PNC Bank 2000 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

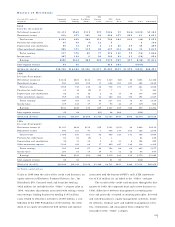

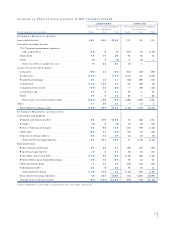

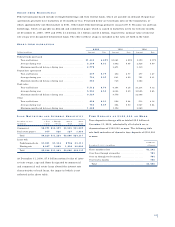

AL L O W A N C E F O R CR E D I T LO S S E S

SU M M A R Y O F LO A N LO S S EX P E R I E N C E

Year ended December 31 - dollars in millions 2000 1999 1998 1997 1996

Allowance at beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . $674 $753 $972 $1,166 $1,259

Charge-offs

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46 63 83 104 100

Credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60 297 208 66

Residential mortgage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88799

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 121 72 122 48 52

Commercial real estate

Commercial mortgage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 6 8 10

Real estate project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13248

Lease financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89742

Total charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186 216 524 385 247

Recoveries

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22 25 34 36 34

Credit card . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 17 25 7

Residential mortgage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21112

Commercial . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 22 20 38 28

Commercial real estate

Commercial mortgage . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 2 10 6

Real estate project . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13124

Lease financing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21 2 1

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 1

Total recoveries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51 55 77 113 83

Net charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 135 161 447 272 164

Provision for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 136 163 225 70

(Divestitures)/acquisitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (81) 3 8 71

Allowance at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $675 $674 $753 $972 $1,166

Allowance as a percent of period-end

Loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.33% 1.36% 1.31% 1.79% 2.25%

Nonperforming loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 208.98 231.62 263.29 360.00 337.97

As a percent of average loans

Net charge-offs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27 .31 .80 .51 .34

Provision for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27 .31 .40 .13

Allowance for credit losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.35 1.28 1.35 1.84 2.39

Allowance as a multiple of net charge-offs . . . . . . . . . . . . . . . . . . . 5.00x 4.19x 1.68x 3.57x 7.11x

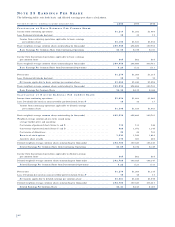

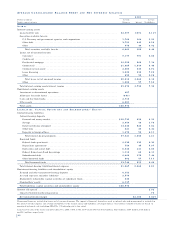

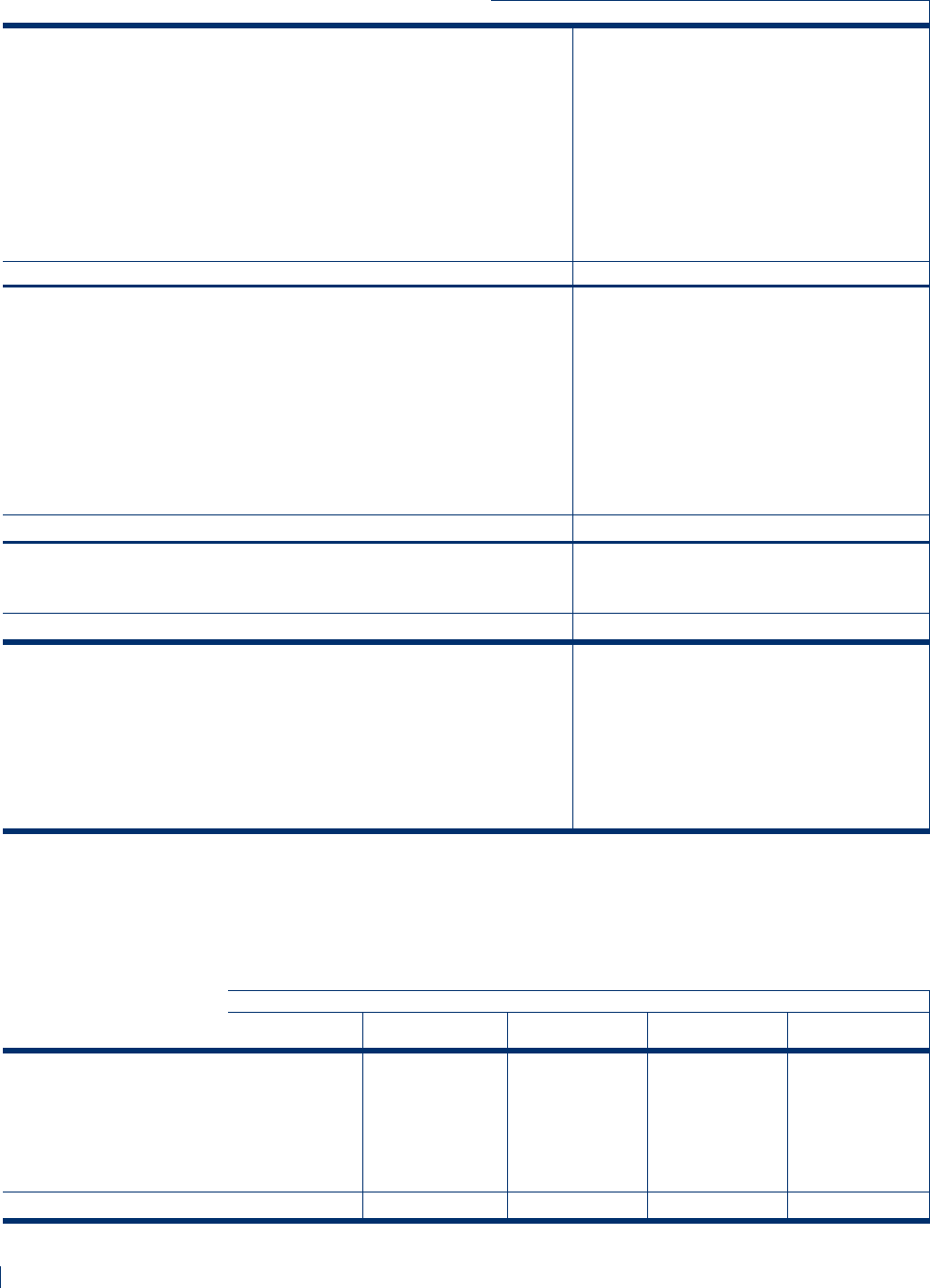

The following table presents the allocation of allowance for credit losses and the categories of loans as a percentage of total

loans. For purposes of this presentation, the unallocated portion of the allowance for credit losses has been assigned to loan

categories based on the relative specific and pool allocation amounts.

AL L O C AT I O N O F AL L O W A N C E F O R CR E D I T LO S S E S

2000 1999 1998 1997 1996

December 31 Loans to Loans to Loans to Loans to Loans to

Dollars in millions Allowance Total Loans Allowance Total Loans Allowance Total Loans Allowance Total Loans Allowance Total Loans

Consumer . . . . . . . . . . . . . . . . $51 18.0% $58 18.8% $74 19.0% $107 20.7% $139 23.3%

Credit card . . . . . . . . . . . . . . . 136 5.1 258 7.0 141 5.4

Residential mortgage . . . . . . . . 10 26.2 10 25.2 8 21.3 42 23.6 80 24.5

Commercial . . . . . . . . . . . . . . . 536 41.9 510 43.2 446 43.7 406 36.9 606 35.9

Commercial real estate . . . . . . 53 5.1 64 5.5 59 6.0 141 7.3 173 7.9

Other . . . . . . . . . . . . . . . . . . . 25 8.8 32 7.3 30 4.9 18 4.5 27 3.0

Total . . . . . . . . . . . . . . . . . . $675 100.0% $674 100.0% $753 100.0% $972 100.0% $1,166 100.0%

90