PNC Bank 2000 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

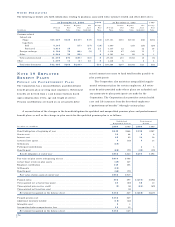

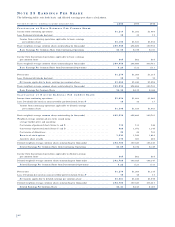

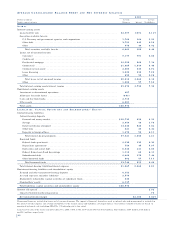

NO T E 2 4 CO M P R E H E N S I V E IN C O M E

The Corporation’s other comprehensive income consists of

unrealized gains or losses on securities available for sale

and minimum pension liability adjustments. The income

effects allocated to each component of other comprehensive

income (loss) are as follows:

Year ended December 31 Pretax Tax Benefit After-tax

In millions Amount (Expense) Amount

2000

Unrealized securities gains . . . . . . . $127 $(41) $86

Less: Reclassification

adjustment for losses

realized in net income . . . . . . . . . (3) 1 (2)

Net unrealized

securities gains . . . . . . . . . . . . 130 (42) 88

Minimum pension

liability adjustment . . . . . . . . . . . 2 (1) 1

Other comprehensive

income from

continuing operations . . . . . . . $132 $(43) $89

1999

Unrealized securities losses . . . . . . . $(184) $63 $(121)

Less: Reclassification

adjustment for losses

realized in net income . . . . . . . . . (28) 10 (18)

Net unrealized

securities losses . . . . . . . . . . . (156) 53 (103)

Minimum pension

liability adjustment . . . . . . . . . . . (8) 3 (5)

Other comprehensive

loss from

continuing operations . . . . . . . $(164) $56 $(108)

1998

Unrealized securities losses . . . . . . . $(12) $4 $(8)

Less: Reclassification

adjustment for losses

realized in net income . . . . . . . . . (15) 5 (10)

Net unrealized

securities gains . . . . . . . . . . . 3 (1) 2

Minimum pension

liability adjustment . . . . . . . . . . . (11) 4 (7)

Other comprehensive

loss from continuing

operations . . . . . . . . . . . . . . . . $(8) $3 $(5)

The accumulated balances related to each component of

other comprehensive loss are as follows:

December 31 – in millions 2000 1999

Net unrealized securities losses . . . . . . . . . . . $(32) $(120)

Minimum pension liability adjustment . . . . . . (11) (12)

Accumulated other comprehensive

loss from continuing operations . . . . . . . . $(43) $(132)

NO T E 2 5 LI T I G AT I O N

The Corporation and persons to whom the Corporation may

have indemnification obligations, in the normal course of

business, are subject to various pending and threatened

lawsuits in which claims for monetary damages are asserted.

Management, after consultation with legal counsel, does not

at the present time anticipate the ultimate aggregate liabili-

ty, if any, arising out of such lawsuits will have a material

adverse effect on the Corporation’s financial condition. At

the present time, management is not in a position to deter-

mine whether any such pending or threatened litigation will

have a material adverse effect on the Corporation’s results of

operations in any future reporting period.

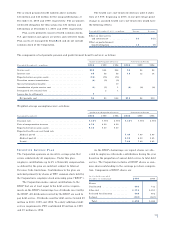

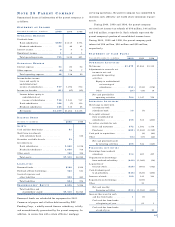

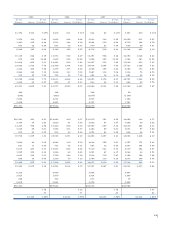

NO T E 2 6 FA I R VA L U E O F

FI N A N C I A L IN S T R U M E N T S

2000 1999

Carrying Fair Carrying Fair

December 31 – in millions Amount Value Amount Value

AS S E T S

Cash and

short-term assets . . . . . .

$5,041 $5,041

$4,465 $4,465

Securities available

for sale . . . . . . . . . . . . . .

5,902 5,902

5,960 5,960

Loans held for sale . . . . . . .

1,655 1,655

3,477 3,477

Net loans

(excludes leases) . . . . . .

46,066 46,872

46,041 46,398

Commercial mortgage

servicing rights . . . . . . . .

156 267

125 171

LI A B I L I T I E S

Demand, savings

and money

market deposits . . . . . . .

30,686 30,686

27,823 27,823

Time deposits . . . . . . . . . . .

16,978 17,101

17,979 17,890

Borrowed funds . . . . . . . . .

11,822 12,043

14,389 14,442

OF F - B A L A N C E - SH E E T

Unfunded loan

commitments . . . . . . . . .

(11) (11)

(5) (5)

Letters of credit . . . . . . . . .

(10) (10)

(9) (9)

Financial derivatives

Interest rate risk

management . . . . . . . .

63 104

75 (50)

Commercial mortgage

banking risk

management . . . . . . . .

(2) (10)

51

Credit-related

activities . . . . . . . . . . .

(2)

(4)

Customer/other

derivatives . . . . . . . . . 21 21