Travelers 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

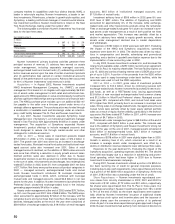

$250 million mature in 2010, with a weighted average pay rate of

1.79% and a weighted average receive rate of 7.57%. These swaps

had a fair value of $65 million at December 31, 2002.

We also have liability for payment under “Company-obligated

mandatorily redeemable preferred securities of trusts holding solely

subordinated debentures of the company” that mature at various

times, the earliest of which is 2027. The principal amounts due under

these obligations were $897 million and $901 million at December 31,

2002 and 2001, respectively, with a weighted average preferred distri-

bution rate of 7.8 % as of December 31, 2002 and 2001.The fair value

of these securities was $927 million and $893 million as of

December 31, 2002 and 2001, respectively. Approximately $575 mil-

lion of the securities are callable at the company’s option after

November 13, 2006. An additional $78 million are callable at the com-

pany’s option between 2007 and their maturity in 2027.

Credit Risk — Our portfolios of fixed income securities, mortgage

loans and to a lesser extent short-term and other investments are

subject to credit risk. This risk is defined as the potential loss in mar-

ket value resulting from adverse changes in the borrower’s ability to

repay the debt. Our objective is to earn competitive relative returns

by investing in a diversified portfolio of securities. We manage this

risk by up-front, stringent underwriting analysis, reviews by a credit

committee and regular meetings to review credit developments.

Watchlists are maintained for exposures requiring additional review,

and all credit exposures are reviewed at least annually. At December

31, 2002, approximately 97% of our fixed income portfolio was rated

investment grade.

In our Discover Re operation, we underwrite certain business for

sophisticated insurance purchasers, and reinsure a substantial por-

tion of that risk with traditional reinsurers or captive insurance enti-

ties. Although these transactions are highly collateralized, there is a

degree of credit risk associated with these transactions. We perform

credit reviews of the underlying financial stability of the insured

and/or assuming reinsurance entity as part of our program to man-

age this risk.

We also have other receivable amounts subject to credit risk. The

most significant of these are reinsurance recoverables.To mitigate the

risk of these counterparties’ nonpayment of amounts due, we estab-

lish business and financial standards for reinsurer approval, incorpo-

rating ratings by major rating agencies and considering current

market information.

Foreign Currency Exposure — Our exposure to market risk for

changes in foreign exchange rates is concentrated in our invested

assets, and insurance reserves, denominated in foreign currencies.

Cash flows from our foreign operations are the primary source of

funds for our purchase of investments denominated in foreign curren-

cies. We purchase these investments primarily to hedge insurance

reserves and other liabilities denominated in the same currency, effec-

tively reducing our foreign currency exchange rate exposure. For

those foreign insurance operations that were identified at the end of

2001 as businesses to be exited, we intend to continue to closely

match the foreign currency-denominated liabilities with assets in the

same currency. At December 31, 2002 and 2001, respectively,

approximately 13% and 11% of our invested assets were denomi-

nated in foreign currencies. Invested assets denominated in the

British Pound Sterling comprised approximately 6% of our total

invested assets at December 31, 2002. We have determined that a

hypothetical 10% reduction in the value of the Pound Sterling would

have an approximate $125 million reduction in the value of our assets,

although there would be a similar offsetting change in the value of the

related insurance reserves. No other individual foreign currency

accounts for more than 3% of our invested assets.

We have also entered into foreign currency forwards with a U.S.

dollar equivalent notional amount of $115 million as of December 31,

2002 to hedge our foreign currency exposure on certain contracts. Of

this total, 77% are denominated in British Pound Sterling, 11% are

denominated in the Australian dollar, and 12% are denominated in the

Canadian dollar.

Equity Price Risk – Our portfolio of marketable equity securities,

which we carry on our balance sheet at market value, has exposure

to price risk. This risk is defined as the potential loss in market value

resulting from an adverse change in prices. Our objective is to earn

competitive relative returns by investing in a diverse portfolio of high-

quality, liquid securities. Portfolio characteristics are analyzed regu-

larly and market risk is actively managed through a variety of

modeling techniques. Our holdings are diversified across industries,

and concentrations in any one company or industry are limited by

parameters established by senior management, as well as by statu-

tory requirements.

Included in our Other investments at December 31, 2002 was our

14% equity ownership in Platinum Underwriters Holdings, Ltd.

(“Platinum”), received as partial consideration from the transfer of our

ongoing reinsurance business to Platinum. We are prohibited from

selling this investment for 180 days from the October 28, 2002 date of

Platinum’s initial public offering prospectus.We account for our invest-

ment in Platinum using the equity method of accounting. Therefore,

changes in Platinum’s stock price do not impact our balance sheet or

statement of operations, unless our investment in Platinum was

deemed to be impaired. Also included in our Other investments are

stock purchase warrants for Platinum. The warrants had a value of

$61 million as of December 31, 2002. The warrants are considered

derivatives and are marked to market quarterly, with changes in fair

value being recognized as realized gains or losses in our statement of

operations. The warrants are valued using the Roll-Geske-Whaley

valuation model and as such are impacted by the market price of

Platinum stock.

Our portfolio of venture capital investments also has exposure to

market risks, primarily relating to the viability of the various entities in

which we have invested. These investments, primarily in early-stage

companies, involve more risk than other investments, and we actively

manage our market risk in a variety of ways. First, we allocate a com-

paratively small amount of funds to venture capital. At the end of

2002, the cost of these investments accounted for only 3% of total

invested assets. Second, the investments are diversified to avoid

excessive concentration of risk in a particular industry. Third, we per-

form extensive research prior to investing in a new venture to gauge

prospects for success. Fourth, we regularly monitor the operational

results of the entities in which we have invested. Finally, we generally

sell our holdings in these firms soon after they become publicly traded

when we are legally able to do so, thereby reducing exposure to fur-

ther market risk.

At December 31, 2002, our marketable equity securities were

recorded at their fair value of $394 million. A hypothetical 10% decline

in each stock’s price would have resulted in a $40 million impact on

fair value.

At December 31, 2002, our venture capital investments were

recorded at their fair value of $581 million. A hypothetical 10% decline

in each investment’s fair value would have resulted in a $58 million

impact on fair value.

Catastrophe Risk — We manage and monitor our aggregate prop-

erty catastrophe exposure through various methods, including pur-

chasing catastrophe reinsurance, establishing underwriting

restrictions and applying a dedicated catastrophe pricing model. See

page 26 of this discussion for further information about our manage-

ment of catastrophe risk.

THE ST. PAUL COMPANIES

Impact of Accounting Pronouncements to be

Adopted in the Future

In January 2003, the FASB issued FASB Interpretation No. 46,

“Consolidation of Variable Interest Entities” (“FIN 46”), which requires

consolidation of all variable interest entities (“VIE”) by the primary ben-

eficiary, as these terms are defined in FIN 46, effective immediately for

VIEs created after January 31, 2003. The consolidation requirements

apply to VIEs existing on January 31, 2003 for reporting periods begin-

ning after June 15, 2003. In addition, it requires expanded disclosure

The St. Paul Companies 2002 Annual Report 55