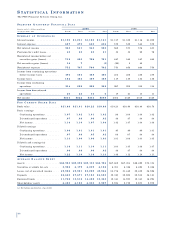

PNC Bank 2000 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

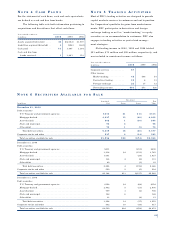

78

Compensation expense related to the portion of contribu-

tions matched with ESOP shares is determined based on the

number of ESOP shares allocated. Compensation expense

related to these plans was $30 million, $17 million and

$4 million for 2000, 1999 and 1998, respectively.

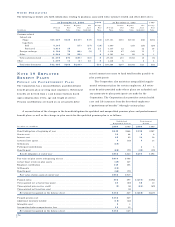

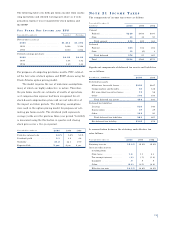

NO T E 2 0 ST O C K -B A S E D

CO M P E N S AT I O N PL A N S

The Corporation has a senior executive long-term incentive

award plan (“Incentive Plan”) that provides for the granting

of incentive stock options, nonqualified options, stock

appreciation rights, performance units and incentive shares.

In any given year, the number of shares of common stock

available for grant under the Incentive Plan may range from

1.5% to 3% of total issued shares of common stock deter-

mined at the end of the preceding calendar year.

ST O C K OP T I O N S

Options are granted at exercise prices not less than the mar-

ket value of common stock on the date of grant. Options

granted in 2000 and 1999 become exercisable in install-

ments after the grant date. Options granted prior to 1999

are mainly exercisable twelve months after the grant date.

Payment of the option price may be in cash or shares of

common stock at market value on the exercise date. A sum-

mary of stock option activity follows:

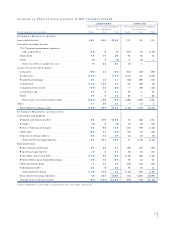

Per Option

Weighted-

Average

Shares in thousands Exercise Price Exercise Price Shares

January 1, 1998 . . . . . $11.38 - $43.75 $32.25 8,791

Granted . . . . . . . . . 43.66 - $66.00 55.17 3,449

Exercised . . . . . . . 11.38 - $43.75 31.26 (2,449)

Terminated . . . . . . 43.75 - $54.72 52.35 (225)

December 31, 1998 . . 11.38 - $66.00 40.30 9,566

Granted . . . . . . . . . 50.47 - $76.00 51.68 3,612

Exercised . . . . . . . 11.38 - $54.72 33.89 (1,856)

Terminated . . . . . . 21.75 - $59.31 51.68 (247)

December 31, 1999 . . 11.38 - $76.00 44.83 11,075

Granted . . . . . . . . . 42.19 - $66.22 44.20 4,171

Exercised . . . . . . . 11.38 - $59.31 37.77 (2,952)

Terminated . . . . . . 31.13 - $61.75 48.10 (464)

December 31, 2000 21.63 - 76.00 46.24 11,830

At December 31, 2000, the weighted-average remaining

contractual life of outstanding options was 7 years and

7 months and options for 5,834,898 shares of common stock

were exercisable at a weighted-average price of $45.96 per

share. The grant-date fair value of options granted in 2000

was $9.86 per option. Options for 82,000 shares of common

stock were granted in 1999 with an exercise price in excess

of the market value on the date of grant. There were no

options granted in excess of market value in 2000. Shares of

common stock available for the granting of options under

the Incentive Plan and the predecessor plans were

10,584,683 at December 31, 2000, 1999 and 1998.

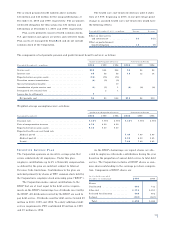

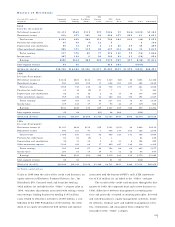

IN C E N T I V E SH A R E AW A R D S

In 1998, incentive share awards potentially re p r e s e n t i n g

362,250 shares of common stock were granted to certain

senior executives pursuant to the Incentive Plan. Issuance of

restricted shares pursuant to these incentive awards is sub-

ject to the market price of PNC’s common stock equaling or

exceeding specified levels for defined periods. The re s t r i c t e d

period ends two years after the issue date. During the

restricted period, the recipient receives dividends and can

vote the shares. If the recipient leaves the Corporation before

the end of the restricted period, the shares will be forf e i t e d .

At December 31, 2000, the incentive share awards granted in

1998 had not met the specified levels re q u i red for issuance of

restricted stock. In 2000, incentive share awards potentially

re p resenting 606,000 shares of common stock were granted

to certain senior executives pursuant to the Incentive Plan.

Of this amount, the grant of 105,000 shares is subject to

s h a r eholder approval. One-half of any shares of re s t r i c t e d

stock issued pursuant to these awards will vest after 3 years

and one-half vest after year 4. Shares awarded, if any, under

this grant will be offset on a share - f o r- s h a re basis by any

s h a r es received by the executive from the 1998 grant. There

w e re 66,000 incentive shares forfeited in 2000, no forf e i t u r e s

in 1999 and 12,000 incentive shares forfeited in 1998. In

addition, 245,000 shares of restricted stock were granted to

senior executives with a 3-year vesting period of which the

grant of 60,000 shares is subject to shareholder appro v a l .

Compensation expense recognized for incentive share award s

was $8 million, $12 million and $15 million in 2000, 1999

and 1998, re s p e c t i v e l y.

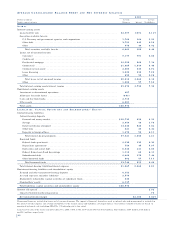

EM P L O Y E E ST O C K PU R C H A S E PL A N

The Corporation’s employee stock purchase plan (“ESPP”)

has approximately 3.0 million shares available for issuance.

Persons who have been continuously employed for at least

one year are eligible to participate. Participants purchase

the Corporation’s common stock at 85% of the lesser of fair

market value on the first or last day of each offering period.

No charge to earnings is recorded with respect to the ESPP.

Shares issued pursuant to the ESPP were as follows:

Year ended December 31 Shares Price Per Share

2000 . . . . . . . . . . . . 504,988 $42.82 and $45.53

1999 . . . . . . . . . . . . 406,740 43.99 and 47.39

1998 . . . . . . . . . . . . 315,097 43.83 and 48.34