Travelers 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

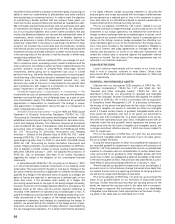

Realized and Unrealized Investment Gains (Losses) – The follow-

ing summarizes our pretax realized investment gains and losses, and

the change in unrealized appreciation or depreciation of investments

recorded in common shareholders’ equity and in comprehensive

income.

Years ended December 31 2002 2001 2000

(In millions)

PRETAX REALIZED INVESTMENT GAINS (LOSSES)

Fixed income:

Gross realized gains $191 $28 $ 29

Gross realized losses (91) (105) (58)

Total fixed income 100 (77) (29)

Equities:

Gross realized gains 116 276 296

Gross realized losses (184) (280) (201)

Total equities (68) (4) 95

Real estate and mortgage loans 212 4

Venture capital (200) (43) 554

Other investments 118 8

Total pretax realized investment gains (losses) $(165) $(94) $ 632

CHANGE IN UNREALIZED APPRECIATION

Fixed income $446 $187 $ 457

Equities (17) (347) (199)

Venture capital (88) (314) (61)

Other 8(80) 47

Total change in pretax unrealized

appreciation on continuing operations 349 (554) 244

Change in deferred taxes (120) 214 (88)

Total change in unrealized appreciation on

continuing operations, net of taxes 229 (340) 156

Change in pretax unrealized appreciation

on discontinued operations —26 63

Change in deferred taxes —(9) (22)

Total change in unrealized appreciation

on discontinued operations, net of taxes —17 41

Total change in unrealized appreciation, net of taxes $229 $(323) $ 197

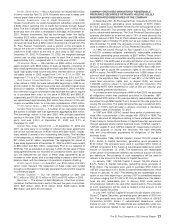

Included in gross realized losses for our fixed income portfolio in

2002 and 2001 were impairment write-downs totaling $74 million and

$77 million, respectively. No such write-downs occurred in 2000.

Gross realized losses in our equity portfolio in 2002 included impair-

ment write-downs of $26 million. No such write-downs occurred in

2001 or 2000. In our venture capital portfolio, impairment write-downs

totaled $122 million, $88 million and $13 million in 2002, 2001 and

2000, respectively. See Note 1 for additional information regarding our

accounting policy for other-than-temporary investment impairments.

10. DERIVATIVE FINANCIAL INSTRUMENTS

Derivative financial instruments include futures, forward, swap and

option contracts and other financial instruments with similar character-

istics.We have had limited involvement with these instruments, prima-

rily for purposes of hedging against fluctuations in foreign currency

exchange rates and interest rates. All investments, investment tech-

niques and risk management strategies, including the use of derivative

instruments, have some degree of market and credit risk associated

with them. We believe our derivatives’ market risk substantially offsets

the market risk associated with fluctuations in interest rates, foreign

currency exchange rates and market prices. We seek to reduce our

credit risk exposure by conducting derivative transactions only with

reputable, investment-grade counterparties, and by seeking to avoid

concentrations of exposure individually or with related parties.

Effective January 1, 2001, we adopted the provisions of SFAS

No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” as amended (“SFAS No. 133”). The statement requires the

recognition of all derivatives as either assets or liabilities on the bal-

ance sheet, carried at fair value. In accordance with the statement,

derivatives are specifically designated into one of three categories

based on their intended use, and the applicable category dictates the

accounting for each derivative.We have held the following derivatives,

by category.

Fair Value Hedges — For the years ended December 31, 2002

and 2001, we have several pay-floating, receive-fixed interest rate

swaps, with notional amounts totaling $730 million and $230 million,

respectively. They are designated as fair value hedges for a portion of

our medium-term and senior notes, which we have entered into for the

purpose of managing the effect of interest rate fluctuations on this

debt. The terms of the swaps match those of the debt instruments,

and the swaps are therefore considered 100% effective. The balance

sheet impacts for years ended December 31, 2002 and 2001 from

movements in interest rates were increases of $42 million and $8 mil-

lion, respectively, in the fair value of the swaps and the related debt on

the balance sheet, with the statement of operations impacts offsetting

in both years.

Cash Flow Hedges — We have purchased forward foreign cur-

rency contracts that are designated as cash flow hedges.They are uti-

lized to minimize our exposure to fluctuations in foreign exchange

rates from our expected foreign currency payments, and settlement of

our foreign currency payables and receivables. In the year ended

December 31, 2002 we recognized a $1 million gain on the cash flow

hedges, which is included in Other Comprehensive Income (“OCI”).

The comparable amount for the year ended December 31, 2001 was

a $2 million loss. The amounts included in OCI will be realized into

earnings concurrent with the timing of the hedged cash flows, which

is not expected to occur within the next twelve months. For the year

ended December 31, 2002, we did not recognize a gain or loss in the

statement of operations. For the year ended December 31, 2001 we

recognized a realized loss of less than $1 million in the statement of

operations, representing the portion of the forward contracts deemed

ineffective.

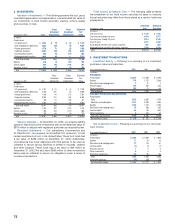

The accumulated changes in OCI as a result of cash flow hedges

for 2002 (net of taxes) are summarized as follows.

Year ended December 31, 2002

(In millions)

Beginning balance $(2)

Net gains from cash flow hedges 1

Ending balance $(1)

Non-Hedge Derivatives — We have other financial instruments

that are considered to be derivatives, but which are not designated as

hedges. These include our investment in stock purchase warrants of

Platinum, received as partial consideration from the sale of our rein-

surance business (see Note 2), and stock warrants in our venture cap-

ital business. For the years ended December 31, 2002 and 2001 we

recorded $13 million and $3 million, respectively, of realized gains in

continuing operations related to those non-hedge derivatives. For

those same periods we also recorded a loss of $22 million and a gain

of $17 million, respectively, of income from discontinued operations

relating to non-hedge derivatives associated with the sale of our life

insurance business.

Derivative-type Investments Accounted for Under EITF 99-2 — We

have also offered insurance products that are accounted for as

weather derivatives accounted for under EITF 99-2, “Accounting for

Weather Derivatives,” which provides for accounting similar to that for

SFAS No. 133 derivatives. The net impact to our statement of opera-

tions of these insurance products in 2002 and 2001, was a gain of

less than $1 million and a $2 million loss, respectively. As part of our

December 2001 strategic review, we determined that we would no

longer issue this type of product. At December 31, 2002, we had one

remaining contract outstanding, with total maximum exposure of less

than $1 million.

The St. Paul Companies 2002 Annual Report 73