PNC Bank 2000 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

The Series F preferred stock is nonconvertible and

nonvoting, except in limited circumstances. Noncumulative

dividends are payable quarterly through September 30,

2001, at a rate of 6.05% and, thereafter, indexed to certain

market indices at rates not less than 6.55% or greater than

12.55% . The Series F preferred stock is redeemable until

September 29, 2001, in the event of certain amendments to

the Internal Revenue Code, at a declining redemption price

from $51.50 to $50.50 per share. After September 29, 2001,

the Series F preferred stock may be redeemed at

$50 per share.

During 2000, the board of Directors adopted a share-

holders rights plan providing for issuance of share purchase

rights. If a person or a group becomes beneficial owner of

10% or more of PNC's common stock, all holders of the

rights, other than such person or group, may purchase PNC

common stock or equivalent preferred stock at half of the

market value.

The Corporation has a dividend reinvestment and stock

purchase plan. Holders of preferred stock and common

stock may participate in the plan, which provides that addi-

tional shares of common stock may be purchased at market

value with reinvested dividends and voluntary cash pay-

ments. Common shares purchased pursuant to this plan

were: 649,334 shares in 2000, 567,266 shares in 1999 and

596,179 shares in 1998.

At December 31, 2000, the Corporation had reserved

approximately 10.9 million common shares to be issued in

connection with certain stock plans and the conversion of

certain debt and equity securities.

NO T E 1 7 RE G U L AT O R Y MAT T E R S

The Corporation is subject to the regulations of certain fed-

eral and state agencies and undergoes periodic examina-

tions by such regulatory authorities. Neither the Corporation

nor any of its subsidiaries is subject to written regulatory

agreements.

Under capital adequacy guidelines and the regulatory

framework for prompt corrective action, the Corporation

must meet specific capital guidelines that involve quantita-

tive measures of assets, liabilities and certain

off-balance-sheet items as calculated under regulatory

accounting practices. Failure to meet minimum capital

requirements can initiate certain mandatory and possibly

additional discretionary actions by regulators that, if under-

taken, could have a direct material effect on PNC’s financial

condition and results of operations. The Corporation’s capi-

tal amounts and classification are also subject to qualitative

judgments by regulatory agencies about components, risk

weightings and other factors.

The following table sets forth regulatory capital

ratios for PNC and its only significant bank subsidiary,

PNC Bank, N.A.:

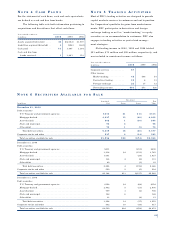

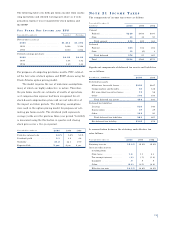

RE G U L AT O R Y CA P I TA L

December 31 Amount Ratios

Dollars in millions 2000 1999 (a) 2000 1999 (a)

Risk-based capital

Tier I

PNC . . . . . . . . . $5,367 $4,731 8.60% 7.05%

PNC Bank, N.A. 5,055 4,746 8.74 7.69

Total

PNC . . . . . . . . . 7,845 7,438 12.57 11.08

PNC Bank, N.A. 7,012 6,815 12.12 11.04

Leverage

PNC . . . . . . . . . . 5,367 4,731 8.03 6.61

PNC Bank, N.A. 5,055 4,746 8.20 7.13

(a) Includes discontinued operations

The access to and cost of funding new business initiatives

including acquisitions, the ability to pay dividends, deposit

insurance costs, and the level and nature of regulatory over-

sight depend, in large part, on a financial institution’s capi-

tal strength. The minimum regulatory capital ratios are 4%

for Tier I risk-based, 8% for total risk-based and 3% for

leverage. However, regulators may require higher capital

levels when particular circumstances warrant. To qualify as

well capitalized, regulators require banks to maintain capi-

tal ratios of at least 6% for Tier I risk-based, 10% for total

risk-based and 5% for leverage. At December 31, 2000, the

Corporation and each bank subsidiary met the well capital-

ized capital ratio requirements.

Dividends that may be paid by subsidiary banks to the

parent company are subject to certain legal limitations and

also may be impacted by capital needs, regulatory require-

ments, corporate policies, contractual restrictions and other

factors. Without regulatory approval, the amount available

for payment of dividends by all subsidiary banks was $634

million at December 31, 2000.

Under federal law, bank subsidiaries generally may not

extend credit to the parent company or its nonbank sub-

sidiaries on terms and under circumstances that are not

substantially the same as comparable extensions of credit to

nonaffiliates. No extension of credit may be made to the

parent company or a nonbank subsidiary which is in excess