PNC Bank 2000 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

TA B L E O F CO N T E N T S

The PNC Financial Services Group, Inc.

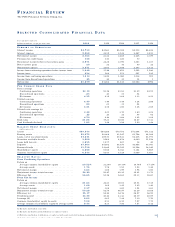

FI N A N C I A L RE V I E W

33 Selected Consolidated

Financial Data

34 Overview

35 Review of Businesses

37 Community Banking

38 Corporate Banking

39 PNC Real Estate Finance

40 PNC Business Credit

41 PNC Advisors

42 BlackRock

43 PFPC

44 Consolidated Income

Statement Review

46 Consolidated Balance

Sheet Review

48 Risk Factors

49 Risk Management

56 1999 Versus 1998

58 Forward-Looking

Statements

RE P O RT S O N

CO N S O L I D AT E D

FI N A N C I A L STA T E M E N T S

59 Management’s Responsibility

for Financial Reporting

59 Report of Ernst & Young

LLP, Independent Auditors

72 NOTE 12 –

Securitizations

73 NOTE 13 – Deposits

73 NOTE 14 – Borrowed

Funds

73 NOTE 15 – Capital

Securities of Subsidiary

Trusts

73 NOTE 16 –

Shareholders’ Equity

74 NOTE 17 – Regulatory

Matters

75 NOTE 18 – Financial

Derivatives

76 NOTE 19 – Employee

Benefit Plans

78 NOTE 20 – Stock-Based

Compensation Plans

79 NOTE 21 – Income

Taxes

80 NOTE 22 – Segment

Reporting

82 NOTE 23 – Earnings

Per Share

83 NOTE 24 –

Comprehensive Income

83 NOTE 25 – Litigation

83 NOTE 26 – Fair Value

of Financial

Instruments

84 NOTE 27 – Unused

Line of Credit

85 NOTE 28 – Parent

Company

CO N S O L I D AT E D

FI N A N C I A L STA T E M E N T S

60 Consolidated Statement

of Income

61 Consolidated Balance

Sheet

62 Consolidated Statement

of Shareholders’ Equity

63 Consolidated Statement

of Cash Flows

NO T E S T O

CO N S O L I D AT E D

FI N A N C I A L STA T E M E N T S

64 NOTE 1 – Accounting

Policies

68 NOTE 2 – Discontinued

Operations

68 NOTE 3 – Sale of

Subsidiary Stock

69 NOTE 4 – Cash Flows

69 NOTE 5 – Trading

Activities

69 NOTE 6 – Securities

Available for Sale

70 NOTE 7 – Loans and

Commitments to Extend

Credit

71 NOTE 8 –

Nonperforming Assets

72 NOTE 9 – Allowance for

Credit Losses

72 NOTE 10 – Premises,

Equipment and Leasehold

Improvements

72 NOTE 11 – Goodwill and

Other Amortizable Assets

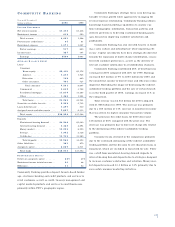

STAT I S T I C A L

IN F O R M AT I O N

86 Selected Quarterly

Financial Data

87 Analysis of Year-to-Year

Changes in Net Interest

Income

88 Average Consolidated

Balance Sheet and Net

Interest Analysis

90 Allowance for Credit Losses

91 Short-T erm Borrowings

91 Loan Maturities and

Interest Sensitivity

91 Time Deposits of $100,000

or More