PNC Bank 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

The amount of nonperforming loans that were current

as to principal and interest was $67 million at December

31, 2000 and $42 million at December 31, 1999. There

were no troubled debt restructured loans outstanding as of

either period end.

The increase in nonaccrual loans during 2000 was pri-

marily in specialized industry segments. A sustained or fur-

ther weakening of the economy, among other things, could

result in an increase in the number of delinquencies, bank-

ruptcies or defaults, which could result in a higher level of

nonperforming assets, net charge-offs and provision for

credit losses in future periods. See the Forward-Looking

Statements section of this Financial Review for additional

factors that could cause actual results to differ materially

from forward-looking statements or historical performance.

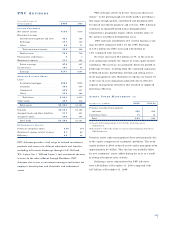

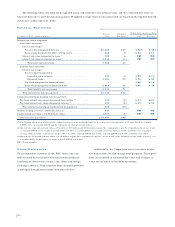

CH A N G E I N NO N P E R F O R M I N G AS S E T S

Year ended December 31

In millions 2000 1999

January 1 . . . . . . . . . . . . . . . . . . . . $325 $319

Transferred from accrual . . . . . . . . . 471 394

Returned to performing . . . . . . . . . . (13) (8)

Principal reductions . . . . . . . . . . . . (184) (265)

Sales . . . . . . . . . . . . . . . . . . . . . . . . (79) (31)

Charge-offs and other . . . . . . . . . . . (148) (84)

December 31 . . . . . . . . . . . . . . . $372 $325

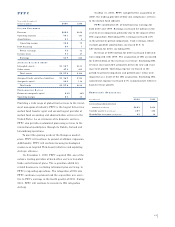

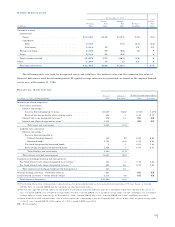

AC C R U I N G LO A N S PA S T DU E 9 0 D AY S O R MO R E

Year ended December 31

Amount Percent of Loans

December 31 – dollars in millions 2000 1999 2000 1999

Commercial . . . . . . . . . . . $46 $30 .22% .14%

Commercial real estate . . . 65.23 .18

Residential mortgage . . . . 36 24 .27 .19

Consumer . . . . . . . . . . . . 24 25 .26 .27

Lease financing . . . . . . . . 12.03 .07

Total . . . . . . . . . . . . . . $113 $86 .22 .17

Loans not included in nonaccrual or past due categories,

but where information about possible credit problems caus-

es management to be uncertain about the borrower’s ability

to comply with existing repayment terms over the next six

months totaled $182 million at December 31, 2000.

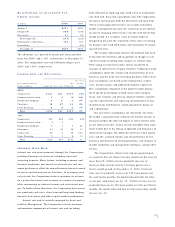

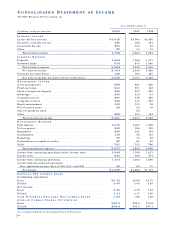

AL L O W A N C E FO R CR E D I T LO S S E S

In determining the adequacy of the allowance for credit

losses, the Corporation makes specific allocations to

impaired loans and to pools of watchlist and nonwatchlist

loans for various credit risk factors. Allocations to loan

pools are developed by business segment and risk rating

and are based on historical loss trends and management’s

judgment concerning those trends and other relevant fac-

tors. Those factors may include, among other things, actual

versus estimated losses, regional and national economic

conditions, business segment and portfolio concentrations,

industry competition and consolidation, and the impact of

government regulations. Consumer and residential mortgage

loan allocations are made at a total portfolio level based on

historical loss experience adjusted for portfolio activity and

economic conditions.

While PNC’s pool reserve methodologies strive to

reflect all risk factors, there continues to be a certain ele-

ment of risk associated with, but not limited to, potential

estimation or judgmental errors. Unallocated reserves are

designed to provide coverage for such risks. While alloca-

tions are made to specific loans and pools of loans, the total

reserve is available for all credit losses.

Senior management’s Reserve Adequacy Committee

provides oversight for the allowance evaluation process,

including quarterly evaluations and methodology and esti-

mation changes. The results of the evaluations are reported

to the Credit Committee of the Board of Directors.

The provision for credit losses for 2000 and the evalua-

tion of the allowance for credit losses as of December 31,

2000 reflected changes in loan portfolio composition and

changes in asset quality. The unallocated portion of the

allowance for credit losses represented 20% of the total

allowance and .26% of total loans at December 31,

2000 compared with 20% and .27%, respectively, at

December 31, 1999.