PNC Bank 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

n 2000, Corporate Banking continued

its transition to becoming a provider of

diversified financial services to companies

and government agencies — which

included developing a stronger focus on

more highly-valued earnings. Central to

this transition are Corporate Banking’s

specialized credit, capital markets, treasury

management and leasing services.

At the same time, Corporate

Banking has focused on decreasing

its reliance on institutional lending,

which has historically demonstrated

earnings volatility. As a result of these

strategies, more valuable noncredit-

related sources now generate 52% of

Corporate Banking’s revenues.

Treasury Management has

leveraged leading technology and strong

receivables management products to

grow revenue at nearly twice the industry

average since 1998.

And its inherent technology and

receivables management strengths were

key reasons behind PNC’s joint venture

with Perot Systems to create BillingZone.

This business will help position PNC

as a leader in the growing business-to-

business electronic bill payment and

presentment (EBPP) arena.

PNC Capital Markets, with its

strong, middle market focus, has been

another important contributor. With spe-

cialized expertise in loan syndications,

asset securitization, foreign exchange and

public finance, PNC Capital Markets has

grown earnings at a 20% compound annu-

al rate over the last three years. And it

has minimal involvement in higher-risk,

proprietary trading activities.

Driving growth across these sectors

and focusing intensely on increasing cro s s -

r e f e rral activity with other PNC businesses

should better position Corporate Banking

to continue its transition and deliver more

valuable earn i n g s .

Equally important, in an

increasingly challenging asset quality

environment, Corporate Banking will

take continued actions to limit large

credit exposures and further reduce

reliance on lending revenue.

PNC BA NK

—

CO R P O R AT E BA N K I N G

17

FEDERATED DEPARTMENT STORES

Cincinnati-based Federated Department Stores,

Inc., has long valued PNC for its ability to deliv-

er a broad spectrum of sophisticated financial

products and services. In addition to providing

corporate expense disbursement services, PNC

Bank’s Treasury Management group recently

joined with Federated to implement a customized

electronic data interchange merchandise payables

system for suppliers. PNC Capital Markets was

instrumental in financing Federated’s co-branded

Visa card program through an asset securitization

facility, and BlackRock provides investment

management services. Pictured are Federated

Vice Chairman Ron Tysoe and PNC Senior

Vice President Joe Richardson.

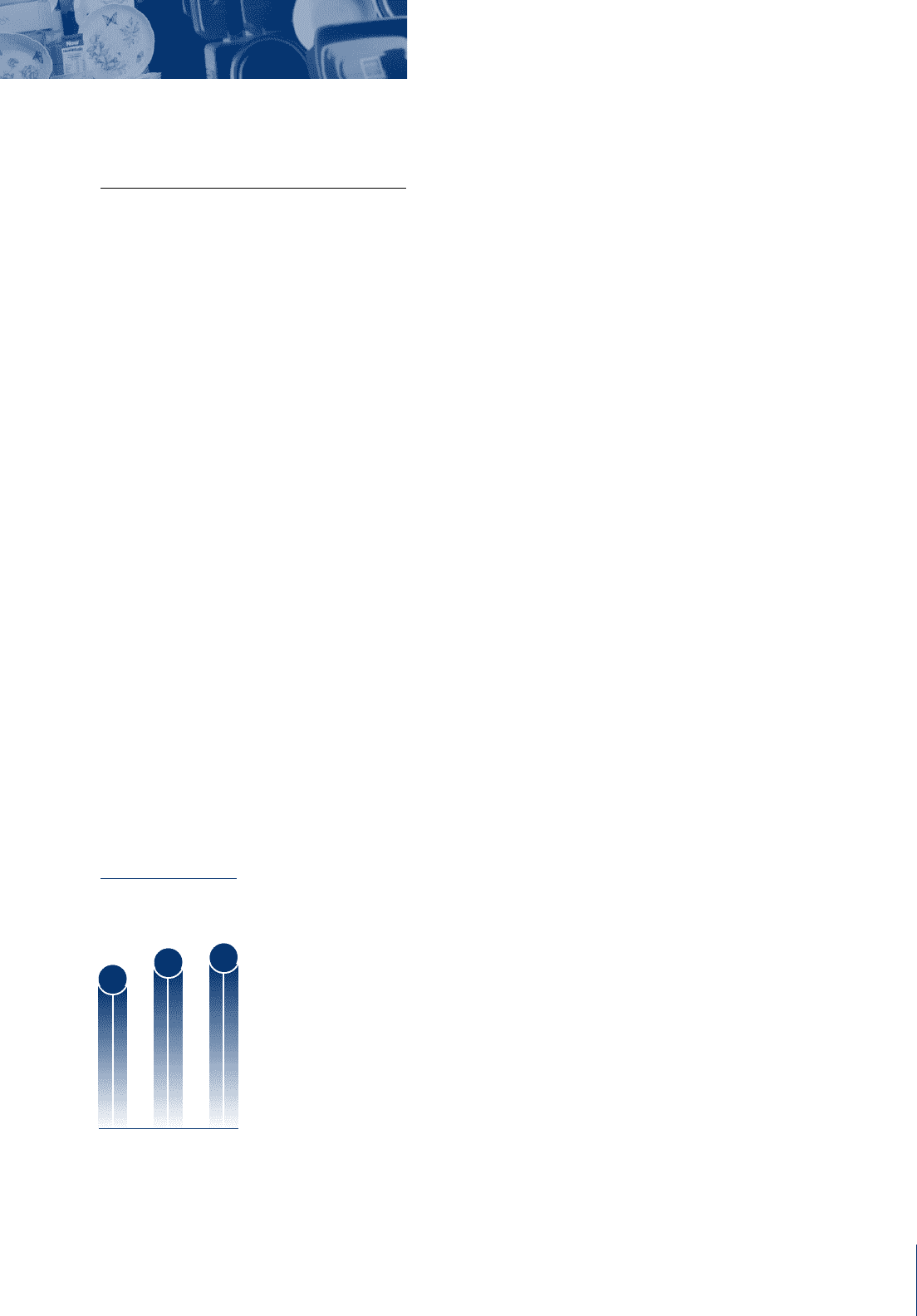

$339

98 99 00

$373 $433

NO N C R E D I T

RE V E N U E

(in millions)

I