Travelers 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Travelers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If you think you know The St. Paul,

think again.

2002 Annual Report

Table of contents

-

Page 1

If you think you know The St. Paul, think again. 2002 Annual Report -

Page 2

... 8 Middle Market improves not only the 'what' of the business but also the 'how' by focusing on service to agents and brokers. Small Commercial page 10 The tools and products are in place for Small Commercial's expansion into the small business insurance marketplace. Oil and Gas page 12 Underwriting... -

Page 3

After a year of tremendous change within our business, The St. Paul has been transformed. We have a renewed energy and spirit. More than ever, we're committed to the market, to our shareholders and to our customers. Most of all, we're focused on the future and the opportunities that lie ahead. -

Page 4

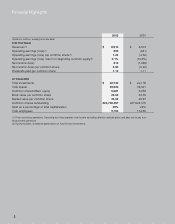

... income (loss) Net income (loss) per common share Dividends paid per common share AT YEAR END $ 8,918 290 1.24 6.1% 218 0.92 1.15 $ 8,919 (941) (4.52) (13.6%) (1,088) (5.22) 1.11 Total investments Total assets Common shareholders' equity Book value per common share Market value per common share... -

Page 5

... a strategy that was likely to succeed. As a result, we made the difficult decision to exit the business, issuing nonrenewal notices to nearly all of our medical liability policyholders by year-end 2002. Jay S. Fishman Chairman and Chief Executive Officer The St. Paul Companies 2002 Annual Report 3 -

Page 6

... in the marine, aviation, property and specialty personal lines. Our ongoing International and Lloyd's business produced a 2002 combined ratio of 90.9. • Repositioned The St. Paul in the reinsurance marketplace. Rather than continue to operate St. Paul Re as a U.S.based division of our company, we... -

Page 7

...managed asset growth. Nuveen, through its long-term, conservative investment philosophy and consistent product innovation, has attained a leadership position in exchange-traded funds and managed accounts, and is a growing factor in the institutional sector. The St. Paul Companies 2002 Annual Report... -

Page 8

... Corporation, retired from The St. Paul Board in May 2002. Three directors will be retiring in May: Pierson M. Grieve, a director since 1985 and the former chairman and chief executive officer of Ecolab, Inc., a developer and marketer of cleaning and sanitizing products, systems and services... -

Page 9

... a leading institutional manager of market-neutral alternative investment portfolios. In total, Nuveen Investments now manages approximately $80 billion in assets. Nuveen Investments is listed on the New York Stock Exchange, trading under the symbol JNC. The St. Paul Companies 2002 Annual Report 7 -

Page 10

Middle Market excels at service to agents, brokers "Commercial Middle Market underwriting at The St. Paul has always been a mainstay of The St. Paul's commercial insurance offerings. In 2002, we not only worked to improve the 'what' of our business, but also the 'how.' We made a commitment to excel ... -

Page 11

Commercial Middle Market regional executives, left to right: Jack Roche, Central region; John Casper, Western region; Armando Calderon, Upper Midwest region; Dave Kuhn, Pacific region; Doug McDonough, Mid-Atlantic region; Robin Nicks, South Central region; Dennis Crosby, president, Commercial Middle... -

Page 12

...companies, and developed 'SPCXpressSM,' a state-of-the-art online technology platform for agents and brokers. We created a dedicated local and regional sales force and opened a commercial service center to take care of customer contacts on our small business policy renewals. We launched our St. Paul... -

Page 13

Scott Shader, vice president, underwriting and product development, Small Commercial (left) and Marc Schmittlein, president, Small Commercial. 1111 -

Page 14

Expertise establishes The St. Paul in oil and gas market 12 -

Page 15

... agents and brokers who also share a specialty in oil and gas. And, to ensure access to those agents, brokers and customers, we headquartered our unit in Houston - the oil and gas capital - and located other underwriting operations in other key cities: Dallas, Denver, New York and Oklahoma City. We... -

Page 16

Construction Underwriting poised to prosper as population grows 14 -

Page 17

...term due to the economic slowdown and budget deficits in many states, but The St. Paul's Construction underwriting operations are still poised to prosper. We have unmatched expertise in this segment. No one has our level of service: one-third of our unit's employees work in construction risk control... -

Page 18

Technology operation achieves unique position in marketplace 16 -

Page 19

"The Technology underwriting business unit is the leading underwriter of insurance for technology companies because we're a stable force in the marketplace, and we address the needs of our customers in innovative ways. Our employees ask the right questions and listen to what our customers have to ... -

Page 20

... ways to improve our service and professionalism. Our employees are specialists. When a claim is submitted, it's directed to an employee who specializes in a particular coverage area such as errors and omissions or workers' compensation. In 2002, we initiated an in-house training program for new... -

Page 21

Left to right: Paul Ramsey, senior vice president, Claim; Margie Allen, assistant vice president-Claim, Central Region; Ricky Jones, assistant vice president-Claim, Upper Midwest Region 19 -

Page 22

At Nuveen, heritage + foresight = quality 20 -

Page 23

... to effectively manage risk through all market cycles. At Nuveen Investments we are well positioned to meet their needs with the value, growth and income-oriented core components of a conservative, well-diversified portfolio." -Tim Schwertfeger, chief executive officer, Nuveen Investments Timothy... -

Page 24

... rating level to use higher-rated insurers or causing us to borrow at higher interest rates; • the risk that our investment portfolio suffers reduced returns or investment losses which could reduce our profitability; • the effect of financial market and interest rate conditions on pension plan... -

Page 25

... in property-liability underwriting results in several segments of our business, principally Health Care, Reinsurance and International & Lloyd's. The decline in the "Parent company and other operations" pretax loss in 2001 resulted from a reduction in executive management stock compensation expense... -

Page 26

... consisting of operations in the United Kingdom, Canada and the Republic of Ireland), and Global Accounts. All operations in this segment are under common management. • The new runoff segment Other was formed, comprised of the results of all of our international and Lloyd's business considered to... -

Page 27

... and claim servicing fees in our insurance underwriting operations and foreign exchange gains and losses. In 2001, consolidated revenue growth was driven by price increases, strong business retention rates and new business in several segments that resulted in a 30% increase in earned premiums over... -

Page 28

...to limit a ceding insurer's maximum net loss from individually large or aggregate risks as well as to provide protection against catastrophes. Our reinsurance program is generally managed from a corporate risk-tolerance perspective. Reinsurance contracts addressing specific business center risks are... -

Page 29

... MacArthur's November 1999 settlement of a similar claim brought against another defendant insurer for $26 million. Given the facts and circumstances known by management at the time we filed our annual report on Form 10-K, we believed that our best estimate of aggregate asbestos reserves as of... -

Page 30

... 31, 2002, St. Paul Guarantee produced net written premiums of $57 million and an underwriting loss of $6 million since the acquisition date. In December 2001, we purchased the right to seek to renew surety bond business previously underwritten by Fireman's Fund Insurance Company ("Fireman's Fund... -

Page 31

... assets as of January 1, 2002) that we are amortizing over 20 years. Pacific Select's results of operations from the date of acquisition are included in the catastrophe risk results included in our Commercial Lines segment (commercial coverages) and in our Specialty Commercial segment (personal... -

Page 32

.... Purported Class Action Shareholder Lawsuits - In the fourth quarter of 2002, several purported class action lawsuits were filed against us, our chief executive officer and our chief financial officer. The lawsuits make various allegations relating to the adequacy of our previous public disclosures... -

Page 33

... the total pretax gross unrealized loss recorded in our common shareholders' equity at December 31, 2002 and 2001, by invested asset class. December 31 (In millions) December 31 2002 Fair Value Gross Unrealized Loss Fair Value 2001 Gross Unrealized Loss (In millions) Fixed income (including... -

Page 34

... - In 2002, we adopted the provisions of SFAS No. 141, "Business Combinations," which established financial accounting and reporting standards for business combinations. (Nuveen Investments had applied the relevant provisions of this statement to its 2001 acquisition of Symphony Asset Management LLC... -

Page 35

... related to its 2001 acquisition of Symphony Asset Management LLC and additional goodwill recorded at The St. Paul parent company resulting from Nuveen Investments' repurchase of common shares from its minority shareholders. Our acquisition of St. Paul Guarantee in 2002 also contributed to the... -

Page 36

...in several Lloyd's syndicates. UNDERWRITING RESULT Underwriting result is a common measurement of a property-liability insurer's performance, representing premiums earned less losses incurred and underwriting expenses. The statutory combined ratio, representing the sum of the statutory loss and loss... -

Page 37

... are presented on a statutory accounting basis). All data for 2001 and 2000 were reclassified to conform to our new segment reporting format implemented in the fourth quarter of 2002. Following the table are detailed analyses of our results by segment. The St. Paul Companies 2002 Annual Report 35 -

Page 38

... price increases, particularly in the Directors and Officers line of business. Umbrella/Excess & Surplus Lines' written premiums of $293 million were 48% higher than comparable 2001 volume of $198 million, driven by a new commercial umbrella operation launched in 2002. Specialty Programs recorded... -

Page 39

... development. Underwriting profits in Financial & Professional Services in 2002 were $41 million higher than in 2001, and results in our Specialty Programs business center improved by $34 million over 2001. All of our operations in the Specialty Commercial segment benefited in 2002 from strong price... -

Page 40

... St. Paul Guarantee and Northern Indemnity, which, on a combined basis, make us the largest surety bond underwriter in Canada. In total, based on 2001 premium volume, our surety operations are the largest in North America. The Construction business center offers a variety of products and services... -

Page 41

...single wholly-owned syndicate at Lloyd's established in 2002, we underwrite insurance in four principal lines of business: Aviation, Marine, Global Property and Personal Lines. Aviation underwrites a broad spectrum of international airline, manufacturer, airport and general aviation business. Marine... -

Page 42

and new business throughout these operations. The 2001 total included approximately $44 million of incremental premiums from the elimination of the one-quarter reporting lag. Public Sector Services coverages accounted for $83 million of 2002 international specialty premium volume, and Financial and ... -

Page 43

...quarter, both average payments and average case reserves increased significantly for the ACIC business. Reserve additions of $65 million were made based upon our analysis. Our observations with respect to the St. Paul Fire and Marine Insurance Company ("F&M"), our primary U.S. insurance underwriting... -

Page 44

... reflect these new increased averages in its reserve analysis and record a reserve increase of $97 million. Throughout 2002, we initiated significant changes to our Health Care claims organization and resolution process. During the third quarter of 2002, we began to see the results of executing this... -

Page 45

...business that was not placed in runoff. PROPERTY-LIABILITY INSURANCE OPERATIONS Reinsurance In the years prior to 2002, our Reinsurance segment ("St. Paul Re") generally underwrote treaty and facultative reinsurance for property, liability, ocean marine, surety, certain specialty classes of coverage... -

Page 46

... professional services syndicate at Lloyd's contributed to the increase in underwriting losses in 2001. Fixed Income Securities - Our portfolio of fixed income investments is primarily composed of high-quality, intermediate-term taxable U.S. government, corporate and mortgage-backed bonds, and tax... -

Page 47

...reflected the lower average level of fixed income invested assets during 2001 due to net sales of investments to fund operational cash flow needs, and the significant reduction in interest rates available on new investments. Additional information regarding our fixed income portfolio is disclosed in... -

Page 48

.... PROPERTY-LIABILITY UNDERWRITING Loss and Loss Adjustment Expense Reserves Our loss reserves reflect estimates of total losses and loss adjustment expenses we will ultimately have to pay under insurance policies, surety bonds and reinsurance agreements. These include losses that have been reported... -

Page 49

.... Payment totals for these coverages are driven by a few very large claims, accompanied by a large number of very small claims. While the number of new reported claims appears to increase, they are primarily matters for which there is no expectation The St. Paul Companies 2002 Annual Report 47 -

Page 50

...Specialty Commercial Commercial Lines Surety & Construction International & Lloyd's Subtotal - ongoing segments Health Care Reinsurance Other Subtotal - runoff segments Total PROPERTY-LIABILITY UNDERWRITING Environmental and Asbestos Claims We continue to receive claims, including through lawsuits... -

Page 51

... its investment products and services, including individually managed accounts, closed-end exchange-traded funds and mutual funds, to the affluent and high-networth market segments through unaffiliated intermediary firms including broker/dealers, commercial banks, affiliates of insurance providers... -

Page 52

... under terms of a strategic alliance agreement. The purchase price was funded through a combination of available cash and borrowings under an intercompany credit facility between The St. Paul and Nuveen Investments. In July 2001, Nuveen Investments acquired Symphony Asset Management LLC ("Symphony... -

Page 53

...Investments' third-party debt Real estate mortgages 8.375% senior notes Total debt obligations Fair value of interest rate swap agreements Total reported debt * At December 31, 2002, commercial paper outstanding included $250 million of borrowings that were subsequently lent to our asset management... -

Page 54

.... THE ST. PAUL COMPANIES Liquidity Liquidity is a measure of our ability to generate sufficient cash flows to meet the short- and long-term cash requirements of our business operations. Our underwriting operations' short-term cash needs primarily consist of paying insurance loss and loss adjustment... -

Page 55

... ST. PAUL COMPANIES Pension Plans Due to the long-term nature of obligations under our pension plans, the accounting for such plans is complex and reflects various actuarial assumptions. Management's selection of plan assumptions, primarily the discount rate used to calculate the projected benefit... -

Page 56

...in our insurance reserves. We match these expected liability payments with our fixed income cash flows. Interest-sensitive Investment Assets December 31, 2002 December 31, 2001 Our expected long-term rate of return for our postretirement benefits plan differs from that used for our pension plan due... -

Page 57

...market information. Foreign Currency Exposure - Our exposure to market risk for changes in foreign exchange rates is concentrated in our invested assets, and insurance reserves, denominated in foreign currencies. Cash flows from our foreign operations are the primary source of funds for our purchase... -

Page 58

... and Disclosure," which provides alternative methods of transition for a voluntary change to the fair value based method of accounting for stock-based employee compensation. This statement requires additional disclosures in the event of a voluntary change. It also no longer permits the use of the... -

Page 59

... Totals assets Debt Redeemable preferred securities Common shareholders' equity Common shares outstanding PER COMMON SHARE DATA Income (loss) from continuing operations Year-end book value Year-end market price Cash dividends declared PROPERTY-LIABILITY INSURANCE Written premiums Pretax income (loss... -

Page 60

...The St. Paul Companies, Inc. and subsidiaries as of December 31, 2002 and 2001, and the results of their operations and their cash flows for each of the years in the three-year period ended December 31, 2002, in conformity with accounting principles generally accepted in the United States of America... -

Page 61

... The St. Paul Companies Years ended December 31 (In millions, except per share data) 2002 2001 2000 REVENUES Premiums earned Net investment income Asset management Realized investment gains (losses) Other Total revenues EXPENSES Insurance losses and loss adjustment expenses Policy acquisition... -

Page 62

... SHEETS The St. Paul Companies December 31 (In millions) 2002 2001 ASSETS Investments: Fixed income Real estate and mortgage loans Venture capital Equities Securities on loan Other investments Short-term investments Total investments Cash Reinsurance recoverables: Unpaid losses Paid losses Ceded... -

Page 63

...common shares Deferred compensation - restricted stock Tax benefit on employee stock options, and other changes Premium on preferred shares redeemed End of year Unrealized appreciation on investments, net of taxes: Beginning of year Change for the year End of year Unrealized loss on foreign currency... -

Page 64

CONSOLIDATED STATEMENTS OF CASH FLOWS The St. Paul Companies Years ended December 31 (In millions) 2002 2001 2000 OPERATING ACTIVITIES Net income (loss) Adjustments: Loss (income) from discontinued operations Change in property-liability insurance reserves Change in reinsurance balances Change ... -

Page 65

... increase to our 2001 pretax loss on continuing operations. Related Party Transactions - The following summarizes our related party transactions: Indebtedness of Management - We have made loans to certain current and former executive officers for their purchase of our common stock in the open market... -

Page 66

...coverage was discounted using rates up to 7.5%, based on our return on invested assets or, in many cases, on yields contractually guaranteed to us on funds held by the ceding company, as permitted by the state of domicile. Lloyd's - We participate in Lloyd's as an investor in underwriting syndicates... -

Page 67

... portfolio products. Underwriting fees are earned on the initial public offering of Nuveen Investments' exchange-traded funds. Through its subsidiary, Symphony, which manages equity and fixed-income market-neutral accounts and funds for institutional investors, Nuveen Investments earns performance... -

Page 68

... currency translation gain or loss on the investments in the foreign operations, they were included in the statement of operations. Related to our use of interest rate swap agreements to manage the effect of interest rate fluctuations on some of our debt and investments, we netted the interest paid... -

Page 69

... foreign currency translation gain or loss during the year, net of tax, is a component of comprehensive income. Both the remeasurement and translation are calculated using current exchange rates for the balance sheets and average exchange rates for the statements of operations. STOCK OPTION... -

Page 70

... investment income" from the date of closing. Our warrants to purchase additional Platinum shares are carried at their market value ($61 million at December 31, 2002), with changes in their fair value recorded as other realized gains or losses in our statement of operations. 3. ASBESTOS SETTLEMENT... -

Page 71

... would record would not be material to our results of operations. Total cost of settlement Less: Utilization of existing IBNR loss reserves Net reinsurance recoverables Net pretax loss Tax benefit @ 35% Net after-tax loss $ 995 (153) (370) 472 165 $ 307 When the settlement agreement was initially... -

Page 72

...St. Paul Guarantee"), a Canadian specialty property-liability insurance company focused on providing surety products and management liability, bond, and professional indemnity products. The total cost of the acquisition was approximately $80 million. The preliminary allocation of this purchase price... -

Page 73

... asset in 2002 and will be amortized on an accelerated basis over the remaining life of the intangible asset. Penco - In January 2001, we acquired the right to seek to renew a book of municipality insurance business from Penco, a program administrator for Willis North America Inc., for total... -

Page 74

... (In millions) December 31, 2002 (In millions) Cost Fixed income: U.S. government $ 1,054 State and political subdivisions 4,263 Foreign governments 1,779 Corporate securities 6,482 Asset-backed securities 660 Mortgage-backed securities 1,940 Total fixed income 16,178 Equities 416 Venture capital... -

Page 75

.... The accumulated changes in OCI as a result of cash flow hedges for 2002 (net of taxes) are summarized as follows. Year ended December 31, (In millions) 2002 $ (2) 1 $ (1) Included in gross realized losses for our fixed income portfolio in 2002 and 2001 were impairment write-downs totaling $74... -

Page 76

... reserves of acquired companies Provision for losses and LAE for claims incurred on continuing operations: Current year Prior years Total incurred Losses and LAE payments for claims incurred on continuing operations: Current year Prior years Total paid Unrealized foreign exchange gain Net loss and... -

Page 77

... income tax expense (benefit) at statutory rate Increase (decrease) attributable to: Nontaxable investment income Valuation allowance Foreign operations Goodwill Employee stock ownership plan State income taxes, net of federal benefit Other Total income tax expense (benefit) on continuing operations... -

Page 78

... the forward contract fee payments was recorded as a reduction to our reported common shareholders' equity. The number of shares to be purchased will be determined based on a formula that considers the average trading price of the stock immediately prior to the time of settlement in relation to the... -

Page 79

...Paper - We maintain an $800 million commercial paper program with $600 million of back-up liquidity, consisting of bank credit agreements totaling $540 million and $60 million of highlyliquid, high-quality fixed income securities. Interest rates on commercial paper issued in 2002 ranged from 1.4% to... -

Page 80

... Stock Ownership Plan. Dividend Restrictions - We primarily depend on dividends from our subsidiaries to pay dividends to our shareholders, service our debt, and pay expenses. St. Paul Fire and Marine Insurance Company ("Fire and Marine") is our lead U.S. property-liability underwriting subsidiary... -

Page 81

...of year Service cost Interest cost Plan amendment Actuarial (gain) loss Foreign currency exchange rate change Acquisition Benefits paid Curtailment loss (gain) Benefit obligation at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Foreign... -

Page 82

... Long-Term Incentive Program, of $9 million, $(8) million and $28 million in 2002, 2001 and 2000, respectively. FIXED OPTION GRANTS U.S.-Based Plans - Our fixed option grants for certain U.S.-based employees and outside directors give these individuals the right to buy our stock at the market price... -

Page 83

... outside the United States, together with a concurrent sale of shares by Old Mutual by means of an overallotment option, which was exercised by the underwriters. We sold all of the Old Mutual shares we were holding on June 6, 2002 for a total net consideration of $287 million, resulting in a pretax... -

Page 84

...American Continental Life Insurance Company, a small life insurance company we had acquired as part of our MMI purchase, to CNA Financial Corporation. We received cash proceeds of $21 million, and recorded a net after-tax loss on the sale of $1 million. Standard Personal Insurance Business - In June... -

Page 85

... Purported Class Action Shareholder Lawsuits - In the fourth quarter of 2002, several purported class action lawsuits were filed against our chief executive officer, our chief financial officer and us. The lawsuits make various allegations relating to the adequacy of our previous public disclosures... -

Page 86

... Operations Before Income Taxes and Cumulative Effect of Accounting Change" in Note 21. The employee-related costs represent severance and related benefits such as outplacement services to be paid to, or incurred on behalf of, employees to be terminated by the end of 2002. We estimated that a total... -

Page 87

...was corporatewide, with coverage triggered when our insurance losses and LAE across all lines of business reached a certain level, as prescribed by terms of the treaty (the "corporate program"). We were not party to such a treaty in 2002. Additionally, our Reinsurance segment benefited from cessions... -

Page 88

... require specialized expertise and focus exclusively on the customers served by those respective business centers. This segment includes Financial & Professional Services, Technology, Public Sector Services, Umbrella / Excess & Surplus Lines, Ocean Marine, Discover Re, National Programs, Oil & Gas... -

Page 89

...dedicated underwriting, claims and risk control services that require specialized expertise and focus exclusively on the customers served by respective operations. This operation is under common executive management and its business is generally conducted outside the United States. Health Care (with... -

Page 90

... Commercial Lines Surety & Construction International & Lloyd's Asset Management Property-Liability Investment Operations Total The increase in goodwill in our Asset Management segment resulted from Nuveen Investments' purchase of shares from minority shareholders, its acquisition of NWQ Investment... -

Page 91

... gains included in net income Net change in unrealized appreciation on investments Net change in unrealized loss on foreign currency translation Total other comprehensive income $ 902 595 307 (41) $ 266 $ 318 208 110 1 $ 111 $ 584 387 197 (42) $ 155 The St. Paul Companies 2002 Annual Report 89 -

Page 92

...and after-tax net realized investment losses of $22 million. Fourth quarter 2002 pretax underwriting losses of $12 million were comprised of profits of $59 million from ongoing business segments and losses of $71 million from segments that are being exited. Ongoing underwriting results included $175... -

Page 93

... highly rated municipal securities that were formed for the purpose of enabling the company to more flexibly generate investment income in a manner consistent with our investment objectives and tax position. As of December 31, 2002, there were a total of 36 trusts, which held a combined total market... -

Page 94

... the history of The St. Paul is illustrated in four such stories, narrated and recorded in video format, which can be accessed at the company's web site, www.stpaul.com. Above: The oldest policy on file at the company was issued May 20, 1865 and provided $500 coverage against fire loss for $5 annual... -

Page 95

... their lives in service to their country. Many shared their thoughts, and kept in touch with their fellow employees, in letters published in the company's employee publication of the time, the "Saint Paul Letter." Integrity can be demonstrated in many ways, and the 150-year history of The St. Paul... -

Page 96

... Jay S. Fishman Chairman and Chief Executive Officer Timothy M. Yessman CEO, Claim Laura C. Gagnon Investor Relations Marita Zuraitis Business Unit Leaders George L. Estes III CEO, Discover Re CEO, Commercial Lines William H. Heyman Chief Investment Officer Corporate Officers Bruce A. Backberg... -

Page 97

..., general Jim Craig, vice president, Specialty Claims (8) manager, St. Paul International and CEO, St. Paul at Lloyd's (27) Paul Ramsey, senior vice president, Claim (22) Alan Crater, Northeast regional executive, Commercial Middle Market (4) Barnabas Hurst-Banister, chairman, St. Paul Syndicate... -

Page 98

... President and Chief Executive Officer (retired), Allina Health System The St. Paul Companies Corporate Headquarters The St. Paul Companies, Inc. 385 Washington Street Saint Paul, MN 55102 Tel: 651.310.7911 www.stpaul.com The Companies St. Paul Fire and Marine Insurance Company 385 Washington... -

Page 99

... Nuveen Investments, Inc. The St. Paul reported 2002 revenues from continuing operations of $8.9 billion and total assets of $39.9 billion. For more information about The St. Paul and its products and services, visit the company's Web site, www.stpaul.com. Your Dividends A quarterly dividend... -

Page 100

The St. Paul Companies, Inc. 385 Washington St. Saint Paul, MN 55102 Tel: 651.310.7911 www.stpaul.com Form No. 55804