PNC Bank 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

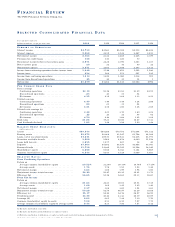

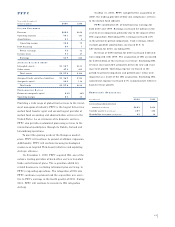

FI N A N C I A L RE V I E W

The PNC Financial Services Group, Inc.

SE L E C T E D CO N S O L I D AT E D FI N A N C I A L DATA

Year ended December 31

Dollars in millions, except per share data 2000 1999 1998 1997 1996

SU M M A R Y O F OP E R AT I O N S

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $4,732 $4,583 $5,024 $4,912 $4,812

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,568 2,239 2,536 2,467 2,413

Net interest income . . . . . . . . . . . . . . . . . . . . . . . . . 2,164 2,344 2,488 2,445 2,399

Provision for credit losses . . . . . . . . . . . . . . . . . . . . . 136 163 225 70

Noninterest income before net securities gains . . . . . . 2,871 2,428 2,070 1,583 1,217

Net securities gains . . . . . . . . . . . . . . . . . . . . . . . . . . 20 22 16 40 22

Noninterest expense . . . . . . . . . . . . . . . . . . . . . . . . . 3,071 2,843 2,698 2,403 2,112

Income from continuing operations before income taxes . 1,848 1,788 1,651 1,595 1,526

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 634 586 571 557 535

Income from continuing operations . . . . . . . . . . . . . . 1,214 1,202 1,080 1,038 991

Income from discontinued operations . . . . . . . . . . . . . 65 62 35 14 1

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,279 $1,264 $1,115 $1,052 $992

PE R CO M M O N SH A R E DAT A

Basic earnings

Continuing operations . . . . . . . . . . . . . . . . . . . . . . $4.12 $3.98 $3.53 $3.29 $2.91

Discontinued operations . . . . . . . . . . . . . . . . . . . . .23 .21 .11 .04

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.35 4.19 3.64 3.33 2.91

Diluted earnings

Continuing operations . . . . . . . . . . . . . . . . . . . . . . 4.09 3.94 3.49 3.24 2.88

Discontinued operations . . . . . . . . . . . . . . . . . . . . .22 .21 .11 .04

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.31 4.15 3.60 3.28 2.88

Diluted cash earnings (a)

Continuing operations . . . . . . . . . . . . . . . . . . . . . . 4.48 4.21 3.70 3.40 3.02

Discontinued operations . . . . . . . . . . . . . . . . . . . . .22 .21 .12 .05 .02

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.70 4.42 3.82 3.45 3.04

Book value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21.88 19.23 18.86 16.87 17.13

Cash dividends declared . . . . . . . . . . . . . . . . . . . . . . 1.83 1.68 1.58 1.50 1.42

BA L A N C E SH E E T HI G H L I G H T S

(at December 31) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $69,844 $69,286 $70,754 $71,694 $71,312

Earning assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,373 60,268 63,547 63,798 64,028

Loans, net of unearned income . . . . . . . . . . . . . . . . . 50,601 49,673 57,633 54,235 51,791

Securities available for sale . . . . . . . . . . . . . . . . . . . . 5,902 5,960 4,472 8,040 11,512

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,655 3,477 467 18 40

Deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47,664 45,802 46,150 46,956 45,043

Borrowed funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,718 14,229 15,939 16,958 18,345

Shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . 6,656 5,946 6,043 5,384 5,869

Common shareholders’ equity . . . . . . . . . . . . . . . . . . 6,344 5,633 5,729 5,069 5,553

SE L E C T E D RA T I O S . . . . . . . . . . . . . . . . . . . . . . .

From Continuing Operations . . . . . . . . . . . . . . . .

Return on . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Average common shareholders’ equity . . . . . . . . . . 20.52% 21.29% 20.14% 19.74% 17.15%

Average assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.76 1.76 1.55 1.52 1.44

Net interest margin . . . . . . . . . . . . . . . . . . . . . . . . . . 3.64 3.86 3.99 3.98 3.85

Noninterest income to total revenue . . . . . . . . . . . . . . 56.99 50.87 45.35 39.61 33.73

Efficiency (b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56.85 55.54 54.81 55.33 55.87

From Net Income

Return on . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Average common shareholders’ equity . . . . . . . . . . 21.63 22.41 20.81 20.01 17.18

Average assets . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.68 1.69 1.49 1.49 1.40

Net interest margin . . . . . . . . . . . . . . . . . . . . . . . . . . 3.37 3.68 3.85 3.94 3.83

Noninterest income to total revenue . . . . . . . . . . . . . . 59.28 52.79 46.97 41.29 35.68

Efficiency (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55.17 54.82 54.76 56.07 56.95

Dividend payout . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42.06 40.22 43.43 45.39 48.89

Leverage (d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.03 6.61 7.28 7.30 7.70

Common shareholders’ equity to assets . . . . . . . . . . . 9.08 8.13 8.10 7.07 7.79

Average common shareholders’ equity to average assets 8.44 8.13 7.56 7.57 8.32

(a) Excludes amortization of goodwill.

(b) Excludes amortization and distributions on capital securities.

(c) Excludes amortization, distributions on capital securities and residential mortgage banking risk management activities.

(d) Includes discontinued operations in the years 1996 through 1999.

33