Travelers 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

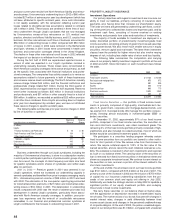

PROPERTY-LIABILITY INSURANCE OPERATIONS

Surety & Construction

We consider our Surety & Construction segment a specialty oper-

ation, because each business requires specialized underwriting, risk

management and claim expertise. These operations have a shared

customer base and are under common management. Our Surety busi-

ness center underwrites surety bonds, which are agreements under

which one party (the surety) guarantees to another party (the owner or

obligee) that a third party (the contractor or principal) will perform in

accordance with contractual obligations. For Contract Surety, we pro-

vide bid, performance and payment bonds, to a broad spectrum of

clients specializing in general contracting, highway and bridge con-

struction, asphalt paving, underground and pipeline construction, man-

ufacturing, civil and heavy engineering, and mechanical and electrical

construction. Bid bonds provide financial assurance that the bid has

been submitted in good faith and that the contractor intends to enter

into the contract at the price bid and provide the required performance

and payment bonds. Performance bonds require us to fulfill the con-

tractor’s obligations to the obligee should the contractor fail to perform

under the contract. Payment bonds guarantee that the contractor will

pay certain subcontractor, labor and material bills associated with a

project. For Commercial Surety, we currently offer license and permit

bonds, reclamation bonds, fiduciary bonds, court bonds, public official

bonds, indemnity bonds, workers’ compensation self-insurer bonds,

transfer agent indemnity bonds, depository bonds, and other miscella-

neous bonds. In addition to its U.S. operations, our Surety business

center includes our Mexican subsidiary, Afianzadora Insurgentes, the

largest surety bond underwriter in Mexico, and our Canadian opera-

tions St. Paul Guarantee and Northern Indemnity, which, on a com-

bined basis, make us the largest surety bond underwriter in Canada.

In total, based on 2001 premium volume, our surety operations are the

largest in North America. The Construction business center offers a

variety of products and services, including traditional insurance and

risk management solutions, to a broad range of contractors and par-

ties responsible for construction projects.

The following table summarizes results for this segment for the last

three years. Results presented for all three years exclude the impact of

the corporate reinsurance program, and results for 2002 and 2001 also

exclude the impact of the terrorist attack. Data including these factors

is presented on page 36 of this discussion.

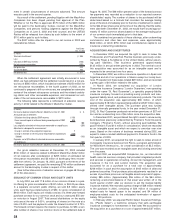

Years Ended December 31 2002 2001 2000

($ in millions)

Written premiums $1,252 $1,006 $ 913

Percentage increase over prior year 24% 10%

Underwriting result $(212) $(52) $ 19

Loss and loss adjustment expense ratio 82.2 68.8 55.6

Underwriting expense ratio 35.0 35.9 40.0

Combined ratio 117.2 104.7 95.6

2002 vs. 2001 — Total premium volume for the Surety &

Construction segment increased by $246 million over 2001, primarily

driven by $153 million of premium growth in Construction, where price

increases averaged 30% in 2002. In the Surety business center, pre-

mium volume was $93 million higher than in 2001, primarily due to the

combined $100 million contributed by St. Paul Guarantee in Canada

(formerly London Guarantee), acquired in March 2002, and our acqui-

sition in late 2001 of the right to seek to renew surety business previ-

ously underwritten by Fireman’s Fund Insurance Company (see

page 28 of this discussion for further details about these acquisitions).

Excluding the impact of the two acquisitions, Surety’s net premium vol-

ume in 2002 was slightly below comparable 2001 levels, reflecting the

tightened underwriting standards instituted over the last two years, par-

ticularly with respect to our commercial surety business, and an

increase in domestic reinsurance costs in 2002.

Both business centers contributed to the $160 million deterioration

in underwriting results compared with 2001. The Construction under-

writing loss of $94 million was $37 million worse than the comparable

2001 loss of $57 million, driven by adverse prior-year loss develop-

ment that prompted a $113 million fourth-quarter provision to

38

strengthen loss reserves in our general liability and workers’ compen-

sation coverages. The 2002 current accident year loss ratio for

Construction, however, was much improved over the same 2001 ratio,

reflecting the impact of strong underwriting initiatives, price increases

and the shift to a larger-sized account profile. Approximately $93 mil-

lion of Construction’s $113 million adverse prior year development was

concentrated in general liability coverages. The table below allocates

the general liability coverage portion of our reserve charge in 2002, by

accident year, within our Construction business center.

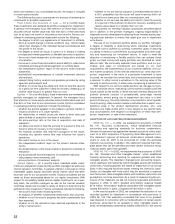

2002

Beginning Reserve

Accident Year Reserve Charge

(In millions)

2001 $ 150 $13

2000 74 64

1999 90 35

Prior 255 (19)

Total $ 569 $93

Our analysis of trends for our general liability coverages in 2002

revealed case reserve strengthening occurring throughout the year. In

addition, actual loss development during the year continued to exceed

our expectations. The average paid closed claim trend had exceeded

the average case reserve trend in the recent development.The average

outstanding case reserve increased from $54,000 at year-end 2001 to

$66,000 at year-end 2002. The average paid claim increased from

$18,000 at year-end 2001 to $28,000 at year-end 2002.While the aver-

age paid claim was still below the average case reserve, this develop-

ment in the data caused us to revise our trends and increase our

estimate of ultimate losses.We increased our estimate of required loss

reserves and recorded a $93 million increase to loss reserves.

However, no changes were made to any other underlying assumptions.

The remaining reserve charge of $20 million related to workers’

compensation coverages (with beginning 2002 reserves of $363 mil-

lion), primarily from the 2001 accident year. This charge resulted from

a comprehensive claim review which focused on, among other data, a

better estimate of our life-time benefit obligations. As a result of this

review, we increased the number of claims identified as receiving life-

time benefits and, accordingly, increased the related loss reserves. No

changes were made to our underlying assumptions.

Surety’s 2002 underwriting loss was $118 million, compared with a

profit of $5 million in 2001. The 2002 results reflected prior-year

reserve charges of $104 million, which included $34 million related to

the judgment regarding the Petrobras oil rig construction (see further

details on page 30 of this discussion), related to a 1996 incident, and

$7 million for the settlement of litigation related to surety contracts

issued on behalf of Enron Corporation (see further details on page 30

of this discussion), related to a 2001 reported incident. Surety’s under-

writing results in 2002 were also negatively impacted by reinstatement

premiums paid for contract surety reinsurance, which reduced our net

earned premiums, as well as an increase in losses in our contract

surety business where we have experienced a higher than normal level

of loss frequency.

In addition to the Petrobras and Enron events referred to above, we

have experienced an increase in the frequency of losses, with much of

this increase being tied to the recent economic downturn. Included in

the $104 million of prior-year development for 2002 was a fourth-

quarter provision totaling $63 million in our domestic surety operations

as detailed in the following table. The entire Surety business center

prior year reserve charge was driven by development on specific

claims. Since surety losses are not recognized until the period a claim

is filed, no changes were made to assumptions.The insurance concept

of “accident year” is not meaningful to surety business.The yearly infor-

mation in the following table represents the year in which we deter-

mined that an incident had occurred, which might give rise to a

possible claim.