PNC Bank 2000 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

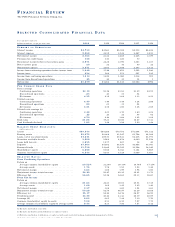

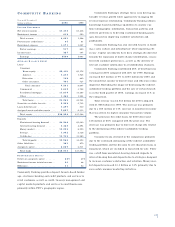

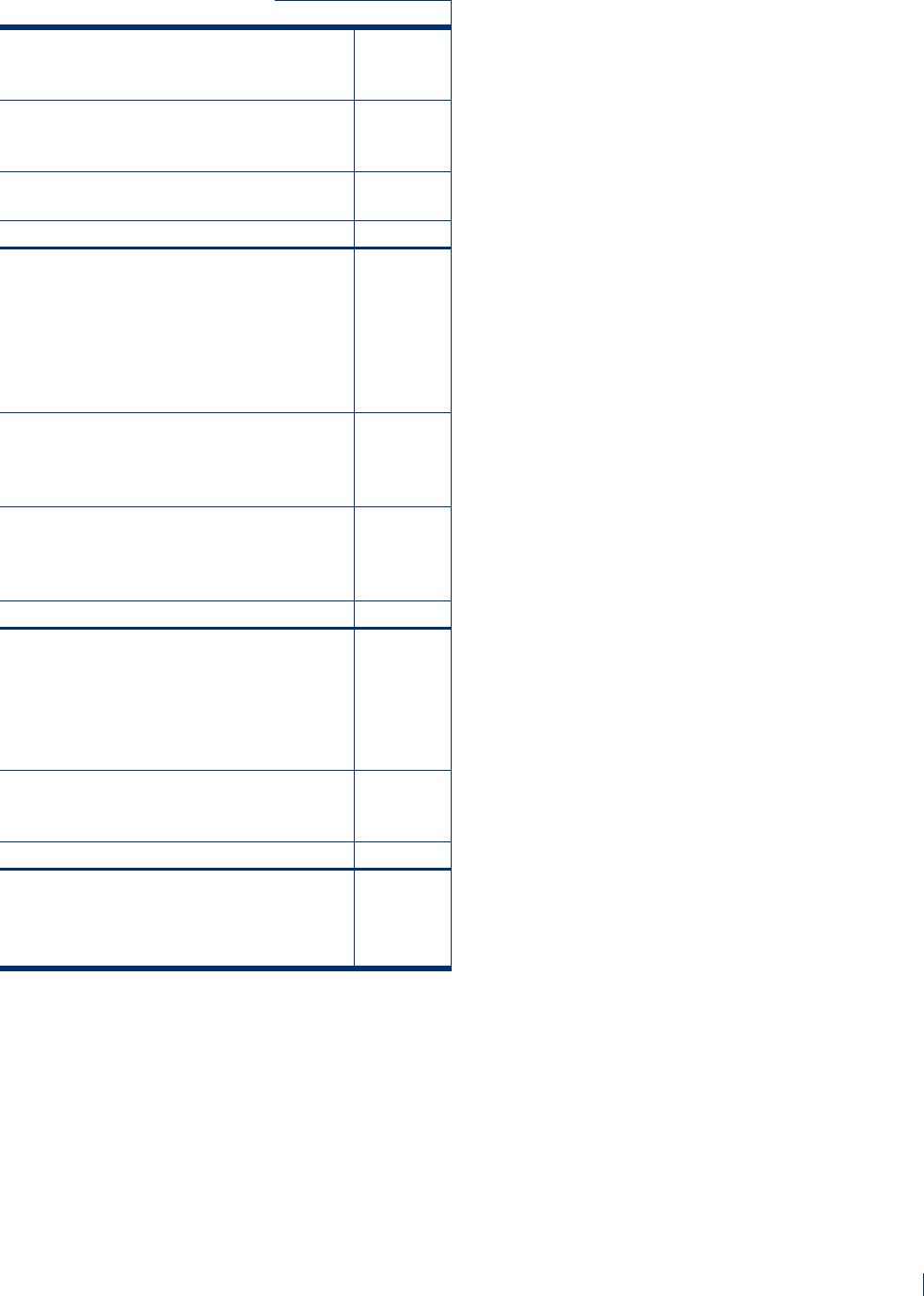

CO M M U N I T Y BA N K I N G

Year ended December 31

Dollars in millions 2000 1999

IN C O M E ST A T E M E N T

Net interest income . . . . . . . . . . . . . $1,414 $1,418

Noninterest income . . . . . . . . . . . . . 619 550

Total revenue . . . . . . . . . . . . . . . 2,033 1,968

Provision for credit losses . . . . . . . . 45 61

Noninterest expense . . . . . . . . . . . . 1,071 1,057

Pretax earnings . . . . . . . . . . . . . . 917 850

Income taxes . . . . . . . . . . . . . . . . . . 327 307

Earnings . . . . . . . . . . . . . . . . . . . $590 $543

AV E R A G E BA L A N C E SH E E T

Loans

Consumer

Home equity . . . . . . . . . . . . . . $5,419 $5,176

Indirect . . . . . . . . . . . . . . . . . . 1,215 1,945

Education . . . . . . . . . . . . . . . . 102 849

Other consumer . . . . . . . . . . . . 795 727

Total consumer . . . . . . . . . . 7,531 8,697

Commercial . . . . . . . . . . . . . . . . . 3,649 3,708

Residential mortgage . . . . . . . . . . 11,619 11,285

Other . . . . . . . . . . . . . . . . . . . . . 1,466 1,254

Total loans . . . . . . . . . . . . . . . . 24,265 24,944

Securities available for sale . . . . . . . 5,539 5,735

Loans held for sale . . . . . . . . . . . . . 1,297 510

Assigned assets and other assets . . . 7,857 6,313

Total assets . . . . . . . . . . . . . . . . . $38,958 $37,502

Deposits

Noninterest-bearing demand . . . . $4,548 $5,000

Interest-bearing demand . . . . . . . 5,428 4,894

Money market . . . . . . . . . . . . . . . 10,253 8,990

Savings . . . . . . . . . . . . . . . . . . . . 1,992 2,328

Certificates . . . . . . . . . . . . . . . . . 13,745 13,280

Total deposits . . . . . . . . . . . . . 35,966 34,492

Other liabilities . . . . . . . . . . . . . . . . 363 479

Assigned capital . . . . . . . . . . . . . . . 2,629 2,531

Total funds . . . . . . . . . . . . . . . . . $38,958 $37,502

PE R F O R M A N C E RA T I O S

Return on assigned capital . . . . . . . 22% 21%

N o n i n t e rest income to total re v e n u e . . 30 28

Efficiency . . . . . . . . . . . . . . . . . . . . 51 52

Community Banking provides deposit, branch-based broker-

age, electronic banking and credit products and services to

retail customers as well as credit, treasury management and

capital markets products and services to small businesses

primarily within PNC’s geographic region.

Community Banking’s strategic focus is on driving sus-

tainable revenue growth while aggressively managing the

revenue/expense relationship. Community Banking utilizes

knowledge-based marketing capabilities to analyze cus-

tomer demographic information, transaction patterns and

delivery preferences to develop customized banking pack-

ages focused on improving customer satisfaction and

profitability.

Community Banking has also invested heavily in build-

ing a sales culture and infrastructure while improving effi-

ciency. Capital investments have been strategically directed

towards the expansion of multi-channel distribution, consis-

tent with customer preferences, as well as the delivery of

relevant customer information to all distribution channels.

Community Banking contributed 46% of total business

earnings for 2000 compared with 48% for 1999. Earnings

increased $47 million or 9% to $590 million for 2000 and

the noninterest income to total revenue and efficiency ratios

improved. Excluding the impact of downsizing the indirect

automobile lending portfolio and the sale of certain branch-

es in the third quarter of 1999, earnings increased 11% in

the comparison.

Total revenue was $2.033 billion for 2000 compared

with $1.968 billion for 1999. The increase was primarily

due to a $69 million or 13% increase in noninterest income

that was driven by higher consumer transaction volume.

The provision for credit losses for 2000 decreased

$16 million or 26% compared with the prior year. The

decrease was primarily due to lower net charge-offs related

to the downsizing of the indirect automobile lending

portfolio.

Consumer loans declined in the comparison primarily

due to the continued downsizing of the indirect automobile

lending portfolio and the decision to sell education loans in

repayment, which are included in loans held for sale. There

was a shift from noninterest-bearing demand deposits to

interest-bearing demand deposits due to strategies designed

to increase customer satisfaction and retention. Money mar-

ket deposits increased $1.3 billion or 14% primarily due to

successful consumer marketing initiatives.

37