PNC Bank 2000 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

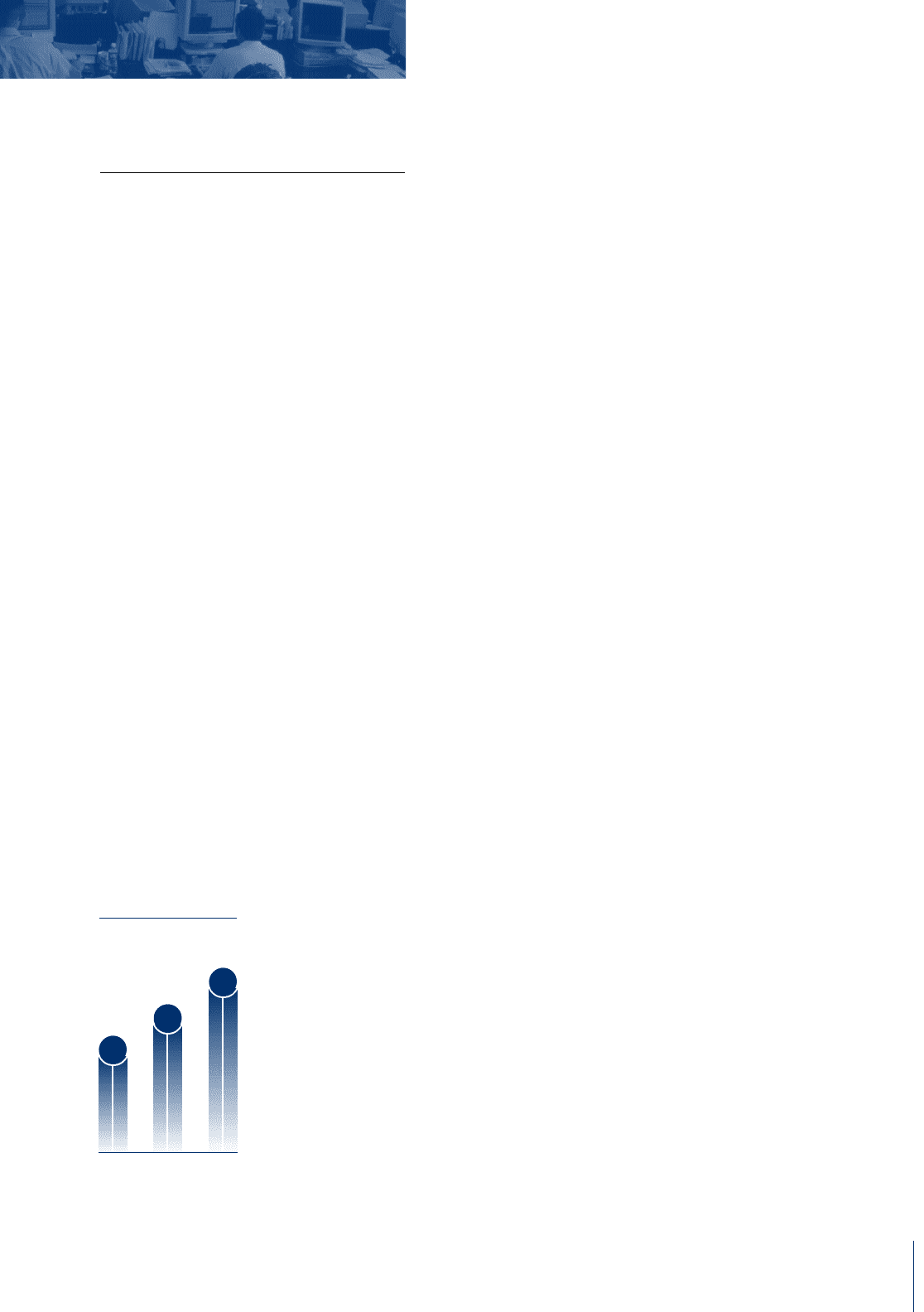

and diluted earnings per share increasing

by 25% , 29% and 30%, respectively.

Assets under management grew by 24%

to $204 billion, led by a 35% increase

in separate account assets. Net new

business accounted for over 80% of growth

in assets under management, and included

a substantial amount of additional sub-

scriptions from existing clients — a clear

endorsement of the firm’s success in

achieving client investment objectives

and service expectations.

A number of BlackRock’s achieve-

ments in 2000 have helped to create a

solid platform for future growth. The

firm delivered exceptional investment per-

formance in its fixed income and liquidity

products. The successful integration of a

European equity team in Edinburgh result-

ed in more than $6 billion in new European

equity mandates. New leadership was

added to the domestic large cap value

team, significantly improving performance

in existing portfolios. BlackRock Solutions

was successfully launched (see story). And

the firm continued to expand its personnel

base, including the addition of more than

50 college graduates, reflecting the firm’s

commitment to building from within.

In 2001, BlackRock will continue to

focus on its overriding objective — deliver-

ing superior investment performance and

exceptional service to its clients — while

pursuing strategies to build on its core

strengths and selectively expand the firm’s

expertise and breadth of distribution.

BL A C K RO C K

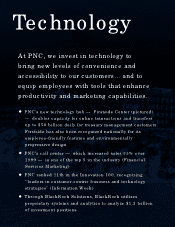

BLACKROCK SOLUTIONS

Since its founding, BlackRock has invested

substantial resources in the development

of proprietary analytics and technology to

enhance its investment process and operating

efficiency. The resulting industry-leading

capabilities are unique in their integration of

sophisticated risk analytics with a comprehensive

trading system that features straight-through,

paperless processing of the firm’s investment

operations. Since 1994, BlackRock has selectively

met client requests for access to these

services, and has reinvested the revenue generated

from these assignments to further refine and

enhance its analytics and systems. In August 2000,

BlackRock announced that these services would

be offered to a broader universe of institutional

investors under the name BlackRock Solutions,

building in 2001 on a year-end base of over

$1.37 trillion in “ assets under risk management.”

27

ne of the nation’s premier investment

management companies, BlackRock

offers a full range of investment products

through individually managed accounts

and mutual funds, including its flagship

fund families, BlackRock Funds and

BlackRock Provident Institutional Funds.

Through BlackRock Solutions, the firm

also offers sophisticated risk management

and investment technology services to

large institutional investors.

BlackRock delivered exceptional

returns for shareholders in its first full

year as a public company (NYSE: BLK).

The firm’s financial performance was

strong, with revenue, operating income

O

AS S E T S UN D E R

MA N A G E M E N T

(in billions)

$131

98 99 00

$165

$204