PNC Bank 2000 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

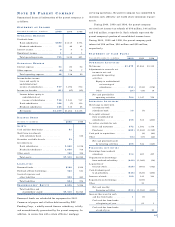

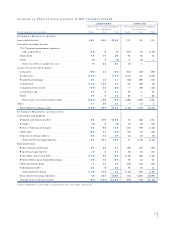

TI M E DE P O S I T S O F $ 1 0 0 , 0 0 0 O R MO R E

Time deposits in foreign offices totaled $2.2 billion at

December 31, 2000, substantially all of which are in

denominations of $100,000 or more. The following table

sets forth maturities of domestic time deposits of $100,000

or more:

Certificates

December 31, 2000 – in millions of Deposit

Three months or less . . . . . . . . . . . . . . . . . . . . . . . $1,202

Over three through six months . . . . . . . . . . . . . . . . 783

Over six through twelve months . . . . . . . . . . . . . . . 785

Over twelve months . . . . . . . . . . . . . . . . . . . . . . . . 786

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,5 56

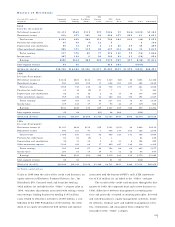

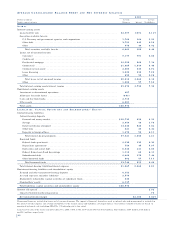

LO A N MA T U R I T I E S A N D IN T E R E S T SE N S I T I V I T Y

December 31, 2000 1 Year 1 Through After 5 Gross

In millions or Less 5 Years Years Loans

C o m m e r c i a l . . . . . . . . . $ 8 , 2 7 1 $ 1 0 , 3 9 7 $ 2 , 5 3 9 $ 2 1 , 2 0 7

Real estate pro j e c t . . . . 9 5 7 8 2 6 1 2 7 1 , 9 1 0

To t a l . . . . . . . . . . . . $ 9 , 2 2 8 $ 1 1 , 2 2 3 $ 2 , 6 6 6 $ 2 3 , 1 1 7

Loans with

P r e d e t e rmined rate . $ 1 , 0 2 1 $ 1 , 3 5 4 $ 7 3 6 $ 3 , 1 1 1

Floating rate . . . . . . 8 , 2 0 7 9 , 8 6 9 1 , 9 3 0 2 0 , 0 0 6

To t a l . . . . . . . . . . . . $ 9 , 2 2 8 $ 1 1 , 2 2 3 $ 2 , 6 6 6 $ 2 3 , 1 1 7

At December 31, 2000, $7.0 billion notional value of inter-

est rate swaps, caps and floors designated to commercial

and commercial real estate loans altered the interest rate

characteristics of such loans, the impact of which is not

reflected in the above table.

91

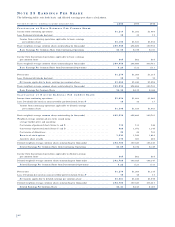

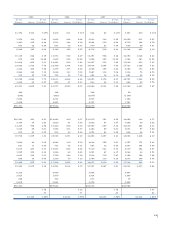

SH O R T -T E R M BO R R O W I N G S

Federal funds purchased include overnight borrowings and term federal funds, which are payable on demand. Repurchase

agreements generally have maturities of 18 months or less. Presented below are total bank notes of the Corporation, of

which approximately one-third mature in 2001. Other short-term borrowings primarily consist of U.S. Treasury, tax and loan

borrowings, which are payable on demand and commercial paper, which is issued in maturities not to exceed nine months.

At December 31, 2000, 1999 and 1998, $3.4 billion, $3.1 billion and $3.4 billion, respectively, notional value of interest

rate swaps were designated to borrowed funds. The effect of these swaps is included in the rates set forth in the table.

SH O R T -T E R M B O R R O W I N G S

2000 1999 1998

Dollars in millions Amount Rate Amount Rate Amount Rate

Federal funds purchased

Year-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,445 4.89% $1,281 4.05% $390 5.17%

Average during year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,139 6.31 1,662 5.05 2,526 5.50

Maximum month-end balance during year . . . . . . . . . . . . . . 2,778 2,671 3,139

Repurchase agreements

Year-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 607 5.77 402 4.77 477 3.47

Average during year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 754 5.97 621 4.99 791 5.31

Maximum month-end balance during year . . . . . . . . . . . . . . 864 725 1,682

Bank notes

Year-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,512 6.74 6,354 6.25 10,234 5.32

Average during year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,934 6.55 8,224 5.29 10,505 5.65

Maximum month-end balance during year . . . . . . . . . . . . . . 6,527 9,775 12,008

Other

Year-end balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 632 6.31 956 5.64 513 4.16

Average during year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 784 6.87 654 6.00 1,047 5.84

Maximum month-end balance during year . . . . . . . . . . . . . . 1,368 1,192 2,069