PNC Bank 2000 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

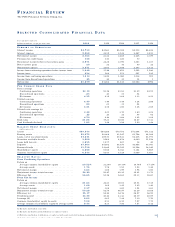

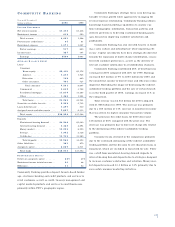

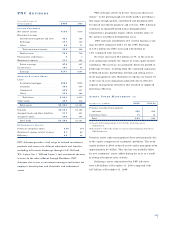

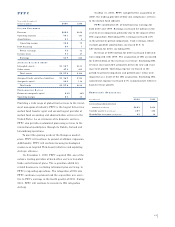

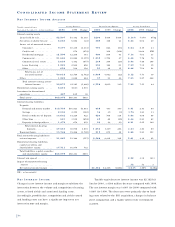

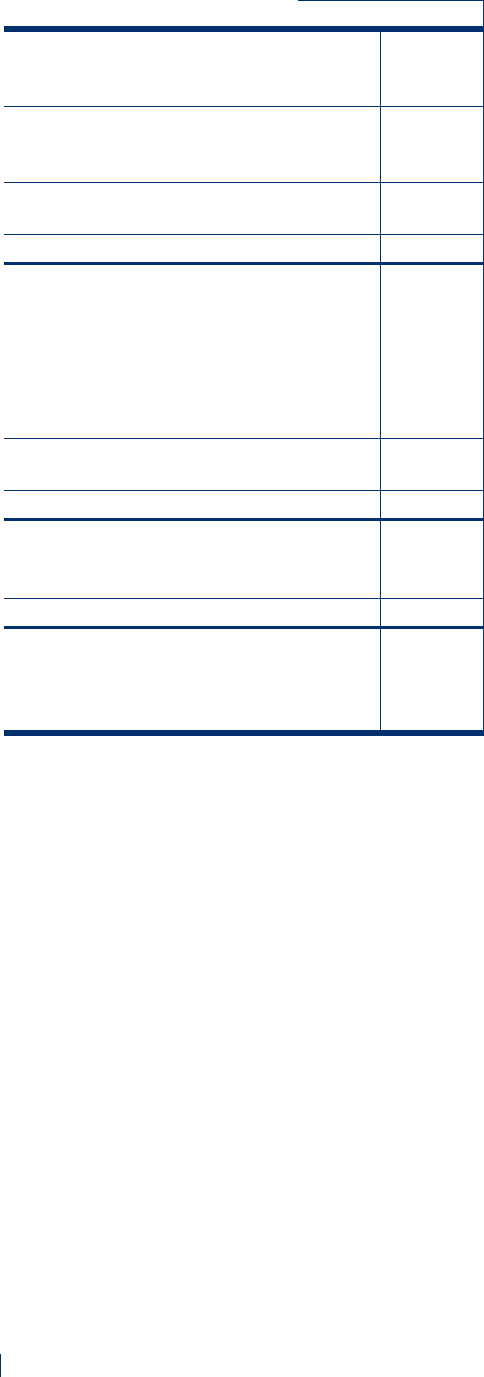

CO R P O R AT E BA N K I N G

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Credit-related revenue . . . . . . . . . . . $406 $372

Noncredit revenue . . . . . . . . . . . . . . 433 373

Total revenue . . . . . . . . . . . . . . . 839 745

Provision for credit losses . . . . . . . . 79 16

Noninterest expense . . . . . . . . . . . . 384 360

Pretax earnings . . . . . . . . . . . . . . 376 369

Income taxes . . . . . . . . . . . . . . . . . . 132 123

Earnings . . . . . . . . . . . . . . . . . . . $244 $246

AV E R A G E BA L A N C E SH E E T

Loans

Middle market . . . . . . . . . . . . . . . $5,866 $5,655

Specialized industries . . . . . . . . . 3,780 3,975

Large corporate . . . . . . . . . . . . . . 2,564 2,276

Leasing . . . . . . . . . . . . . . . . . . . . 1,844 1,340

Other . . . . . . . . . . . . . . . . . . . . . 254 454

Total loans . . . . . . . . . . . . . . . . 14,308 13,700

Other assets . . . . . . . . . . . . . . . . . . 2,074 1,887

Total assets . . . . . . . . . . . . . . . . . $16,382 $15,587

Deposits . . . . . . . . . . . . . . . . . . . . . $4,701 $4,499

Assigned funds and other liabilities . 10,452 9,919

Assigned capital . . . . . . . . . . . . . . . 1,229 1,169

Total funds . . . . . . . . . . . . . . . . . $16,382 $15,587

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . 20% 21%

N o n c r edit revenue to total re v e n u e . . 52 50

Efficiency . . . . . . . . . . . . . . . . . . . . 45 48

Corporate Banking provides credit, equipment leasing,

treasury management and capital markets products and

services to large and mid-sized corporations, institutions and

government entities primarily within PNC’s geographic

region.

The strategic focus for Corporate Banking is to empha-

size higher-margin noncredit products and services, espe-

cially treasury management and capital markets. Lending

activities are focused primarily within PNC’s geographic

region with consideration given to risk/return characteristics

and are a complement to sales of noncredit products and

services. Loans are syndicated to meet the credit needs of

larger borrowers and to reduce and diversify credit exposure.

Approximately 40% of the total loan portfolio at

December 31, 2000 was the result of syndications.

Corporate Banking made the decision to exit certain

non-strategic lending businesses during 1999. These

activities are excluded from business results in both periods

presented. Management continues to evaluate opportunities

to reduce lending exposure and improve the risk/return

characteristics of this business, including the downsizing of

certain specialized industry portfolios.

Corporate Banking contributed 19% of total business

earnings for 2000 compared with 21% for 1999. Earnings of

$244 million for 2000 were comparable with earnings of

$246 million for 1999.

Total revenue of $839 million for 2000 increased

$94 million or 13% compared with the prior year. Average

loans and credit-related revenue increased in the period-to-

period comparison primarily driven by loans to middle mar-

ket and large corporate customers that utilize higher-margin

noncredit products and services and the expansion of equip-

ment leasing. Noncredit revenue includes noninterest

income and the benefit of compensating balances received

in lieu of fees. Noncredit revenue increased $60 million or

16% compared with 1999 primarily driven by increases in

treasury management and capital markets fees and income

associated with equity investments. Noncredit revenue

comprised 52% of total revenue for 2000 compared with

50% last year, reflecting the emphasis on sales of

fee-based products.

The provision for credit losses was $79 million for

2000 compared with $16 million for 1999. The higher pro-

vision reflected an increase in net charge-offs associated

with the impact of a slowing economy primarily on the spe-

cialized industry portfolios. The provision for credit losses

for 2001 could increase further if the economy continues to

deteriorate or asset quality otherwise declines. See Credit

Risk in the Risk Management section of this Financial

Review for additional information regarding credit risk.

The increase in noninterest expense in the period-to-

period comparison was associated with growth in noncredit

products and services.

Treasury management and capital markets products

offered through Corporate Banking are sold by several busi-

nesses across the Corporation and related profitability is

included in the results of those businesses. Consolidated

revenue from treasury management was $341 million for

2000, an 11% increase compared with 1999. Consolidated

revenue from capital markets was $133 million for 2000, a

21% increase compared with 1999.

38