PNC Bank 2000 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

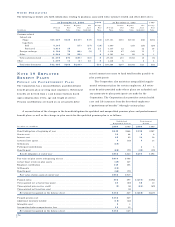

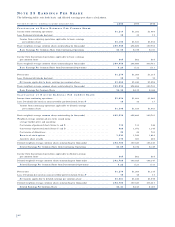

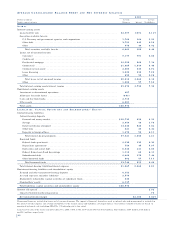

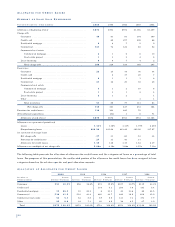

RE S U LT S O F BU S I N E S S E S

PNC PNC

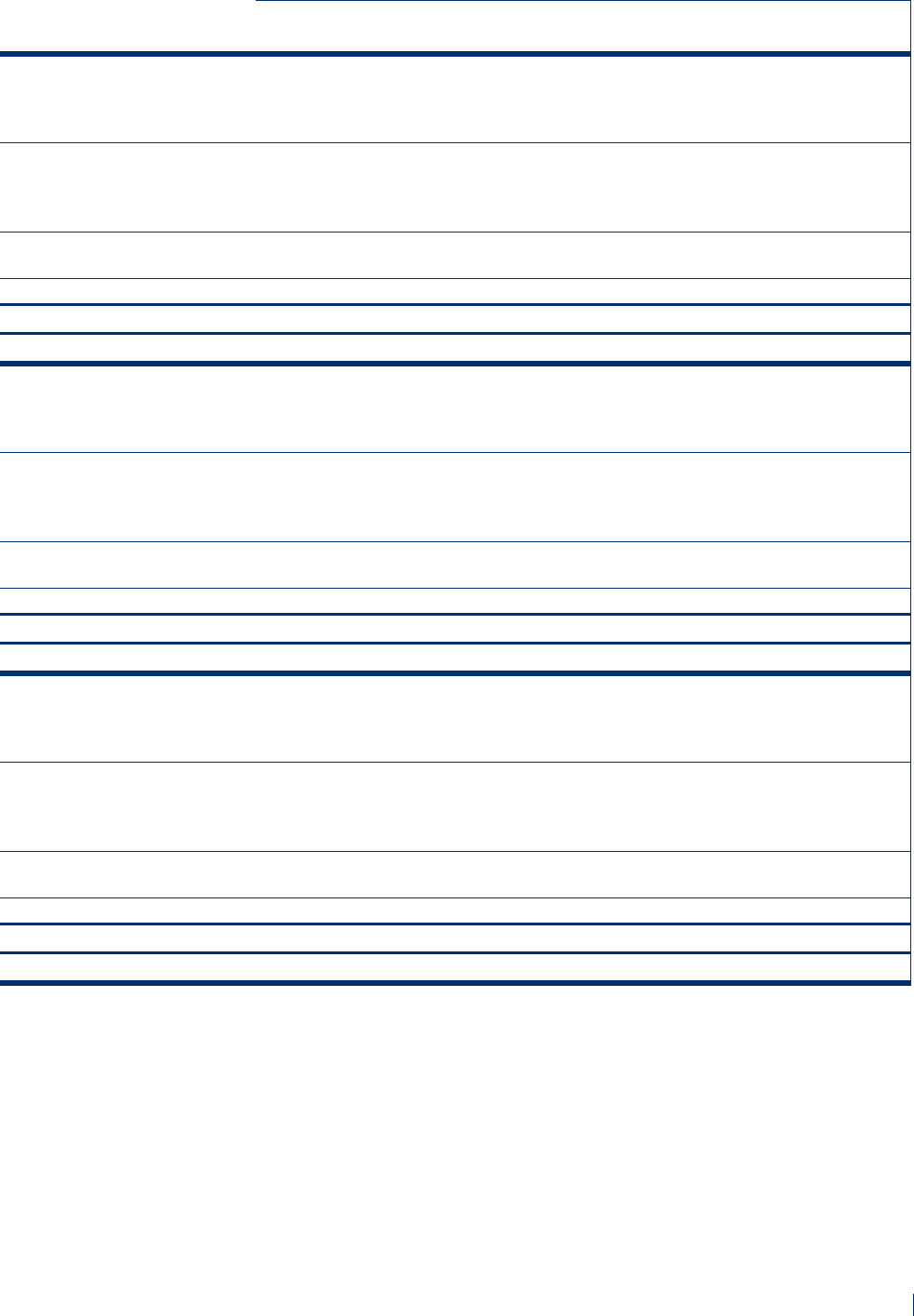

Year ended December 31 Community Corporate Real Estate Business PNC Black-

In millions Banking Banking Finance Credit Advisors Rock PFPC Other Consolidated

2000

IN C O M E ST A T E M E N T

Net interest income (a) . . . . . . . . $1,414 $562 $115 $99 $136 $7 $(46) $(105) $2,182

Noninterest income . . . . . . . . . . . 619 277 105 20 656 477 656 81 2,891

Total revenue . . . . . . . . . . . . . . 2,033 839 220 119 792 484 610 (24) 5,073

Provision for credit losses . . . . . . 45 79 (7) 12 5 2 136

Depreciation and amortization . . . 85 13 20 2 14 20 49 56 259

Other noninterest expense . . . . . . 986 371 119 28 497 314 483 14 2,812

Pretax earnings . . . . . . . . . . . . 917 376 88 77 276 150 78 (96) 1,866

Income taxes . . . . . . . . . . . . . . . . 327 132 6 28 103 63 31 (38) 652

Earnings . . . . . . . . . . . . . . . . . $590 $244 $82 $49 $173 $87 $47 $(58) $1,214

Inter-segment revenue . . . . . . . . . $3 $5 $13 $84 $(105)

AV E R A G E AS S E T S . . . . . . . . $38,958 $16,382 $5,506 $2,271 $3,500 $537 $1,578 $(241) $68,491

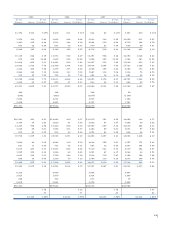

1999

IN C O M E ST AT E M E N T

Net interest income (a) . . . . . . . . $1,418 $481 $112 $71 $130 $(8) $6 $156 $2,366

Noninterest income . . . . . . . . . . . 550 264 100 11 608 381 251 285 2,450

Total revenue . . . . . . . . . . . . . . 1,968 745 212 82 738 373 257 441 4,816

Provision for credit losses . . . . . . 61 16 (5) 11 7 73 163

Depreciation and amortization . . . 88 14 20 2 14 18 10 130 296

Other noninterest expense . . . . . . 969 346 106 23 480 252 175 196 2,547

Pretax earnings . . . . . . . . . . . . 850 369 91 46 237 103 72 42 1,810

Income taxes . . . . . . . . . . . . . . . . 307 123 17 17 90 44 27 (17) 608

Earnings . . . . . . . . . . . . . . . . . $543 $246 $74 $29 $147 $59 $45 $59 $1,202

Inter-segment revenue . . . . . . . . . $5 $2 $(1) $8 $84 $(98)

AV E R A G E AS S E T S . . . . . . . . . $37,502 $15,587 $5,554 $1,759 $3,353 $448 $308 $3,403 $67,914

1998

IN C O M E ST AT E M E N T

Net interest income (a) . . . . . . . . $1,391 $416 $114 $55 $121 $(11) $8 $420 $2,514

Noninterest income . . . . . . . . . . . 605 211 47 7 368 339 183 326 2,086

Total revenue . . . . . . . . . . . . . . 1,996 627 161 62 489 328 191 746 4,600

Provision for credit losses . . . . . . 81 84 (5) 3 1 61 225

Depreciation and amortization . . . 98 13 15 2 6 13 6 106 259

Other noninterest expense . . . . . . 1,036 306 84 17 290 247 125 334 2,439

Pretax earnings . . . . . . . . . . . . 781 224 67 40 192 68 60 245 1,677

Income taxes . . . . . . . . . . . . . . . . 293 81 15 15 73 32 22 66 597

Earnings . . . . . . . . . . . . . . . . . $488 $143 $52 $25 $119 $36 $38 $179 $1,080

Inter-segment revenue . . . . . . . . . $6 $1 $1 $6 $(14)

AV E R A G E AS S E T S . . . . . . . . . . $36,942 $14,329 $5,306 $1,380 $2,731 $441 $229 $7,918 $69,276

(a) Taxable-equivalent basis

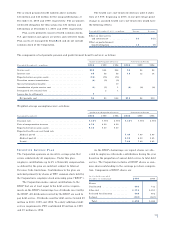

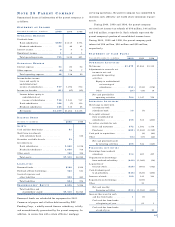

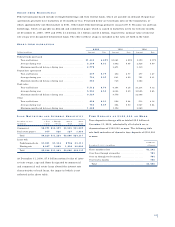

Gains in 1999 from the sales of the credit card business, an

equity interest in Electronic Payment Services, Inc., the

BlackRock IPO, Concord stock and branches totaling

$422 million are included in the “Other” category. Also in

1999, valuation adjustments associated with exiting certain

non-strategic lending businesses totaling $195 million,

costs related to efficiency initiatives of $98 million, a con-

tribution to the PNC Foundation of $30 million, the write-

down of an equity investment of $28 million and expense

associated with the buyout of PNC’s mall ATM representa-

tive of $12 million are included in the “ Other” category.

The results of the credit card business through the first

quarter of 1999, the corporate trust and escrow business in

1998, differences between management accounting prac-

tices and generally accepted accounting principles, divested

and exited businesses, equity management activities, minor-

ity interests, residual asset and liability management activi-

ties, eliminations and unassigned items comprise the

remainder of the “Other” category.