PNC Bank 2000 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2000 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

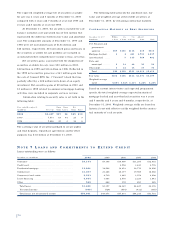

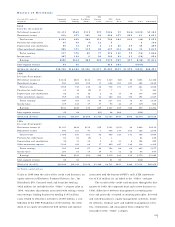

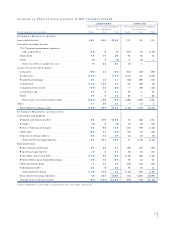

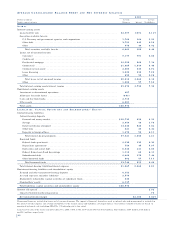

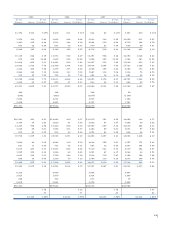

NO T E 2 2 SE G M E N T RE P O R T I N G

PNC operates seven major businesses engaged in communi-

ty banking, corporate banking, real estate finance, asset-

based lending, wealth management, asset management and

global fund services: Community Banking, Corporate

Banking, PNC Real Estate Finance, PNC Business Credit,

PNC Advisors, BlackRock and PFPC.

Business results are presented based on PNC’s man-

agement accounting practices and the Corporation’s

management structure. There is no comprehensive, authori-

tative body of guidance for management accounting equiva-

lent to generally accepted accounting principles; therefore,

PNC’s business results are not necessarily comparable with

similar information for any other financial services institu-

tion. Financial results are presented, to the extent practica-

ble, as if each business operated on a stand-alone basis.

The presentation of business results was changed to

re fl ect the Corporation’s operating stru c t u re during 2000.

Middle market and equipment leasing activities (pre v i o u s l y

included in Community Banking) are re p o r ted in Corporate

Banking. In addition, PNC Real Estate Finance and PNC

Business Credit are re p o r ted separately within PNC Secure d

Finance. Regional real estate lending activities (pre v i o u s l y

included in Community Banking) are re p o rted in PNC Real

Estate Finance. Business financial results for 2000, 1999

and 1998 are presented consistent with this s t ru c t u re.

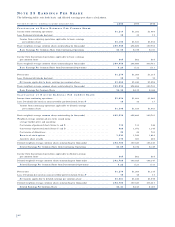

The management accounting process uses various bal-

ance sheet and income statement assignments and transfers

to measure performance of the businesses. Methodologies

change from time to time as management accounting prac-

tices are enhanced and businesses change. Securities or

borrowings and related net interest income are assigned

based on the net asset or liability position of each business.

Capital is assigned based on management’s assessment of

inherent risks and equity levels at independent companies

providing similar products and services. The allowance for

credit losses is allocated to the businesses based on man-

agement’s assessment of risk inherent in the loan portfolios.

Support areas not directly aligned with the businesses are

allocated primarily based on the utilization of services.

Total business financial results differ from consolidated

results from continuing operations primarily due to differ-

ences between management accounting practices and gen-

erally accepted accounting principles, divested and exited

businesses, equity management activities, minority inter-

ests, residual asset and liability management activities,

eliminations and unassigned items, the impact of which is

reflected in the “Other” category.

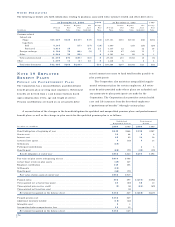

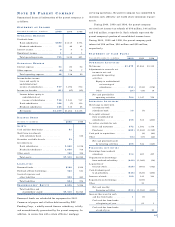

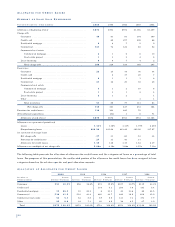

BU S I N E S S SE G M E N T PR O D U C T S A N D SE RV I C E S

Community Banking provides deposit, branch-based broker-

age, electronic banking and credit products and services to

retail customers as well as credit, treasury management and

capital markets products and services to small businesses

primarily within PNC’s geographic region.

Corporate Banking provides credit, equipment leasing,

treasury management and capital markets products and

services to large and mid-sized corporations, institutions

and government entities primarily within PNC’s

geographic region.

PNC Real Estate Finance provides credit, capital mar-

kets, treasury management, commercial mortgage loan serv-

icing and other products and services to developers, owners

and investors in commercial real estate.

PNC Business Credit provides asset-based lending,

capital markets and treasury management products and

services to middle market customers on a national basis.

PNC Business Credit’s lending services include loans

secured by accounts receivable, inventory, machinery and

equipment, and other collateral, and its customers include

manufacturing, wholesale, distribution, retailing and service

industry companies.

PNC Advisors provides a full range of tailored invest-

ment products and services to affluent individuals and fami-

lies including full-service brokerage through J.J.B. Hilliard,

W.L. Lyons, Inc. and investment advisory services to the

ultra-affluent through Hawthorn. PNC Advisors also serves

as investment manager and trustee for employee benefit

plans and charitable and endowment assets.

BlackRock is one of the largest publicly traded invest-

ment management firms in the United States with $204 bil-

lion of assets under management at December 31, 2000.

BlackRock manages assets on behalf of institutions and

individuals through a variety of fixed income, liquidity,

equity and alternative investment separate accounts and

mutual funds, including its flagship fund families,

BlackRock Funds and BlackRock Provident Institutional

Funds. In addition, BlackRock provides risk management

and technology services to a growing number of institutional

investors under the BlackRock Solutions name.

Providing a wide range of global fund services to

the investment management industry, PFPC is the largest

full-service mutual fund transfer agent and second largest

provider of mutual fund accounting and administration serv-

ices in the United States. As an extension of its domestic

services, PFPC also provides customized processing servic-

es to the international marketplace through its Dublin,

Ireland and Luxembourg operations.