Travelers 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

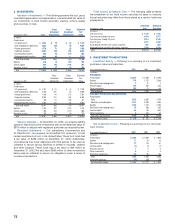

which Platinum reinsured substantially all of the reinsurance contracts

entered into by St. Paul Re on or after January 1, 2002. This transfer

(based on September 30, 2002 balances) included $125 million of

unearned premium reserves (net of ceding commissions), $200 million

of existing loss and loss adjustment expense reserves and $24 million

of other reinsurance-related liabilities. The transfer of unearned pre-

mium reserves to Platinum was accounted for as prospective reinsur-

ance, while the transfer of existing loss and loss adjustment expense

reserves was accounted for as retroactive reinsurance.

As noted above, the transfer of reserves to Platinum at the incep-

tion of the quota share reinsurance agreements was based on the

September 30, 2002 balances. We intend to transfer additional insur-

ance reserves to Platinum to reflect business activity between

September 30, 2002 and the November 2, 2002 inception date of the

quota share reinsurance agreements. Our insurance reserves at

December 31, 2002 included our estimate of additional amounts due

to Platinum for this activity, which totaled $54 million. We expect that

this amount, which is subject to adjustment under the provisions of

the reinsurance agreements, will be agreed to and settled upon in the

first half of 2003. This adjustment, if any, is not expected to be mate-

rial to our results of operations.

For business underwritten in the United States and the United

Kingdom, until October 31, 2003, Platinum has the right to underwrite

specified reinsurance business on our behalf in cases where Platinum

is unable to underwrite that business because it has yet to obtain nec-

essary regulatory licenses or approval to do so, or Platinum has not

yet been approved as a reinsurer by the ceding company. We entered

into this agreement solely as a means to accommodate Platinum

through a transition period. Any business written by Platinum on our

policy forms during this transition period is being fully ceded to

Platinum under the quota share reinsurance agreements.

The transaction resulted in a pretax gain of $29 million and an

after-tax loss of $54 million.The after-tax loss was driven by the write-

off of approximately $73 million in deferred tax assets associated with

previously incurred losses related to St. Paul Re’s United Kingdom-

based operations, as well as approximately $10 million in taxes asso-

ciated with the pretax gain.

Our investment in Platinum is included in “Other Investments.” The

income from our 14% proportionate equity ownership in Platinum is

included in our statement of operations as a component of “Net invest-

ment income” from the date of closing. Our warrants to purchase addi-

tional Platinum shares are carried at their market value ($61 million at

December 31, 2002), with changes in their fair value recorded as other

realized gains or losses in our statement of operations.

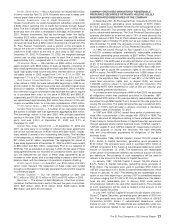

3. ASBESTOS SETTLEMENT AGREEMENT

On June 3, 2002, we announced that we and certain of our sub-

sidiaries had entered into an agreement settling all existing and future

claims arising from any insuring relationship of United States Fidelity

and Guaranty Company (“USF&G”), St. Paul Fire and Marine

Insurance Company and their affiliates and subsidiaries, including us

(collectively, the “USF&G Parties”) with any of MacArthur Company,

Western MacArthur Company (“Western MacArthur”), and Western

Asbestos Company (“Western Asbestos”) (together, the “MacArthur

Companies”).

On March 26, 2002, a trial commenced in the Western MacArthur

litigation which was planned to occur in three phases over the course

of approximately one year, and which involved complex questions of

fact and law. Among the issues to be addressed in the first phase of

the trial were the standing of Western MacArthur to recover under

Western Asbestos’ policies issued by USF&G (USF&G never insured

Western MacArthur and disputed Western Asbestos’ purported

assignment of its insurance rights to Western MacArthur) and the

existence and terms and conditions of the policies, including the issue

of whether the policies contained products hazard coverage and, if so,

whether the policies included aggregate limits for products hazard lia-

bility.USF&G believed it had, and continues to believe that it has, mer-

itorious defenses to the purported assignments of insurance rights by

Western Asbestos to Western MacArthur, which Western MacArthur

68

alleged occurred in the 1967-1970 time period and in 1997, and which

were allegedly ratified in 1999. USF&G also believed that it had a

strong position that the policies did not contain products hazard cov-

erage, but that even if they did the coverage was subject to products

hazard aggregates, which limited the USF&G Parties’ exposure. As

the trial began, the Company believed that it could resolve the case

by litigation or settlement within the existing asbestos reserves (gross

asbestos reserve totaled $478 million as of December 31, 2001) on

the basis of the foregoing defenses, a belief supported by Western

MacArthur’s November 1999 settlement of a similar claim brought

against another defendant insurer for $26 million. Given the facts and

circumstances known by management at the time we filed our annual

report on Form 10-K, we believed that our best estimate of aggregate

asbestos reserves as of December 31, 2001 made a reasonable pro-

vision for Western MacArthur and all other asbestos claims.

The first phase of the trial began on March 26, 2002. During the

second quarter of 2002, developments in the trial caused us to

reassess our exposure based on the increased possibility of an

adverse outcome in the first phase of the litigation. Among the signif-

icant developments in the trial between April 1 and May 15, 2002 were

evidentiary decisions by the trial judge to exclude evidence favorable

to USF&G regarding the assignment issue and to allow into evidence

unfavorable evidence regarding other insurers’ policies on the aggre-

gate limits issue, and unexpected adverse testimony on the aggregate

limits issue. These developments led us to believe that there was an

increased risk that the jury could find that USF&G’s policies did not

contain aggregate limits for products hazard claims.

These developments at trial, coupled with general changes in the

legal environment affecting the potential liability of insurers for

asbestos claims, caused us to engage in more intense settlement dis-

cussions at the end of April, in May, and early June of 2002.

As of May 15, 2002, the date on which we filed our Form 10-Q for

the quarter ended March 31, 2002, the trial and settlement discus-

sions were ongoing, but the parties to the settlement discussions had

been unable to reach agreement on structure, amount and other sig-

nificant terms. At that time, we were prepared to end settlement dis-

cussions based on our continued belief that we could litigate our

position and possibly reach a more favorable outcome than a negoti-

ated settlement would provide. In such circumstances, we perceived

the possible outcomes as ranging from minimal amounts well within

our existing asbestos reserves to unknown higher amounts (poten-

tially higher than the amount in the final settlement agreement, dis-

cussed below). Accordingly, we believed that we could not estimate a

reasonable range of potential loss for the Western MacArthur claim,

and therefore could make no disclosure of such a range. However, at

the time we filed such report on Form 10-Q, we believed, based on

various adverse developments during the course of the first phase of

the trial through May 15, that although the ultimate outcome of the

Western MacArthur case was not determinable at that time, it was

possible that its resolution could be material to our results of opera-

tions, and we made disclosure of this fact in such report. We did not

disclose a range of possible outcomes, as we were unable to do so at

the time of the filing.

Subsequent to May 15, 2002, there were additional adverse devel-

opments at the trial. USF&G’s motions for nonsuit and for reconsider-

ation of prior evidentiary rulings were denied. In light of continued

adverse trial developments, the fact that jury deliberations on the first

phase of the trial were expected to commence as soon as the second

week of June, and in an effort to put its largest known asbestos expo-

sure behind us, we began negotiating a single lump-sum payment set-

tlement with the plaintiffs. Negotiations were intense and ultimately the

Company achieved a comprehensive agreement on June 3, 2002,

before the completion of the first phase of the jury trial. Importantly, this

agreement (which is subject to bankruptcy court approval) not only set-

tled pending claims, it also settled, with possible minor exceptions, all

claims that Western MacArthur and its affiliates could possibly have

against us and USF&G, including but not limited to the claims made in

the pending lawsuit, for a pre-tax liability then estimated at $988 million

as described below. The settlement agreement was filed as an exhibit