PNC Bank 2000 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

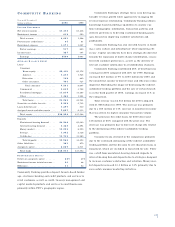

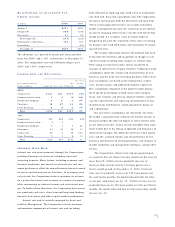

NO N I N T E R E S T EX P E N S E

Noninterest expense was $3.071 billion for 2000 compared

with $2.703 billion for 1999, excluding non-core items that

are detailed in the 1999 Versus 1998 section of this

Financial Review. The efficiency ratio was 57% for 2000

compared with 55% for the prior year, also excluding non-

core items. The increases were primarily related to the ISG

acquisition. Excluding ISG, noninterest expense increased

2% compared with the prior year. Average full-time equiva-

lent employees totaled approximately 24,900 and 22,700

for 2000 and 1999, respectively. The increase was primarily

due to the ISG acquisition, partially offset by the impact

of efficiency initiatives in traditional banking businesses

and the sale of the credit card business in the first quarter

of 1999.

CO N S O L I D AT E D BA L A N C E SH E E T

RE V I E W

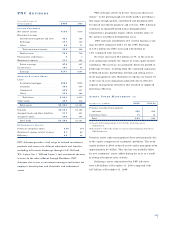

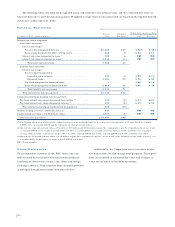

LO A N S

Loans were $50.6 billion at December 31, 2000, a

$928 million increase from year-end 1999 as increases in

residential mortgage loans and lease financing were partial-

ly offset by lower consumer, commercial and commercial

real estate loans.

DE TA I L S O F LO A N S

Year ended December 31

December 31 – in millions 2000 1999

Consumer

Home equity . . . . . . . . . . . . . . . . $6,228 $6,059

Automobile . . . . . . . . . . . . . . . . . 1,166 1,691

Other . . . . . . . . . . . . . . . . . . . . . 1,739 1,598

Total consumer . . . . . . . . . . . . 9,133 9,348

Residential mortgage . . . . . . . . . . . . 13,264 12,506

Commercial

Manufacturing . . . . . . . . . . . . . . . 5,581 5,355

Retail/wholesale . . . . . . . . . . . . . 4,413 4,301

Service providers . . . . . . . . . . . . . 2,900 3,208

Real estate related . . . . . . . . . . . 2,689 2,862

Communications . . . . . . . . . . . . . 1,286 1,370

Health care . . . . . . . . . . . . . . . . . 766 772

Financial services . . . . . . . . . . . . 823 1,300

Other . . . . . . . . . . . . . . . . . . . . . 2,749 2,300

Total commercial . . . . . . . . . . . 21,207 21,468

Commercial real estate

Mortgage . . . . . . . . . . . . . . . . . . . 673 761

Real estate project . . . . . . . . . . . 1,910 1,969

Total commercial real estate . . . 2,583 2,730

Lease financing . . . . . . . . . . . . . . . . 4,845 3,663

Other . . . . . . . . . . . . . . . . . . . . . . . 568 682

Unearned income . . . . . . . . . . . . . . (999) (724)

Total, net of unearned income . . . $50,601 $49,673

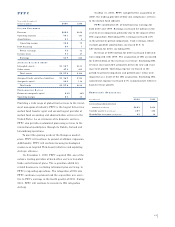

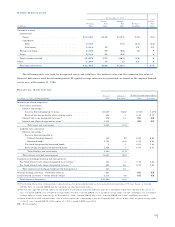

LO A N S HE L D FO R SA L E

Loans held for sale were $1.7 billion at December 31, 2000

compared with $3.5 billion at December 31, 1999. The

decrease was primarily due to dispositions of loans desig-

nated for exit. Total outstandings and exposure designated

for exit during 1999 totaled $3.7 billion and $10.5 billion,

respectively. At December 31, 2000, total outstandings

associated with this initiative were $1.0 billion of which

$286 million were classified as loans held for sale, with the

remainder included in loans. Total exposure relating to this

initiative was $2.7 billion at December 31, 2000.

DE TA I L S O F LO A N S HE L D FO R SA L E

Year ended December 31

December 31 – in millions 2000 1999

Loans designated for exit . . . . . . . . . $286 $1,813

Student loans in repayment . . . . . . . 1,201 1,344

O t h e r . . . . . . . . . . . . . . . . . . . . . . . 168 320

Total loans held for sale . . . . . . . . $1,655 $3,477

SE C U R I T I E S AV A I L A B L E FO R SA L E

The fair value of securities available for sale at December

31, 2000 was $5.9 billion compared with $6.0 billion at

December 31, 1999. Securities represented 8% of total

assets at December 31, 2000. The expected weighted-

average life of securities available for sale was 4 years and

5 months at December 31, 2000 compared with 4 years and

7 months at year-end 1999.

At December 31, 2000, the securities available for sale

balance included a net unrealized loss of $54 million,

which represented the difference between fair value and

amortized cost. The comparable amount at December 31,

1999 was a net unrealized loss of $184 million. Net unreal-

ized gains and losses in the securities available for sale

portfolio are included in accumulated other comprehensive

income or loss, net of tax.