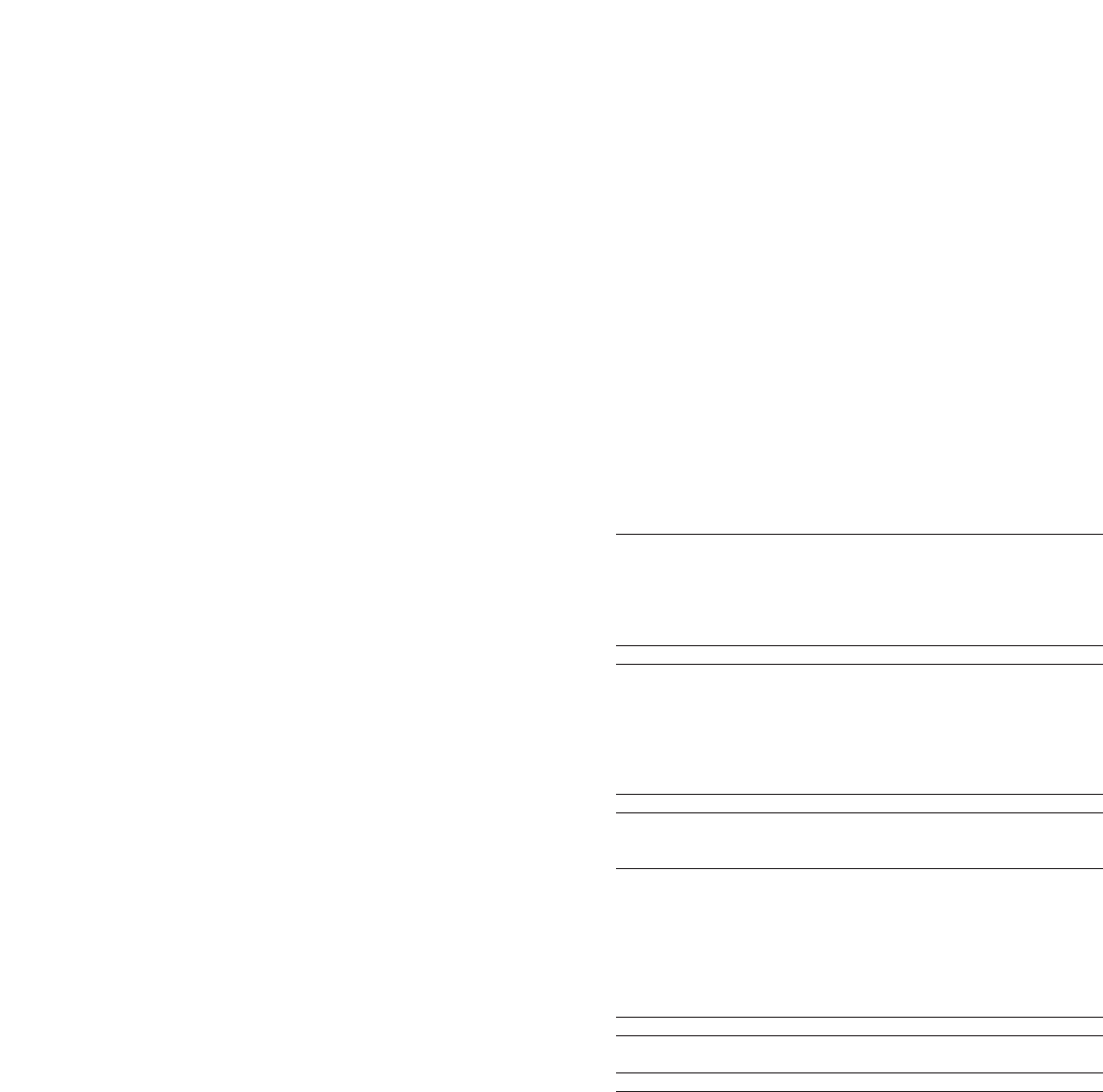

7. EARNINGS PER COMMON SHARE

Years ended December 31 2002 2001 2000

(In millions, except per share amounts)

EARNINGS

Basic

Net income (loss), as reported $218 $(1,088) $ 993

Preferred stock dividends, net of taxes (9) (9) (8)

Premium on preferred shares redeemed (7) (8) (11)

Net income (loss) available to common shareholders $202 $(1,105) $ 974

Diluted

Net income (loss) available to common shareholders $202 $(1,105) $ 974

Dilutive effect of affiliates (3) ——

Effect of dilutive securities:

Convertible preferred stock 7—6

Zero coupon convertible notes 3—3

Convertible monthly income preferred securities ——5

Net income (loss) available to common shareholders $209 $(1,105) $ 988

COMMON SHARES

Basic

Weighted average common shares outstanding 216 212 217

Diluted

Weighted average common shares outstanding 216 212 217

Weighted average effects of dilutive securities:

Stock options 2—3

Convertible preferred stock 6—7

Zero coupon convertible notes 2—2

Equity unit stock purchase contracts 1——

Convertible monthly income preferred securities ——4

Total 227 212 233

EARNINGS (LOSS) PER COMMON SHARE

Basic $0.94 $(5.22) $ 4.50

Diluted $0.92 $(5.22) $ 4.24

The assumed conversion of preferred stock and zero coupon

notes are each anti-dilutive to our net loss per share for the year

ended December 31, 2001, and therefore not included in the EPS cal-

culation. The convertible monthly income preferred securities were

fully converted or redeemed during 2000.

The St. Paul Companies 2002 Annual Report 71