Travelers 2002 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE ST. PAUL COMPANIES

Pension Plans

Due to the long-term nature of obligations under our pension

plans, the accounting for such plans is complex and reflects various

actuarial assumptions. Management’s selection of plan assumptions,

primarily the discount rate used to calculate the projected benefit obli-

gation and the expected long-term rate of return on plan assets

(“LTROR”), can have a significant impact on our resulting estimated

projected benefit obligation and pension cost, and thus on our consol-

idated results of operations. Such plan assumptions are determined

annually, subject to revision if significant events occur during the year,

such as plan mergers and significant plan amendments.

Our pension plan measurement date for purposes of our consoli-

dated financial statements is December 31. The market-related value

of plan assets is determined based on their fair value at the measure-

ment date. The projected benefit obligation is determined based on

the present value of projected benefit distributions at an assumed dis-

count rate.The discount rate used reflects the rate at which we believe

the pension plan obligations could be effectively settled at the meas-

urement date, as though the pension benefits of all plan participants

were determined as of that date. At December 31, 2002 and 2001, the

discount rates used to calculate our projected benefit obligation were

6.50% and 7.00%, respectively, for our consolidated pension plans

(encompassing our U.S. plan, our Canada plan, our U.K. plans and

Nuveen Investments’ plan). For our U.S. plan, which constitutes 93%

of our consolidated pension plan assets, such rates were determined

based on the Moody’s Investor Services AA Long-Term Industrial

December Average Bond yield with a duration of approximately 11 to

13 years (which correlates to the expected duration of our pension

obligations), rounded up to the nearest quarter percent.

Total pension cost encompasses the cost of service, interest costs

based on an assumed discount rate, an expected long-term rate of

return on plan assets and amortization of actuarial gains and losses,

adjusted for curtailment gains or losses, if any. Actuarial gains and

losses include the impact of unrecognized gains and losses that are

deferred and amortized over the expected future service period of

active employees. Any unrecognized gains or losses related to

changes in the amount of the projected benefit obligation or plan

assets resulting from experience that differs from the expected

returns and from changes in assumptions are deferred. To the extent

an unrecognized gain or loss exceeds 10 percent of the greater of the

projected benefit obligation or the fair value of plan assets (“10 per-

cent corridor”), the excess is recognized over the expected future

service periods of active employees.At December 31, 2002, the accu-

mulated unrecognized loss for our consolidated pension plans subject

to minimum amortization approximated $364 million, which exceeded

the 10 percent corridor, and will be amortized over 11 years. As a

result, pension cost in 2003 is expected to include approximately

$33 million of amortization. The amount of the unrecognized gain or

loss that is less than the 10% corridor, and is therefore not subject to

minimum amortization in 2003, was approximately $104 million at

December 31, 2002.

The expected long-term rate of return on plan assets is estimated

based on the plan’s actual historical return results, the expected allo-

cation of plan assets by investment class, market conditions and other

relevant factors. We evaluate only whether the actual allocation has

fallen within an expected range, and we then evaluate actual asset

returns in total, rather than by asset class, giving consideration to the

fact that our equity investments have a higher volatility than our other

investment classes, which is consistent with the market in general.

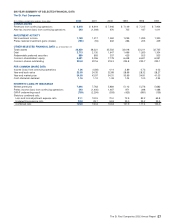

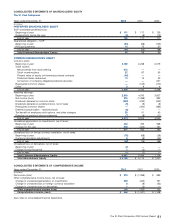

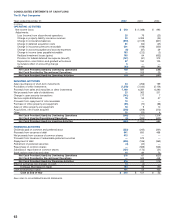

The following table presents the actual allocation of plan assets, in

comparison with the expected allocation range, both expressed as a

percentage of total plan assets, as of December 31 for our U.S. plan

only, which comprised 93% of our consolidated pension plan assets.

December 31 2002 2001

Asset Class Actual Expected Actual Expected

Cash* 22% 0 – 10% 3% 0 – 10%

Fixed maturities 31% 30 – 70% 34% 20 – 60%

Equities 45% 30 – 70% 61% 40 – 80%

Other 2% 0 – 10% 2% 0 – 10%

Total 100% 100%

*The high level of cash at year-end 2002 resulted from a significant contribution we made to the plan in

December.

The following table presents our consolidated pension plan

assumptions.

December 31 2002 2001 2000

Discount rate 6.50% 7.00% 6.75%

Expected long-term rate of return 8.50% 10.00% 10.00%

Expected rate of compensation increase 4.00% 4.00% 4.00%

At December 31, 2000, our discount rate assumption was deter-

mined based on a weighted average of the rates expected to be used

to settle our obligations, considering the portion of our obligation

expected to be settled by annuity payments and the portion expected

to be settled by lump sum payments. At December 31, 2001, consid-

ering the impact of the plan design change to add a cash balance for-

mula, we determined that the vast majority of the participants electing

to remain under the traditional pension formula would select the annu-

ity payment option.As such, we determined our projected benefit obli-

gation was more appropriately calculated using strictly the rate at

which we believed we could settle the annuity obligations. Based on

our assumption that the vast majority of the participants electing to

remain under the traditional pension formula would select the annuity

payment option, we eliminated from our discount rate determination

the lower rate that we assume would otherwise be used to settle lump

sum payments, and thereby increased our discount rate as of

December 31, 2001. In 2002, the declining interest rate environment

caused us to reduce our discount rate and LTROR as of

December 31, 2002.

As discussed above, investment and funding decisions and pen-

sion plan assumptions can materially impact our consolidated finan-

cial results of operations. Consequently, our Investment Benefit

Committee regularly evaluates investment returns, asset allocation

strategies, possible plan contributions, and plan assumptions.

Regardless of the extent of our analysis of such factors, plan assump-

tions reflect judgments and are subject to changes in economic fac-

tors.There can be no assurance that our assumptions will prove to be

correct or that they will not be subject to significant adjustments over

time. For purposes of comparison, for the six-year period and 20-year

period ended December 31, 2002 and 2001, our arithmetic average

actual returns on our U.S. plan assets were 7.71% and 12.48%,

respectively, for 2002 and 10.89% and 14.55%, respectively, for 2001.

Funding decisions are made based on a number of factors, including

the minimum regulatory funding requirements, the maximum tax-

deductible contributions, the estimated market value of plan assets in

relation to our accumulated benefit obligation, current market condi-

tions and other business factors. During 2002, we made contributions

to the U.S. plan and the United Kingdom plans of approximately

$149 million and $9 million, respectively, that were primarily necessi-

tated by the significant decline in market value of equity investments

held by the plans, which was consistent with general market trends

during 2002.

The following table presents the impact of consolidated net pen-

sion cost (income) on our results of operations (before and after the

impact of a curtailment loss resulting from plan design changes in

2001) for the years 2002, 2001, and 2000, respectively.

(In millions) 2002 2001 2000

Net periodic pension cost (income) $17 $(20) $ (41)

Curtailment loss 917 —

Net impact after curtailment loss $26 $(3) $ (41)

The St. Paul Companies 2002 Annual Report 53