Travelers 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

debenture.The proceeds of such redemptions will be used to redeem

a like amount of the Series C Capital Securities.

Under certain circumstances related to tax events, we have the

right to shorten the maturity dates of the Series A, Series B and

Series C debentures to no earlier than June 24, 2016, July 10, 2016

and April 8, 2012, respectively, in which case the stated maturities of

the related Capital Securities will likewise be shortened.

In 2002, we repurchased and retired $4 million of the MMI trust

securities. In 2001, we repurchased and retired $20 million of USF&G

Capital I securities. Purchases in both years were done in open mar-

ket transactions.

Our total distribution expense related to all of these preferred

securities was $70 million in 2002, $33 million in 2001, and $31 mil-

lion in 2000.

PREFERRED SHAREHOLDERS’ EQUITY

The preferred shareholders’ equity on our balance sheet repre-

sents the par value of preferred shares outstanding that we issued to

our Stock Ownership Plan (“SOP”) Trust, less the remaining principal

balance on the SOP Trust debt. The SOP Trust borrowed funds from

a U.S.underwriting subsidiary to finance the purchase of the preferred

shares, and we guaranteed the SOP debt.

The SOP Trust may at any time convert any or all of the preferred

shares into shares of our common stock at a rate of eight shares of

common stock for each preferred share. Our board of directors has

reserved a sufficient number of our authorized common shares to

satisfy the conversion of all preferred shares issued to the SOP

Trust and the redemption of preferred shares to meet employee distri-

bution requirements. Upon the redemption of preferred shares, we

will issue shares of our common stock to the trust to fulfill the redemp-

tion obligations.

COMMON SHAREHOLDERS’ EQUITY

Common Stock and Reacquired Shares — We are governed by

the Minnesota Business Corporation Act. All authorized shares of vot-

ing common stock have no par value. Shares of common stock reac-

quired are considered unissued shares. The number of authorized

shares of the company is 480 million.

We reacquired significant numbers of our common shares in 2001

and 2000 for total costs of $589 million and $536 million, respectively.

We reduced our capital stock account and retained earnings for the

cost of these repurchases. Share repurchases in 2002 were minimal,

primarily related to stock incentive plans.

Issuance of Common Shares — In July 2002, we sold 17.8 million

of our common shares in a public offering for gross consideration of

$431 million, or $24.20 per share.

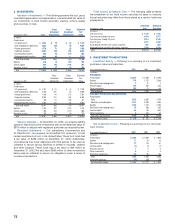

A summary of our common stock activity for the last three years is

as follows.

Years ended December 31 2002 2001 2000

Shares outstanding at beginning of year 207,624,375 218,308,016 224,830,894

Shares issued:

Public offering 17,825,000 — —

Stock incentive plans and other 1,035,326 2,012,533 3,686,827

Conversion of preferred stock 331,513 287,442 661,523

Conversion of MIPS ——7,006,954

Reacquired shares (17,757) (12,983,616) (17,878,182)

Shares outstanding at end of year 226,798,457 207,624,375 218,308,016

Undesignated Shares — Our articles of incorporation allow us to

issue five million undesignated shares. The board of directors may

designate the type of shares and set the terms thereof. The board

designated 1,450,000 shares as Series B Convertible Preferred Stock

in connection with the formation of our Stock Ownership Plan.

Dividend Restrictions — We primarily depend on dividends from

our subsidiaries to pay dividends to our shareholders, service our

debt, and pay expenses. St. Paul Fire and Marine Insurance Company

("Fire and Marine") is our lead U.S. property-liability underwriting sub-

sidiary and its dividend paying capacity is limited by the laws of

78

Minnesota, its state of domicile. Business and regulatory considera-

tions may impact the amount of dividends actually paid.

Approximately $505 million will be available to us from payment of

ordinary dividends by Fire and Marine in 2003. Any dividend pay-

ments beyond the $505 million limitation would require prior approval

of the Minnesota Commissioner of Commerce. Fire and Marine’s abil-

ity to receive dividends from its direct and indirect underwriting sub-

sidiaries is subject to restrictions under the laws of their respective

states or other jurisdictions of domicile. We received no cash divi-

dends from our U.S. property-liability underwriting subsidiaries in

2002. During 2001, we received dividends in the form of cash and

securities of $827 million from our U.S. underwriting subsidiaries.

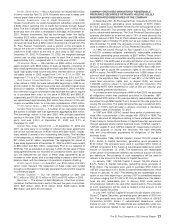

14. RETIREMENT PLANS

During 2000, our U.S. employees hired prior to January 1, 2001

were given the choice of remaining subject to our traditional pension

formula and traditional postretirement healthcare benefits plan, or

switching to a new cash balance pension formula and/or cash balance

retiree health formula. Employees choosing to switch to the cash bal-

ance formula(s) were credited with opening balances effective

January 1, 2001. Employees hired after December 31, 2000 are auto-

matically subject to the cash balance formulas. During 2002, as part

of making further changes to our benefit plans, employees hired prior

to January 1, 2001 were given another choice between our new tradi-

tional pension formula and a new cash balance pension formula.

The traditional pension plan and cash balance pension formulas

were amended effective January 1, 2003, which reduced the pro-

jected benefit obligation by $84 million at December 31, 2002. In addi-

tion, the postretirement medical plan was amended effective

January 1, 2003. As a result, postretirement life insurance coverage

was eliminated for active employees, and employees who were not

within five years of retirement eligibility were switched to the cash bal-

ance retiree health formula from the traditional post-retirement health-

care benefits plan. These actions reduced the accumulated

postretirement benefit obligation by $22 million.

Defined Benefit Pension Plans — We maintain funded defined

benefit pension plans for most of our employees. For those employ-

ees who have elected to remain subject to the traditional pension for-

mula, benefits are based on years of service and the employee’s

compensation while employed by the company. Pension benefits gen-

erally vest after five years of service.

For those employees covered under the cash balance pension for-

mula, we maintain a cash balance pension account to measure the

amount of benefits payable to an employee. For each plan year an

employee is an active participant, the cash balance pension account

is increased for pay credits and interest credits. Pay credits are calcu-

lated based on age, vesting service and actual pensionable earnings,

and added to the account on the first day of the next plan year.Interest

credits are added at the end of each calendar quarter.

These benefits vest after five years of service. If an employee is

vested under the cash balance formula when their employment with

us ends, they are eligible to receive the formula amount in their cash

balance pension account.

Our pension plans are noncontributory. This means that employ-

ees do not pay anything into the plans. Our funding policy is to con-

tribute amounts at least sufficient to meet the minimum funding

requirements of the Employee Retirement Income Security Act that

can be deducted for federal income tax purposes. This may result in

no contribution being made in a particular year.

Plan assets are invested primarily in equities and fixed income

securities, and included 804,035 shares of our common stock with a

market value of $27 million and $35 million at December 31, 2002 and

2001, respectively.

We maintain noncontributory, unfunded pension plans to provide

certain company employees with pension benefits in excess of limits

imposed by federal tax law.